Kenya faces severe fiscal crisis, ex-finance CS warns

By Noel Wandera, August 14, 2024Kenya is facing a severe fiscal crisis, with rising debt levels and lagging revenue growth which is putting the country’s economic stability at risk. This is the honest view of former National Treasury and Planning Cabinet Secretary Njuguna Ndung’u.

His parting shot after 22-months at the Treasury’s corner office was that the unsustainable nature of Kenya’s current debt burden needed urgent strategic fiscal management.

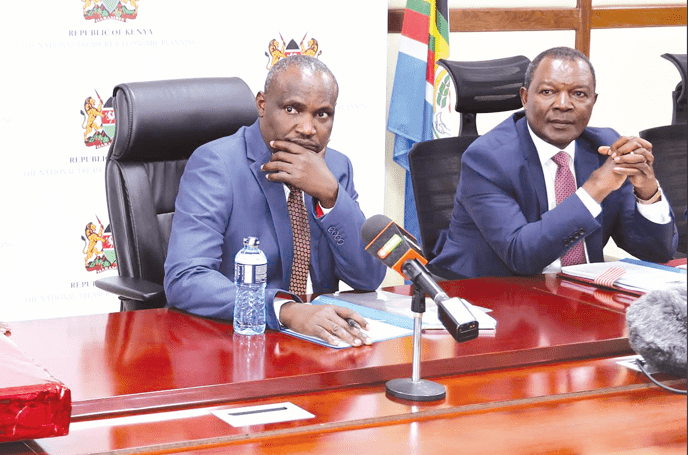

“Debt levels and burden cannot be sustained with the current revenue levels and patterns of expenditures,” Ndung’u who was handing over to new Cabinet Secretary John Mbadi said in his brief handover remarks at the Treasury Building on Monday.

Ndung’u said currently, Kenya’s total revenues stand at 16.5 per cent of the gross domestic product (GDP), with an ambitious target of 18.6 per cent by 2024. However, he observed that expenditures have ballooned to 22.1 per cent of GDP, creating a significant gap that threatens to widen further.

He observed that the government allocated 22.1 per cent of its GDP to essential services and infrastructure including roads schools and hospitals, which are the building blocks of progress, and 2.94 per cent to tax incentives.

Tax incentives shape economic behaviour, with investors, entrepreneurs and citizens responding to their nudges. He said this fiscal imbalance has led to substantial liquidity pressures, particularly from short-term domestic debt instruments like bills and bonds. Ndung’u said while these liquidity constraints have not yet escalated into solvency challenges, the risk remains real, even as he stressed the importance of strong signalling and strategic options to mitigate these pressures.

“These liquidity constraints require strategic options to avoid them creating solvency challenges. This would require strong signalling,” he said. Meanwhile, Ndung’u said that there were ongoing initiatives at the Treasury that required support to achieve significant results, particularly in the context of unfinished business that he hopes Mbadi will carry forward.

Tax policy review

He emphasised the significance of a Danish-supported tax policy review aimed at increasing Kenya’s tax base to 22 per cent to 25 per cent, as it is critical for reforming the country’s tax policy.

The National Tax Policy, adopted by the National Assembly in December last year, sets out broad parameters to enhance transparency, fairness, and efficiency in Kenya’s tax system, addressing challenges such as frequent changes in tax laws and difficulties in taxing the informal sector. Ndung’u further stressed the urgency of Kenya exiting the “grey list,” which refers to countries identified by the Financial Action Task Force (FATF) as having deficiencies in their measures against money laundering and terrorist financing.

He mentioned that the Gates Foundation is supporting the Financial Sector Deepening Africa (FSDA) to build the capacity of Kenya’s financial regulators, coordinated by the Financial Reporting Centre (FRC), to aid in exiting the grey list.

Additionally, he highlighted that capacity building at NT&EP is crucial, along with unfinished reforms such as enhancing resource mobilisation from Gulf countries, linking government payroll to IFMIS to eliminate ghost workers, and auditing the education funding model for sustainability.

Ndung’u emphasised that these initiatives and reforms require support to achieve significant results and contribute to Kenya’s economic stability and growth, particularly as Mbadi takes over the responsibilities at the Treasury. “I do hope all the above makes sense and create an urgency for a new chapter at the National Treasury and Economic Planning ministry’” he said.

More Articles