Insurance firms fall short of IFRS 17 transition demands

Kenya’s mid-tier and small insurance firms are yet to conform to the new sets of financial reporting standards, three months after the deadline for compliance lapsed.

The transition to IFRS 17 requirement came into effect on January 1, 2023, but Business Hub now understands that a number of industry players have not consented to those requirements which seek to provide transparent reporting about a company’s financial position and risk.

Some of the reasons cited for the foot-dragging by some insurers are the high costs of acquiring accounting software and actuarial systems as well as the personnel to manage them. Implementation of the International Financial Reporting Standard (IFRS 17) was delayed by one year due to the Covid-19 pandemic, meaning the majority of insurers, some of whom are contending with financial liquidity issues, must now have such systems in place.

The new conditions for reporting rules for underwriters have seen firms set aside substantive budgets towards the exercise, even though most companies are deficient in actuarial departments, now likely to outsource or hire specialists in that field.

It is, however not a cheap undertaking, according to the Chief executive of the Association of Kenya Insurers (AKI) Tom Gichuhi, who says it will cost small insurance firms “an arm and a leg” to install the two systems whose estimates he said to range between Sh60 million and Sh70 million, “probably more.”

Logistical issues

“With respect to the level of compliance, companies are at different levels and some have not even started due to logistical issues and we can understand why. The small firms have more pressing issues at this time,” he said in a telephone interview yesterday.

Gichuhi added: “The level of compliance was about 50 per cent since the last market review.”

Some companies with financial stability, according to the association, particularly the listed underwriters have already assimilated such systems and expanded their actuarial departments.

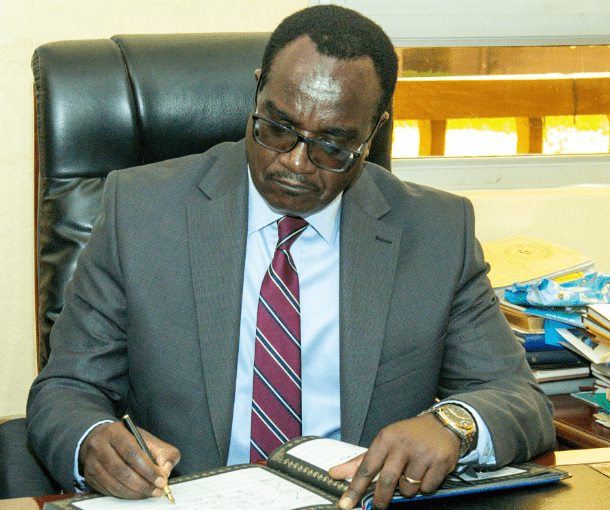

“At Kenya Re, being the oldest reinsurer in the Eastern and Central African region, we are prepared to take the frontline in adopting IFRS 17. So far, we have acquired a database application server and computing power specifically to store IFRS17 data,” said Michael Mbeshi, the acting Kenya-Re MD.

IFRS 17 requires a company to measure insurance contracts using updated estimates and assumptions that reflect the timing of cash flows and any uncertainty relating to insurance contracts. – Steve Umidha