Expect tough measures as Treasury digs in for more

By Victor Mukabi, June 13, 2025The National Treasury is banking on tough revenue collection measures to fund the 2025/26 budget, projected at Sh4.29 trillion.

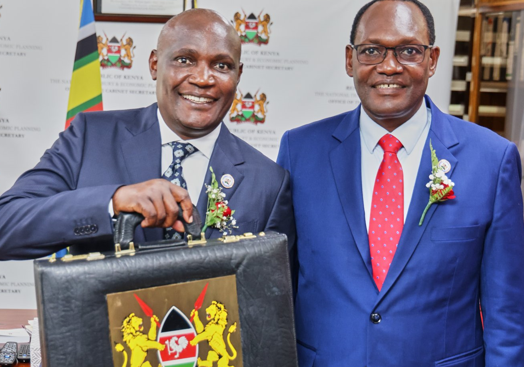

While presenting the budget estimates and revenue collection measures, National Treasury Cabinet Secretary John Mbadi said there will be no new taxes or increase in taxes, claiming that efforts will entail rationalisation of tax expenditures.

“The Finance Bill 2025, has neither proposed new taxes nor raised any tax rates. Instead, we have chosen to enhance tax revenue collection through administrative reforms by simplifying and streamlining tax laws to make them clearer and easier to implement, thereby improving taxpayer compliance,” he asserted.

According to Mbadi, approximately Sh30 billion is set to be raised from the process, which stood at 3.38 per cent of Gross Domestic Product (GDP) in 2023.

The revenue forgone through tax incentives -tax expenditures increased significantly, rising from Sh393.1 billion, which is equivalent to 2.9 per cent of GDP in 2022 to Sh510.6 billion.

“To reverse this trend, the Finance Bill 2025 proposes reforms to rationalise tax expenditures so as to promote equity, fairness, efficiency and reduce distortions within the tax system. The proposed reforms are in line with the National Tax Policy and the Medium-Term Revenue Strategy,” he said.

Additionally, an optimistic Mbadi intends to expand the tax base to achieve the revenue projection of Sh3.3 trillion. During the presentation, he stated that customs measures agreed upon by East African Community (EAC) Ministers during the Pre-Budget 114 Meeting, allowed Kenya to import tea packaging materials at a lower duty rate of 10 per cent and an extension of duty remission to import wheat at the rate of 10 per cent.

Among other reliefs that the country is set to enjoy in the financial year are the extension of the stay of application on the EAC Common External Tariff, and import rice at the rate of 35 per cent or US$200 per 115 metric tonne instead of the CET rate of 75 per cent or US$345 per metric tonne.

Affordable production

Others include extension of duty remission on inputs for assembly of telecommunication devices, including mobile phones, laptops and tablets; extension to import inputs for production of animal feeds duty-free under the EAC Duty Remission Scheme and the extension of the stay of application on the CET rate, and apply import duty rate of 35 per cent on leather products.

These, according to Treasury, are set to allow room for affordable cost of production.

On financing of the budget, he noted that in a bid to safeguard revenue and promote accountability, they are proposing through the Finance Bill to recover VAT where exempted or zero-rated goods or services are used for purposes other than those intended.

“Mr Speaker, entities in Special Economic Zones currently benefit from VAT exemptions and zero-rating, but there is no provision to recover tax when these benefits are misused,” he said.

The Bill also proposes to move some zero-rated goods and services that are consumed locally to exempt status, a proposal that he proposes will be able to tighten the tax loopholes.

“Some of the goods exempted from VAT have multiple uses making it difficult to effectively monitor whether they are finally used for the intended purpose. In this respect, the Bill proposes to amend the VAT Act to remove such exemptions,” he further added.

At the same time, he noted that there are new digitally enhanced means that are set to simplify tax process- aimed at boosting tax compliance such as the auto-populated VAT Returns – for seamless, accurate tax filing; simplified PAYE Returns which is accessible via mobile, web, and Application Programming Interface.

Other tech-driven reforms at the tax man include the Electronic Rental Income Tax System that has enabled transparent rental income declarations; and forecourt electronic Tax Invoice Management System integration in the petroleum sector, connecting fuel dispensers to Point of Sale terminals.

This, according to him, enables real-time transmission of sales data to the electronic Tax Invoice Management System simplifying compliance and ensuring greater transparency in fuel transactions.

“These solutions are more than just tech upgrades; they are drivers of economic empowerment and accountability,” he said.

This digitisation process also involves the “GAVA Connect”, an open Application Programming Interface platform that enables Kenyan developers to build home-grown solutions for efficient access to tax services.

The platform, he says, enhances service delivery, improves transparency, and strengthens the country’s ability to detect tax evasion.

Aside from the above measures, it will be tapping the domestic and foreign markets to fund the budget deficit of Sh973 billion which will essentially be through net external borrowing of Sh287.7 billion equivalent to 1.5 per cent of GDP and net domestic borrowing of Sh635.5 billion, which is equivalent to 3.3 per cent of GDP.

“Kenya’s public debt is projected to remain within sustainable levels over the medium term. In present value terms, the debt to GDP is projected to progressively decline from 63.0 percent in 2024 towards the debt anchor of 55 plus or minus 5 percent of GDP by 2028,” he explained.

Even though this is likely to burden Kenyans in the long run, he defended the need for borrowing noting that the government will explore emerging funding instruments such as debt swaps, diaspora bonds, sustainability linked bonds and Environmental, Social and Governance debt instruments to fund budget deficit and manage public debt.

“This strategic approach will not only diversify our financing options but also strengthen international partnerships and promote sustainable growth,” he said.