Equity Group’s profit dips by 14 per cent

EARNINGS: Equity Group profit after tax for the period ended September 30 declined 14 per cent to Sh15 billion down from Sh17.5 billion same period last year.

The reduced performance follows a familiar trend where companies are posting lower profits compared to last year, mostly due to the effects of the Covid-19 pandemic on the economy.

According to unaudited results released by the group, total non-performing loans (NPLs) for the period almost doubled rising to Sh45.9 billion compared to Sh26.5 billion in 2019.

In cognizance of the challenging business environment brought about by the Covid-19 pandemic, the group increased its loan book provision eleven-fold to Sh14.3 billion up from Sh1.3 billion same period last year.

Total operating expenses rose to Sh45.3 billion up from Sh30 billion same period last year.

Over the period, however, Equity Group reported a 30 per cent growth in its loan book to hit Sh453.9 billion up from Sh348.9 billion in September 2019.

The growth was driven by a 15 per cent growth in Kenya, 37 per cent growth in Uganda, 19 per cent growth by Equity Bank Congo, 15 per cent growth in Rwanda, and an additional Sh48.5 billion from the acquisition of BCDC in the Democratic Republic of Congo.

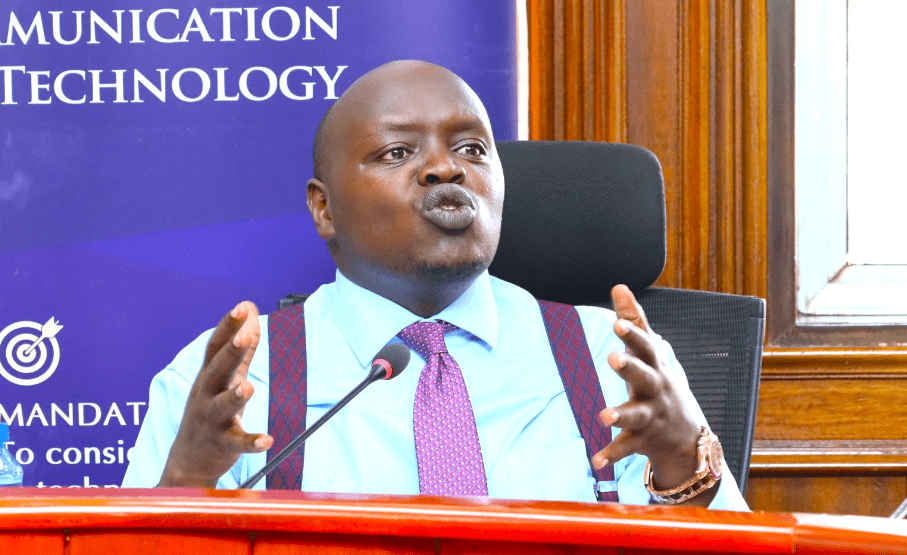

“Most of the new opportunities we funded were in manufacturing of PPE’s, logistics, online businesses, agro- processing, fast moving consumer goods and agriculture value chains,” said Equity Group chief executive, James Mwangi.

Similarly, customer deposits registered a 45 per cent growth to stand at Sh691 up from Sh478 billion, driven by a 51 per cent growth in Uganda, 21 per cent growth in Kenya and an additional Sh130 billion from the acquisition of BCDC in DR Congo.

“Regional expansion and business diversification efforts have reduced dependence on Kenya for performance, making the group truly a regional financial services provider,” Equity Group said in a statement.

According to the banking group, execution of its twin strategy of being defensive and offensive has proven to be effective despite the challenging environment brought about by Covid-19.

Total income for the period grew by 17per cent to Sh63.7 billion up from Sh54.3 billion last year.