Diaspora remit costs high, hit families hard

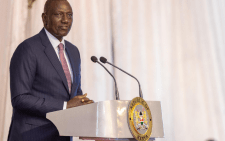

Central Bank of Kenya (CBK) Governor Patrick Njoroge says high cost of sending diaspora remittances is a major burden to millions of families relying on the money to meet their financial needs.

Speaking at the launch of a two days Inter Governmental Authority for Development (IGAD) forum on harmonisation of policies on remittances, the governor urged members to leverage data driven inventions to unlock new investment streams and to encourage more remittances.

“Sending money from Tanzania to Kenya, or for that matter Uganda, you have to pay 20 per cent as a cost yet Tanzania and Uganda are just across the border so something isn’t quite right and we need to do something about it,’ Njoroge said.

Top forex earner

Diaspora remittances, which is the leading foreign exchange earner in Kenya behind tourism and agriculture, has been growing and hit a record $4 billion (Sh548 billion) in 2022, equivalent to 10 per cent of the country’s Gross Domestic Product (GDP).

The inflows are sent to support relatives, money which Njoroge said the regulator is working round the clock to also channel to government securities, through the soon to be launched Central Securities Deposit (CSD) as response to a survey CBK undertook last year.

“We also need to be more innovative and come up with other means of channels that the diaspora could use. Here in Kenya, we have seen a demand by the diaspora in investing in government securities. They want to invest in T-bills and T-bonds but they don’t have an easy way of doing that,” he said.

“Now we have made a point before that we will be launching what we call the Central Securities Deposit that will improve efficiency and transparency in the market,” Njoroge charged.

CBK had expected to launch this a month ago and provide an easy way to invest in government securities which will also be beneficial to the diaspora.

IGAD’s Executive Secretary Workneh Gebeyehu said a harmonised regional remittance policy will lower cost of sending money, increase transparency and accountability in the remittance market. Average cost of remittances within the IGAD region is 8.9 per cent, while that of sending to the region was10.6 per cent, compared to a global average of 6.5 per cent.

“This is nearly 3 times the sustainable development goal target rate of below 3 per cent,” he said.