CBK to fast-track uptake of reduced lending rates

The Central Bank of Kenya (CBK) Governor plans to fast-track the uptake of reduced bank lending rates to ensure they are implemented by commercial banks and transmitted to borrowers as quickly as possible.

The move is expected to boost credit uptake and reduce inflation after the apex bank’s key organ responsible for formulating monetary policy announced Central Bank Rate (CBR) had been reduced from 13 per cent to 12.75 per cent.

Commercial banks have been raising lending rates since the MPC set the benchmark rate at 13 per cent from a low of 10.50 per cent, making it difficult for businesses and individuals to borrow money.

This is after the committee moved to address pressures on the exchange rate and mitigating effects including from global prices, which had hit the economy hard.

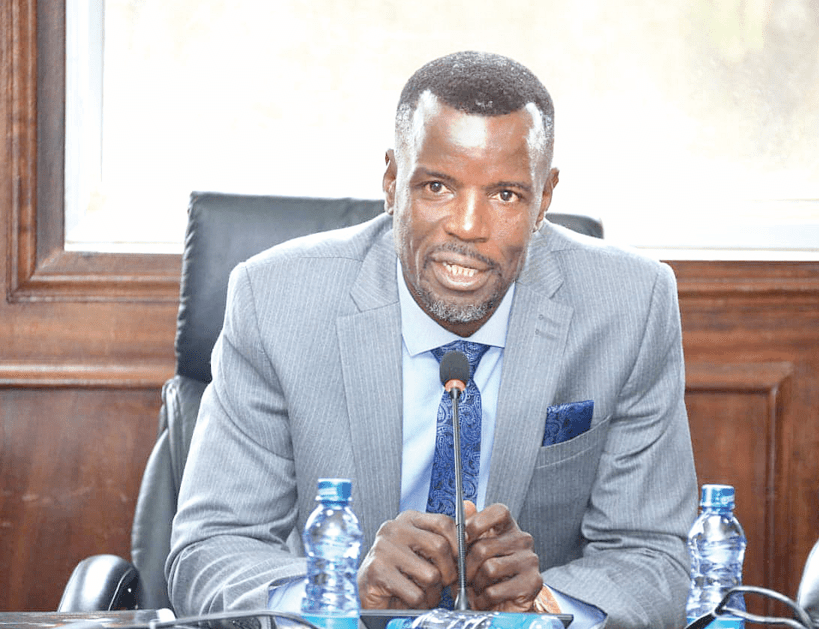

CBK Governor Kamau Thugge said that the bank will now push for the transmission of the lower interest rate and inject more liquidity into the financial system to ensure that the interbank rate comes down.

“In the monetary policy framework, we now have this strong and direct transmission of the policy to the interest rates of the bank, that way we can have that transmission of lower rates to the commercial banks,” he added.

Given the risk-based credit pricing approach, CBK expects that with the reduced interest rates, pricing will also decrease due to reduced domestic financing requirements. Risk-based credit pricing is when a lender offers borrowers less favourable loan terms based on the borrowers’ credit report information.

Borrowing tendencies

This will increase borrowing tendencies and mean more spending money for consumers. A lower CBR also targets inflation; even as overall inflation has declined, mostly driven by lower fuel and non-food and non-fuel inflation and stable food inflation, expectations are that conditions will ease further.

However, CBK noted that previous measures had lowered overall inflation to the mid-point of the target range, having stabilised the exchange rate, and anchored inflationary expectations.

“Kenya’s overall inflation declined to 4.3 per cent in July 2024 from 4.6 per cent in June, thereby remaining below the mid-point of the target range,” Thugge said.

The MPC met against a backdrop of an improved global outlook for growth, easing inflation in advanced economies, and persistent geopolitical tensions.

The contribution of fuel to the overall inflation decline reflects the impact of lower electricity and pump prices, which recorded a decline from 7.8 per cent in October 2022 to 5.5 per cent in July 2024.

Non-food, non-fuel inflation was moderate, reflecting the effect of previous monetary policy measures; from January to April, NFNF inflation was at 3.6 per cent, declining to 3.4 per cent in May and June and finally declining to 3.3 percent in July.

On the other hand, food inflation remained stable in July, reflecting continued easing of non-vegetable price inflation, which offset the rise in vegetable inflation.

Food inflation was also restrained by declines in sugar prices, which fell further in July, with improvements in domestic and global supply, contributing -0.3 percent to overall inflation.