CBK lifts 9-year ban on licensing new commercial banks

The Central Bank of Kenya (CBK) has lifted an embargo, restricting the licensing of new commercial banks.

In a statement on Wednesday, April 16, 2025, the central bank indicated that the lifting of the moratorium will allow new commercial financial institutions to be licensed to operate in the country, ending almost a decade of restrictions.

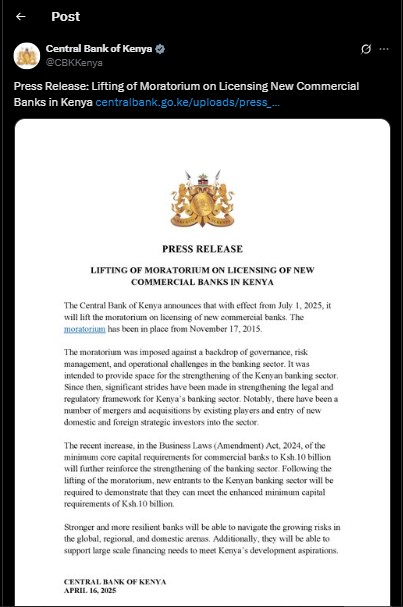

“The Central Bank of Kenya announces that, with effect from July 1, 2025, it will lift the moratorium on licensing of new commercial banks. The moratorium has been in place from November 17, 2015,” CBK’s statement read in part.

The Central Bank of Kenya imposed the moratorium against the backdrop of governance, risk management, and operational challenges in the banking sector.

According to the regulator, the move was aimed at providing space for the strengthening of the Kenyan banking sector.

Progress made

In the nine years, the regulator indicated that the banking sector had made tremendous progress in strengthening the legal framework.

CBK, led by Governor Kamau Thugge, added that the move paved the way for several mergers and acquisitions in the country.

“Since then, significant strides have been made in strengthening the legal and regulatory framework for Kenya’s banking sector. Notably, there have been a number of mergers and acquisitions by existing players and the entry of new domestic and foreign strategic investors into the sector,” CBK explained.

“The recent increase in the Business Laws (Amendment) Act, 2024, of the minimum core capital requirements for commercial banks to Ksh10 billion will further reinforce the strengthening of the banking sector.”

Requirements

Following the lifting of the ban, new commercial financial institutions will be required to demonstrate that they meet the enhanced minimum capital requirements of Ksh10 billion.

“Stronger and more resilient banks will be able to navigate the growing risks in the global, regional, and domestic arenas. Additionally, they will be able to support large scale financing needs to meet Kenya’s development aspirations,” CBK made it clear.