Address hurdles facing industrialists, State told

Treasury’s intention to leverage the manufacturing sector in a post Covid-19 pandemic economic recovery plans could come a cropper after experts pointed to inconsistencies in the bid.

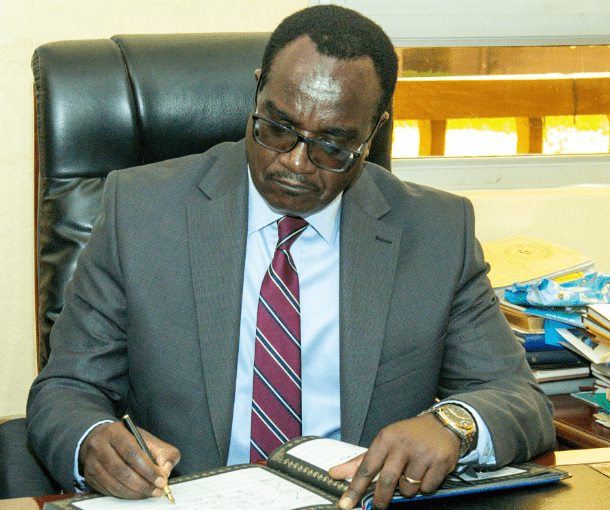

Speaking when he launched the Economic Survey 2021 last week, National Treasury Cabinet Secretary Ukur Yatani said the economy which contracted by -0.3 per cent in 2020 will grow at 6 per cent this year, with the manufacturing sector playing a big part in the expected rebound.

“Key macroeconomic indicators will probably remain stable and supportive of growth in 2021, with the manufacturing and transport sectors likely to rebound to support economic growth,” he said.

However, experts warn that the ambitious intent might be affected, going by the existing business environment.

Robert Waruiru, a tax associate director at audit firm KPMG East Africa, says the country lacks a tax policy that gives manufacturers a long-term view to enable them plan accordingly, which has affected electricity, a key driver of production.

“One example is the Income Tax Act that came into effect on June 1, 2018 to incentivise manufacturers by giving them a 30 per cent refund on the actual units (worth Sh100,000) of electricity they incurred was removed a year later in July 2019,” said Waruiru.

Data by Kenya Association of Manufacturers (KAM) indicate that Kenyan industrialists pay the highest amount of electricity in the region and beyond

They pay at between $0.16 and $0.18 per kw/h, compared to the neighbours Uganda ($0.05 per kw/h); Tanzania at $0.08 per kw/h and Egypt, South Africa and Ethiopia, whose energy cost oscillates between $0.06 and $0.08 per kw/h.

Waruiru said the prohibitive energy cost charged manufacturers if not addressed will continue preventing Kenyan firms penetrating regional regional and continental markets especially the $450 billion (Sh49.4 trillion) African Continental Free Trade Area (AfCFTA) market with a population of over 68 million people.

High energy costs

“We need to think about the impact high energy costs will have on AfCFTA. If other countries are allowed to import into Kenya, how can we protect ,for instance our cement producers,” he said in reference to the possibility of cheap cement from Ethiopia and Tanzania, where Nigerian business magnet Aliko Dangote owns cement factories, flooding the local market and edging out local producers.

While in support of Waruiru’s sentiments, Karaya Mokaya also a tax expert with SKM Africa said the government needs to reduce the period for Value Added Tax (VAT) refunds from three to one month to ensure manufacturers maintained a steady level of liquidity to prevent them from falling into debt.

“There is room for improvement. We are saying pay the money within one month. It will assist companies by reducing over-reliance on debt to clear their liquidity shortfalls.”

Mokaya said beginning January 1, 2022 local manufacturers will be prohibited from claiming 30 per cent interest from their earnings before interest, tax, depreciation and amortisation.

Accordingly, he added this will result in suppressed earnings before ebitda, as companies go through the cycle of high cost of doing business as a result of the exorbitant cost of electricity, off-shore inputs, and competition.

Previously, this was restricted to foreign companies with 25 per cent or more shares were held by non-residents.