Kenyan banks have defied a challenging economic landscape to report unprecedented profitability levels in the first-half of 2024. Lenders faced significant obstacles as the cost of funds surged, with interest expenses rising to a weighted average of 64.7 per cent, up from 40.2 per cent in the same period last year.

Experts say this sharp increase, driven by elevated interest rates, prompted banks to pass these costs onto borrowers strategically. Ronny Chokaa, a Senior Research Analyst at AIB-AXYS Africa, said that banks have managed to preserve their net interest margins (NIMs) despite the economic headwinds by adjusting loan interest rates. He further noted that the profitability seen in the first half of 2024 was driven by strategic shifts such as risk-based credit pricing and higher yields on government securities.

“Banks have soared to unprecedented profitability levels over the first half of 2024 on account of favourable industry shifts, including risk-based credit pricing, rising yields on government securities, deepening smartphone penetration and increased financial literacy levels that have accelerated mobile banking adoption while reducing operating costs for commercial banks,” Chokaa said.

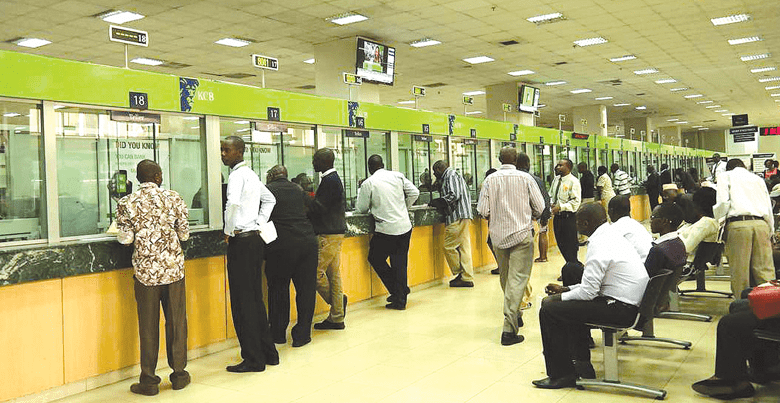

During that period, KCB Group led the big boys in the sector with a 40.8 per cent increase in net interest income, which rose to Sh31.1 billion, driven by a 46 per cent jump in interest income from loans and advances. This resulted in KCB’s NIM increasing to 7.4 per cent, demonstrating effective management of its lending portfolio. Equity Group Holdings also posted strong results, with net profit growing by 25 per cent to Sh16 billion, largely due to robust net interest income, which bolstered the group’s NIM.

Co-operative Bank of Kenya reported a net profit of Sh13 billion in the first half of 2024, up from Sh12.1 billion in the previous year, fuelled by higher income and customer deposits. The bank’s profit before tax rose by 10.7per cent to Sh18.2 billion, compared to Sh16.4 billion in the same period in 2023.

Standard Chartered Bank Kenya saw a 20 per cent increase in net interest income, with its NIM improving to 8.2 per cent, up from 7.9 per cent the previous year. Similarly, I&M Bank’s net interest income grew by 15 per cent, maintaining a stable NIM of 7.5 per cent.

NCBA Group recorded a 12per cent increase in net interest income, with its NIM rising slightly to 7.8per cent, attributed to higher loan volumes and effective interest rate management. These results reflect a strong performance across the banking sector, even as lenders contend with rising costs. While many of these banks are considering paying dividends to shareholders, the increased borrowing costs are putting a strain on households and businesses, raising concerns about potential defaults and the overall health of the economy.

The government’s rising yields on Treasury bills, averaging 10.5 per cent for 91-day bills and reaching up to 14per cent for 10-year bonds, have also contributed to the increasing cost of borrowing for consumers. Financial experts note that banks, many of which have adopted risk-based lending practices, are now optimising interest rates based on borrowers’ creditworthiness.

This approach not only enhances the quality of loan portfolios but also enables banks to extend credit more effectively, ensuring profitability despite rising funding costs. Chokaa added that by accurately assessing borrowers’ risk profiles, banks are charging higher rates for riskier loans while focusing on high-quality borrowers, thereby reducing defaults and improving overall loan health.