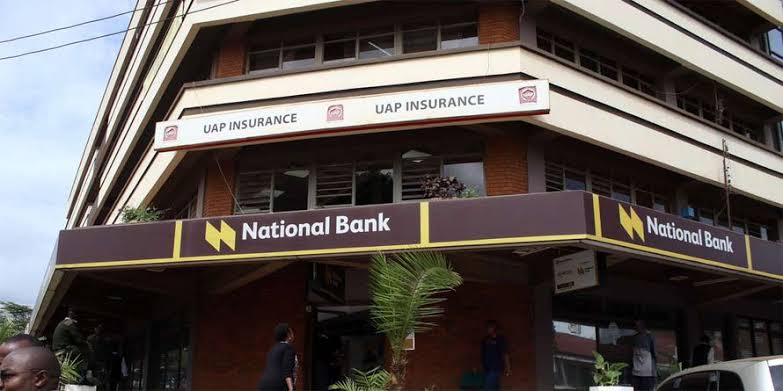

National Bank receives Sh5b cash injection

KCB Group Plc has injected Sh5 billion into its newly acquired subsidiary, National Bank of Kenya, to address it capital adequacy requirement and bolster financial resources.

Capital adequacy ratio, also known as capital-to-risk weighted assets ratio (CRAR), is used to protect depositors and promote the stability and efficiency of financial systems around the world.

The fresh injection was confirmed in a statement to newsrooms dated December 31 2019 and signed by NBK Company Secretary Joseph Kania.

Capital adequacy

“In addition to enabling NBK comply with capital adequacy requirements the injection bolsters NBKs financial resources,” the notice added.

Patrick Mumo, a banking analyst with Genghis Capital said NBK has historically operated below the minimal capital and liquidity threshold of Sh1 billion. By September 2019, NBK’s capital was Sh993.7 million.

“NBK has historically operated on minimal capital and liquidity requirement, which is below the required regulated threshold,” he said.

As at last September, NBK had a non-performing loan portfolio of Sh32 billion, with the bank’s Chief Executive in November, saying they were following up on 30 debtors owing the institution Sh22 billion.

Mumo, who spoke to Business Hub on telephone, said he did not expect the capital injection to trigger a change in the market, since the movement of capital was from the group level to subsidiary.

“If it moves in response (to the capital injection) this will be an overreaction by investors,” he said. Yesterday, KCB Group shares on the Nairobi Securities Exchange were selling at Sh54.75, up from Sh53.25 on Wednesday.

In October, KCB Group appointed a new board led by John Nyerere, completing governance changes instituted in September when Paul Russo replaced immediate former Managing Director Wilfred Mutuku Musau in what was meant to transition and eventual integrate NBK into KCB Group.