Low-income insurance craze dims

Insurance companies are struggling to sell micro-insurance products with experts conceding that the once hyped concept has failed to excite the local market.

Until recently, most insurers both locally and across several African markets, had heavily relied on face-to-face distribution, and still rely on legacy systems that do not accommodate the changing time and needs of consumers.

Experts in the sector now say this must change if players are to reap from this segment of the insurance market, that they admit hasn’t been fully tapped.

Micro-insurance products

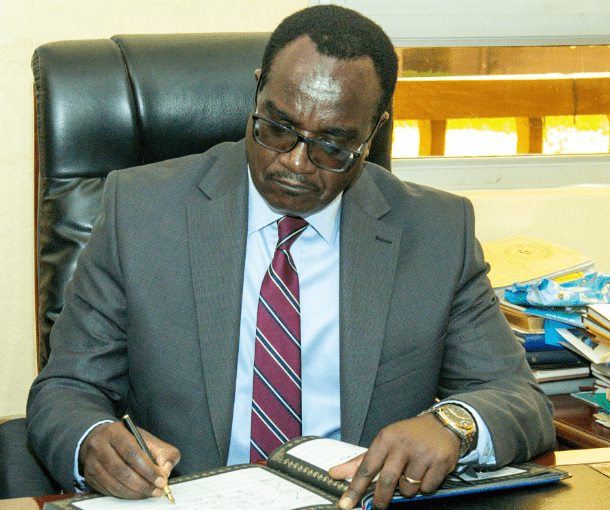

“Technology will be a key driver of micro insurance in Africa as insurers close the protection gap in driving the inclusive insurance agenda,” urged Godfrey Kiptum the Insurance Regulatory Authority (IRA) Commissioner of Insurance at opening of the Eastern and Southern Africa Regional Conference on Inclusive Insurance. He urged players to adopt innovative business models “that will curb the damages that hinder access to insurance.”

Micro-insurance products target low-income households and are often tailored specifically for compensation for illness, injury, or death, and lower valued possessions or assets.

However, the concept is yet to be accepted by most of the target market owing to a number of reasons including the high cost of selling such products to individuals compared to group covers which are most preferred by the insurance firms.

Several insurance firms like CIC insurance have since abandoned products like Afya Bora terming it loss-making with as many products suffering a similar fate.

In a world where consumers bank on technology that revolves around smartphones, insurers are now being advised to digitise customer engagement through software applications so as to boost general insurance penetration.

At 3 per cent, Kenya has the third lowest insurance penetration rate in Sub-Saharan Africa with South Africa leading at 17 per cent. This as most Kenyans perceive insurance as a “nice-to-have, easy to discard” product rather than one that is essential.

Apollo Group Chief Executive Officer Ashok Shah said there is a huge potential in inclusive insurance to drive the premium uptake in the region, citing cost as a key factor inhibiting insurance growth.