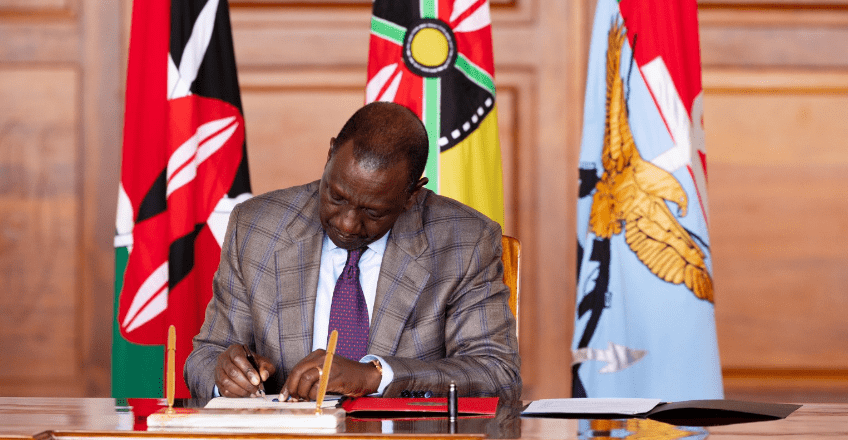

President William Ruto’s decision to order a forensic audit of Kenya’s public debt is a step in the right direction though, to achieve better success, he should have advised Auditor-General Nancy Gathungu to make the appointments.

Part of the reason that the Law Society of Kenya (LSK) and its president, Faith Odhiambo, rejected the appointment has to do with the constitutionality of President Ruto’s making the announcement. As far as they were concerned, he appeared to usurp the powers of the Auditor-General and this did not sit well with them.

In principle, however, all indications are that they would otherwise have agreed with such an audit. Which, in turn, means that if the same window were to be opened by Gathungu, the LSK would be willing to reconsider its position. We should find another way to reopen that window.

Some commentators – such as Busia Senator Okiya Omtatah and businessman Jimi Wanjigi – have been arguing that Kenya already paid off its debt, though this is stretching the facts a little too thin. Such comments, farfetched as they may sound, have fuelled the calls for an audit of how much Kenya owes and who our creditors are.

This is because the lion’s share of our tax revenue – about 61 percent – is spent on debt repayment in a regime where this is the first and mandatory charge on the Exchequer. As a result, we are left with less than 40 percent to pay salaries for our bloated civil and public service and morsels with which to fund development.

This is the very reason that Gen Z protesters questioned this year’s finance bill since it was squeezing taxpayers to fund debt repayment.

In 1998, when the question of public debt first became an issue of concern, every Kenyan, including a day-old child, owed Sh38,000. That was our debt per capita. By 2018, the Jubilee administration was borrowing an average of Sh800 million a day. That was when public debt started ballooning to the point where when the Kenya Kwanza administration came into office, one of the very first far-reaching decisions that the Cabinet made was to make debt a percentage of the country’s wealth, also known as Gross Domestic Product (GDP).

At the time, Kenya’s debt had hit a ceiling at Sh9.8 trillion against a target of Sh10 trillion, and so there was little or no room for the new administration to borrow. Pegging debt at 50 percent of GDP would have allowed the government to borrow an extra Sh7 trillion. By then, debt per capita stood at around Sh200,000. Today, it has grown by another Sh50,000 per person.

This is why we need to audit who we owe and how much we owe them so that when we ask citizens to pay higher taxes to service historical debt, they have a clear picture of where their money is going.

That said, it would and should not come as a surprise if the audit reveals that we owe much of our debt to private entities – individuals and corporations – rather than to bilateral and multilateral lenders. Neither should it come as a surprise that a large chunk of our national debt is equivalent to the amount of money that corrupt public and State officials in past and present administrations have stashed abroad.

If this turns out to be the case, as it could, it would imply that we are paying higher taxes to individuals who have been in positions of political authority, their cronies or their companies, some of which are registered in tax havens and whose shareholding remains shadowy.

Already, and sadly, the appointment of the forensic audit team, to be led by Nancy Onyango, an auditor of no mean repute, has run into political headwinds. The President should, therefore, find ways to unlock the deadlock so that some work can actually get done despite the storm that will blow once the findings are made public.

— The writer is the Editor-in-Chief of the Nairobi Law Monthly and Nairobi Business Monthly-