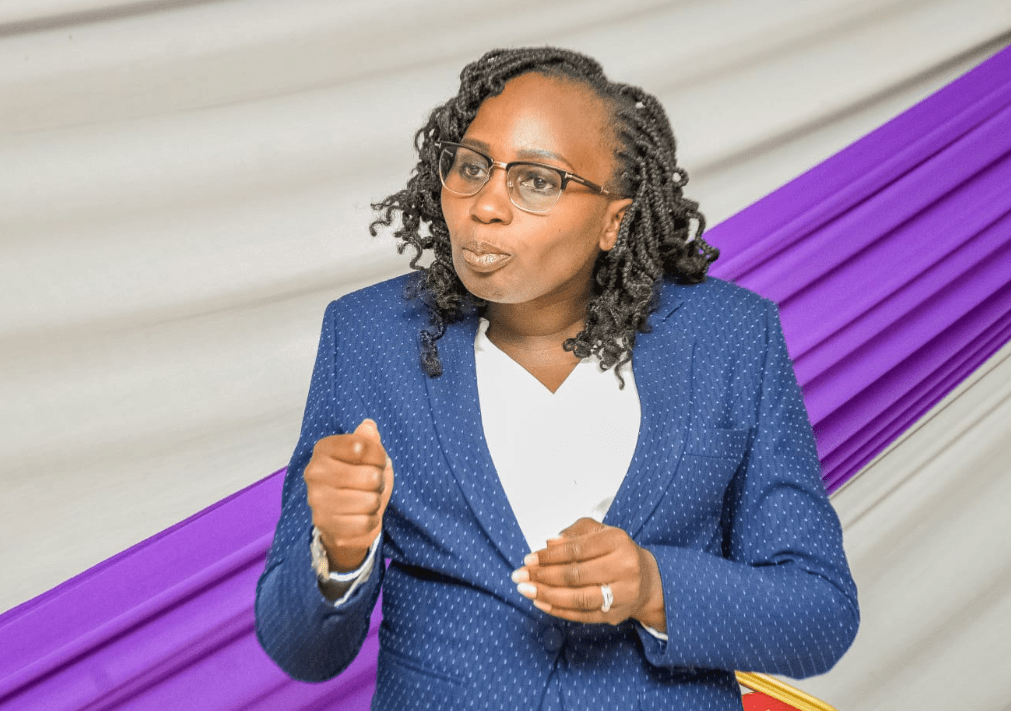

Elizabeth Nkukuu

Whatever you do today, never forget that each spent day gets you closer to a time when you shall not have to work formally again.

This can be both exciting and scary at the same time and the fundamental question then is; what are you doing as that big day draws closer?

People view retirement differently. To some it is the time to do what we have always procrastinated doing.

To others it is the end of working and for some just a time to live as we await our final days.

No matter what it means to you, it is always good to ensure that you are well prepared for that day, as it is during which the time one can potentially create a legacy and change the course of their universe.

To that end, focus is important, hence when investing for retirement one needs to look at the following key factors:

i. Available Time to Retirement: According to George Foreman “The question isn’t at what age I want to retire, it’s at what income.”

But it becomes difficult to know the income you are retiring to if you do not understand how much time you have.

It is good therefore to indicate when one is aspiring to retire and ensure that they are creating sufficient investments towards that,

ii. Cashflow required in Retirement: As a general rule of thump the income replacement ratio should be at 70 per cent.

This means that you need 70 per cent of your pre- retirement income if you are to leave well in retirement.

One of the key challenges in retirement is that some of the basic privileges you used to get while actively employed are taken away eg buying newspaper and since you were used to having it you must plan well for it ,

iii. Life in Retirement: Since retirement is not a perfect destination one needs to look and see how they believe they shall want to lead their lives during retirement.

With the life expectancy having increased much, people are much stronger even later in their lives and they can still engage in their job like activities even in retirement.

The main question then becomes what are you doing to prepare on being useful even in retirement.

This could include starting a business or venture that will engage you when you retire or maybe furthering your education so that you can maybe get a different job in retirement eg consultancy in your area of expertise

iv. Available Investment options: Understanding the available investment options and matching them with the lives goals is of utmost importance.

As one works their retirement portfolios, it is good to ensure that they can select the best available options and the ones that give the maximum returns like contribution into a pension scheme is tax deductible, meaning that you have better benefits if you went that route as opposed to investing your after net income.

If your employer has no retirement fund then you can join individual pension schemes

v. Investment Partners: Commitment to a vision is important. The starting point to achieving any set goals is writing it down the next part is execution.

On the execution part, people are busy with their full-time jobs, the key question then becomes who can help you achieve what you need to do. Selecting the right partner becomes the most important decision one needs to make.

In summary some of the key questions one needs to answer when working on their investment plan include.

i. How much do I need when I retire?

ii. How much monthly investment do I need to put away now to achieve that amount needed,

iii. What sort of minimum returns should my funds generate to accelerate my goal attainment,

iv. Based on the above two what time period is required to achieve this,

v. Marry the difference between i) and the product of ii), iii) and iv above and create a distinct action plan to ensure you plan well.

Irrespective of where you are in our retirement journey, you need to start investing towards retirement, it is that important. The available investment options include:

i. Starting a business,

ii. Investing in real estate

iii. Investing in retirement benefits Schemes

iv. Investing in other formal ways like unit trusts and informal ways like chama.

The starting point is investing in self by gaining knowledge, coming up with a distinct plan and actively implementing the plan while coming up with milestones checks along the way. This can be a daunting task and therefore working this journey with someone is important.

If you are ready to start this journey speak to us at [email protected]