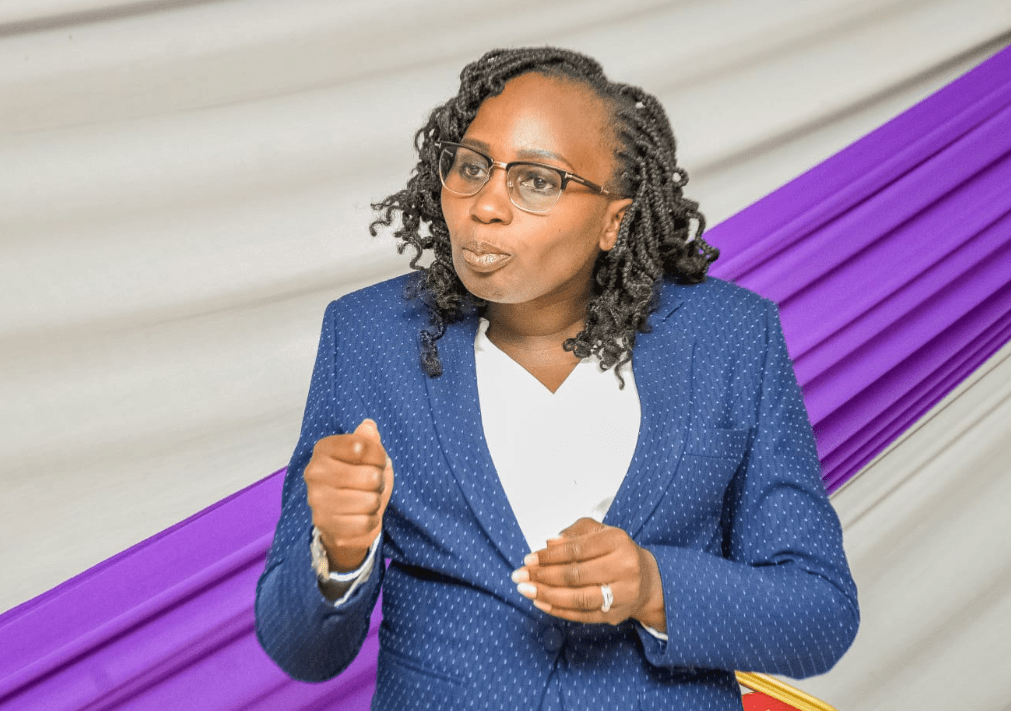

JANET MUNGUTI

Kenya’s emerging technology space has grown exponentially but its best kept secret is the struggle to find, motivate and retain top tech talent.

This is in addition to the fact that the sector has attracted a slew of global tech behemoths and created a competitive ecosystem that has enabled indigenous firms to build and train tech talent locally.

In an unprecedented turn of events, this locally trained talent has become a point of contention between indigenous companies and the world’s tech crème de la crème that have invested in Africa, that is; Microsoft, Google, Huawei, IBM, Intel Corporation et al.

Pandemic-related disruptions have increased the need for digitisation in most industries and created a business case for investing in technology and human resources.

As human relations leaders, we now face a drastically different landscape than before; a hybrid workforce, virtual recruitment, and a greater emphasis on diversity and inclusion have all introduced new dynamics. This scenario has fuelled an already difficult situation in local tech start-ups; motivating and retaining skilled tech talent.

While high salaries and benefits have traditionally been used to attract and retain talent, this is not always a viable option, particularly when startups face poachers from larger and more established competitors.

Type of compensation

In Kenya, an indigenous tech logistics start-up like Sendy Ltd, whose supply, freight, and transportation operations are led by artificial intelligence, takes pride in investing in local tech talent, rigorously training and moulding their own engineers in an in-house engineering hub.

However, it must contend with the loss of this talent to larger global competitors such as Microsoft and IBM’s operations in Kenya.

However, global companies have used a tried-and-true tool to attract and retain workers; the employee stock option plan, or ESOP, a scheme in which a company grants employee stock options.

An employee is given an option that grants them the right to purchase a specified number of shares in the company at a predetermined price at a future date at no additional cost to the employee.

The stock option way was born in 1957, when a group of engineers founded Fairchild Semiconductors, the pioneer chip startup in the world – famous California technopole.

The investors then presented the founders with a relatively new type of compensation; stock options.

By the mid-1970s, investors in venture-funded start-ups were beginning to provide stock options to all of their employees.

While this radical idea has gone through several iterations in mature markets, evolving into more sophisticated ways of raising capital, the trend is slowly gaining traction in the African start-up landscape.

Sendy, which is expanding into East, West, and North Africa, has followed suit with a stock option programme for its employees in order to retain its skilled resources.

The idea is simple – all employees are eligible to receive an option (an offer) to own a part of the company through stock options.

Employees do not get to own their stock options all at once, but the stock trickles out over one to four years, as one “vests” a part of the option grant each month.

As with most stock option plans, unless an employee stays in the company for an entire year, they would not vest any stock.

More like owners

The business case is that by giving current and prospective employees a stake in the company’s future growth–with a clear time horizon for a payoff–employees can act more like owners and provide more value.

The net result is an alignment of employee and investor interests. This bet has mostly worked in the past.

Kenya could benefit greatly on a national scale if it advocated for the retention of tech talent within its borders.

For example, policymakers in the European Union have continued to reform their employee share ownership rules in order to compete with rival Silicon Valley.

France, in particular, has revised its start-up rules to make it easier for French companies to hire and retain employees, including allowing employees based in the country to receive stock options even if the company is not incorporated in that country and ensuring stock options are priced at a fair-market value rather than the price paid by investors. It is now the most appealing to European start-ups. — The writer is the Chief Human Resource Officer at Sendy Ltd