The government has threatened to terminate contracts with health facilities that are demanding upfront payment of insurance premiums as a new outfit to address the challenges that have bedevilled the roll-out of the Universal Health Coverage (UHC), specifically the Social Health Authority (SHA).

Medical Services Harry Kimtai was categorical that health facilities empanelled to offer services under the SHA will lose their contractual licenses if they fail to comply with the law to allow unemployed Kenyans access to treatment.

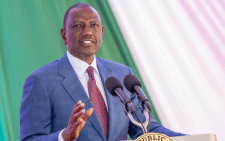

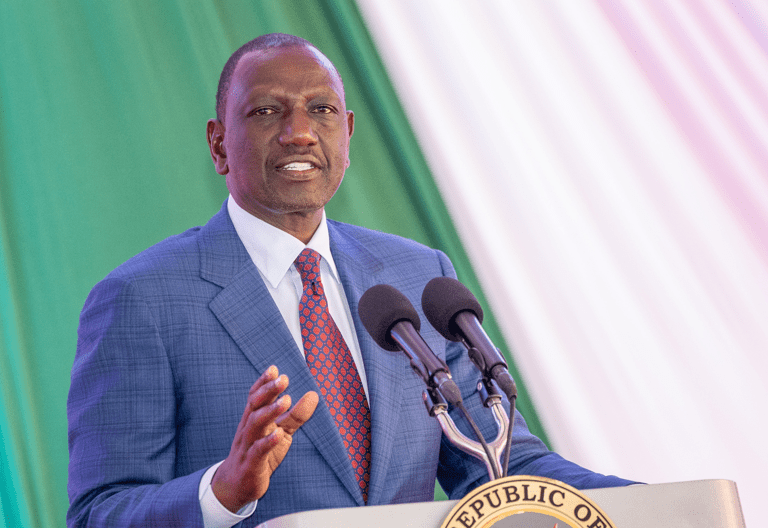

While addressing journalists after meeting members of the National Government Administrative Officers (NGAO), County Executive Members in charge of health (CECs), and the faith-based and private health facilities, the PS said the insurance premium financing model is still incomplete.

“Any facility that has contracted and accepted the terms to provide service under SHA will be able to comply and provide those services. Failure to do that, then actions will be taken in accordance with the law,” Kimtai cautioned.

Insurance premium financing is essentially a loan that a business takes out to purchase an insurance policy, such as life insurance or a retirement policy. “Since most of the people who registered under SHA are not employed, removal of the upfront requirement has been done for the period since the insurance premium financing model is still incomplete,” argued the PS.

He emphasised that when the premium financing model is ready, then the government will urge Kenyans to pay their premiums upfront based on the financing agreement they will enter with either the cooperative societies or some of the financial institutions, who are coming in to support the SHA rollout. “With the option to pay monthly until the premium financing operation is introduced, the citizens are favoured,” he stated.

The members of the NGAO and the CECs are drawn from Central Kenya, Northeastern and eastern regions, and parts of the Rift Valley. Kimtai said that the CECs from these counties within those regions have agreed on a joint effort to ensure the rollout of SHA is uninterrupted.

The main aim, he emphasised, is to continue with the drive of registration to ensure that each and every Kenyan is registered for share and also they are able to access health care within the facilities in the counties.

He said most of those challenges that were experienced earlier have been dealt with, but the few that are remaining will be addressed as a result of the upcoming formation of a technical committee within the counties.

This will include the ICT officers, the technicians from the service providers and the officers from the social health authority.

“Therefore, as a result of some of the contracted facilities continuously asking for upfront payment, they will be under the supervision of the county executive committee members of health together with the county commissioners,” he said.

Another meeting will be conducted for the CECs and the county commissioners from the western region which will cover the entire country after the last meeting was conducted yesterday in Rift Valley.

“We acknowledge that we owe some of the health facilities outstanding debts, but we released Sh4.5 billion last week and the facilities can confirm that they have received payments.

“This week we are releasing another 4.5 billion Kenya shillings for payment of debts that we owe these facilities,” he added.

The main reason for the formation of the multi-stakeholder approach is to sensitize most of the Kenyans register for them to be knowledgeable about the movement away from the NHIF to now the SHA treatment.

The NHIF members who were previously registered were moved in accordance with the law, and they were notified through a message to confirm their registration status.

We’ve not had any case where a former NHIF member has been denied services. The premiums that they had paid were also moved to SHA and so they lost nothing in terms of the transition.

“We had to ensure that there was a smooth transition to SHA.”