The government has raised concern over the escalating mismanagement of Saccos which has led to the loss of savings and investment by the members.

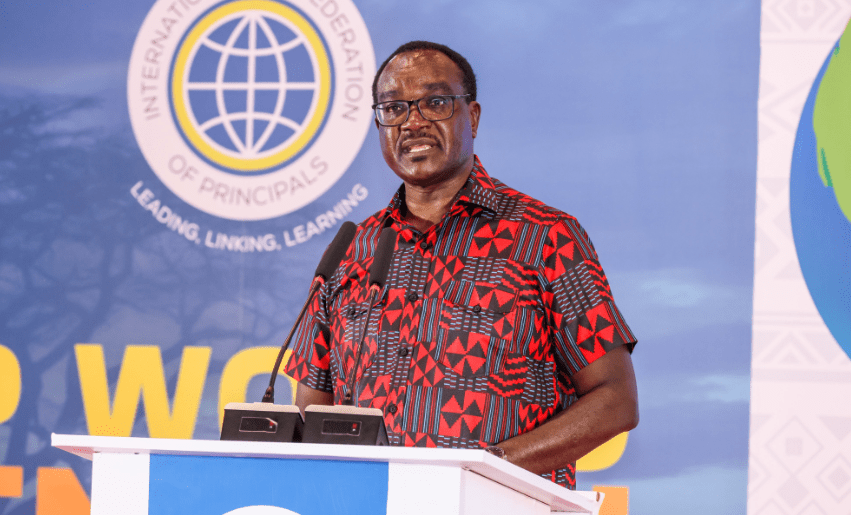

Cabinet Secretary for Cooperatives Wycliffe Oparanya said that despite the government reviewing the legal and regulatory framework governing leadership and management of Saccos, it has not succeeded in eliminating mismanagement and other corrupt practices by some of the officials.

Oparanya urged Sacco members to support the creation of a federation to regulate Saccos as proposed in the Cooperative Bill 2024 which is currently before Parliament.

“Dealing with mismanagement cannot be the business of government alone. It requires cooperation and partnership with yourself, (Saccos) the industry leaders to give meaning to the policy and legal framework obtained. I would expect the federation to be the custodian of good governance as it has both legal and moral authority given the huge public interest circles as depositing financial institutions have,” the newly appointed CS said.

He went on: “The Sacco industry, through the federation, must own, promote, and uphold good governance practices through public education and self-regulation.”

Oparanya who spoke during the launch of the SACCO Societies Regulatory Authority (SASRA) Supervision Report raised concern that whereas there are a total of 357 registered Saccos in Kenya, 73.3 per cent of the total assets owned by the industry are in the hands of a mere 53 Saccos, while a majority 304 Saccos whose members are the hustlers only own 36.6 per cent assets.

“This is uncommon in the financial sector and it raises serious policy concerns on the effect of small Saccos often established by a community of like-minded individuals,