The government is considering transitioning the Credit Guarantee Scheme (CGS) into a company to accommodate more institutions.

The State-backed scheme which seeks to enhance loan access to credit by micro, small and medium enterprises (MSMEs) had disbursed Sh6.2 billion by December 2023, since its launch in 2020.

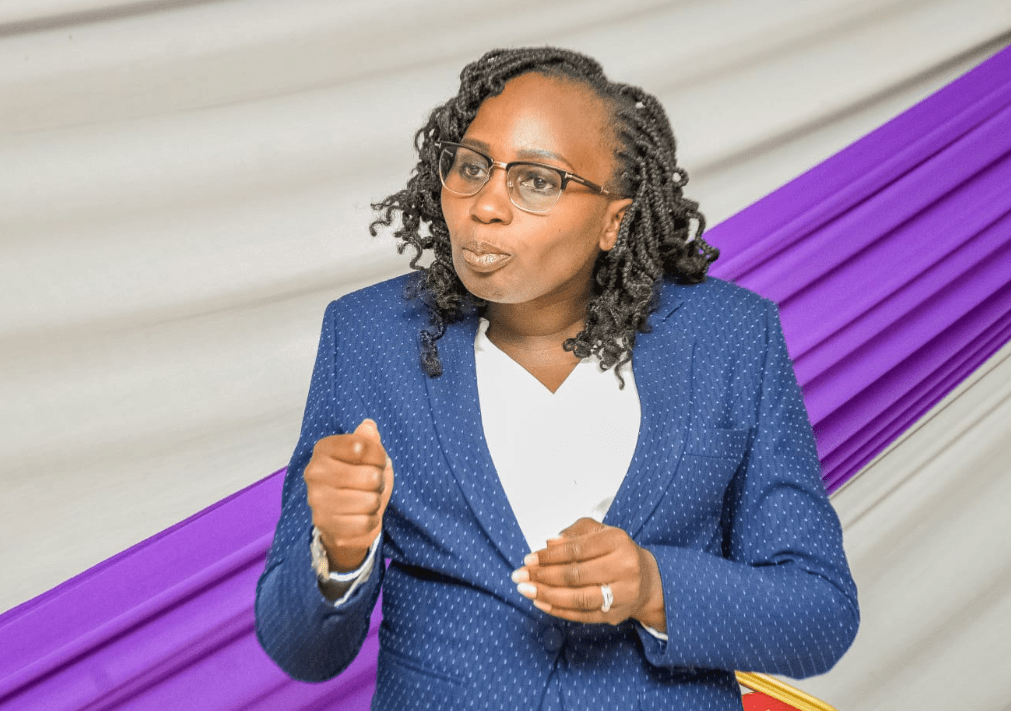

In a rather sluggish sector, the scheme which seeks to share default risks with banks and hence increase the pool of funds available for lending, had disbursed Sh5.8 billion as of June 2023. This has seen the Principal Secretary, State Department of MSMEs Susan Mange’eni claim there is need to rev up the sector by onboarding more Private Financial Institutions (PFIs).

The expected inclusion of more PFIs apart from the current eight in the scheme will broaden its reach and impact, meaning more financial institutions will provide loans to MSMEs, enhancing their credit access.

According to Central Bank of Kenya’s annual banking supervision report, currently, the disbursements represent less than 1 per cent of the value of active MSME loan accounts in the banking industry as of the end of December 2022 or Sh783.3 billion.

“We intend to open up the credit guarantee fund from the current 8 banks to a number of financial institutions, transitioning it to a company,” Mang’eni said yesterday, at the launch of the Kenya Manufacturers Association (KAM) 2024 Manufacturing Priority Agenda (MPA) and the Agriculture for Industry (A4I) Report.

The MPA Report offers a strategic blueprint designed to overcome challenges, capitalise on opportunities, and propel Kenya’s manufacturing industry onto the global stage. Kenya’s manufacturing sector contributed 7.8 per cent to the gross domestic product (GDP) in 2022, representing a value of Sh3.2 trillion, and generating 352,000 direct jobs.

Policy initiative

The CGS is a key government policy initiative designed to enhance access to credit for MSMEs. It operates on a risk-sharing model where the government commits to pay PFIs a portion of the outstanding principal amount in the event of default on qualifying credit facilities advanced to MSMEs.

This mechanism has so far supported 4,078 beneficiaries, with a total loan disbursement of Sh6.2 billion, and a repayment of Sh2.4 billion. Mang’eni revealed that the State Department of MSMEs is working on a cabinet memorandum to set up Common User Facilities (CUF).

This, she said, will enable the MSMEs to gain access to shared resources and services, which can reduce costs and boost productivity.

They will also encourage collaboration and innovation, and can help MSMEs reach larger markets, promoting their growth and sustainability, she said.

“We are currently working on a cabinet memorandum and looking at the legal framework on using the Common User Facilities,” Mang’eni said.

She challenged KAM members to follow the example set by Unilever Kenya’s Emerge Accelerator Programme. This programme is a significant initiative for SMEs, offering training, mentorship, and financial support, with a commitment to spend Sh1 billion annually with diverse businesses by 2025.