The government has introduced a new levy targeting government contractors to boost tax revenue amidst declining collections. Starting September 1, suppliers of goods and services to both national and county governments must remit the levy as stipulated in the Public Procurement Capacity Building Levy Order 2023.

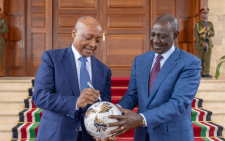

The Public Procurement Regulatory Authority (PPRA) issued a notice informing all public sector stakeholders of the directive, which was authorised by the Cabinet Secretary for National Treasury and Economic Planning, John Mbadi.

According to the Levy Order, 2023, suppliers are required to pay 0.03 per cent of the contract value, exclusive of taxes, on all agreements with procuring entities. The levy applies to all procurement contracts signed from September 1, 2024, including contract extensions, renewals, and variations.

“The levy will be applicable to all procurement contracts signed from September 1, 2024, including any contract extensions, renewals, and variations that are signed on or after this date,” the notice read in part.

Revenue target

The government aims to collect at least $2 million (Sh295.5 million) from this levy, with public procurement accounting for approximately 10 per cent of Kenya’s gross domestic product (GDP).

Despite the Kenya Revenue Authority (KRA) collecting Sh2.407 trillion in the financial year ending June 2024—a growth of 11.1 per cent from the previous year—it missed its revenue target by Sh130 billion.

The new levy will apply to contracts involving national and county governments, state corporations, publicly-owned companies, and any other entities as defined by the Public Finance Management Act, 2012.

Treasury introduced the levy in 2023, claiming it was meant to strengthen public procurement systems and expand revenue collection. After the proposal, public comments were invited, leading to its formal adoption. The PPRA stated that the levy is intended to improve public procurement practices by funding capacity development for those involved in procurement and asset disposal through training, mentoring, and technical assistance. This development follows PPRA’s recent efforts to streamline public tendering, including adopting a new procurement platform for publishing contract awards and tender notices. The levy also applies to long-term contracts, where Local Service Orders (LSOs) or Local Purchase Orders (LPOs) are issued as orders are placed.

Procuring entities must remit the levy through the eCitizen platform by the 20th of the following month, with a 5 per cent penalty for late payments.

Additionally, monthly returns on deducted and remitted levy amounts must be filed with the Public Procurement Information Portal to ensure transparency and accountability. However, concerns have been raised by law firm Bowmans on its website regarding the specific contracts affected, deductible costs, and the developer partner as outlined in the levy order.

To ensure a smooth transition, the PPRA plans to hold stakeholder sensitisation forums starting in September 2024, along with continuous engagement and collaboration to enhance compliance with the Levy Order 2023.