The Ministry of Agriculture and other value chain stakeholders have been directed to provide information of the total stocks of unsold tea currently stored in warehouses in Mombasa.

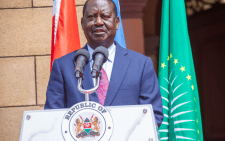

In a letter addressed to the Agriculture Principal Secretary dated July 15, 2024, Prime Cabinet Secretary and Foreign Affairs and Diaspora Affairs Cabinet Secretary Musalia Mudavadi also wants more details on the shelf life of the unsold stocks held in Mombasa. Following a downward trend of tea prices at Mombasa auction in 2021, former Uhuru Kenyatta administration established a minimum reserve price of $2.6 and $2.4 for teas from the East and West of the Rift respectively.

The creation of a minimum reserve price at $2.43 was set in June 2021 as part of stabilising the market. By then tea prices at the Mombasa tea auction had declined to below $2 per kg. The set reserve price was a response to taming the high cost of production which had been accelerated by electricity and labour.

Mudavadi confirmed that his office has in the recent past received information indicating that the minimum pricing policy established in June 2021 has led to a surplus of tea disrupting market dynamics in both the East and West of the Rift.

He wants Agriculture PS, Tea Board of Kenya (TBK) and Kenya Tea Development Agency (KTDA) to furnish his office with information detailing the space occupied by the unsold stocks of tea.

The accumulation of unsold tea at Mombasa auction, Mudavadi stated, followed a set minimum reserve price of $2.4 (Sh315.60) by the government in mid-2021 to stabilise the market which then was struggling with a downward trend.

Former President Uhuru Kenyatta’s administration employed the initiative to stabilise the market and address the declining tea prices at the Mombasa auction. “However, this intervention has led to several unintended consequences without addressing the root causes of the price decline. Specifically, the declining quality of Kenyan teas, a significant factor in the low prices, was not addressed by the minimum pricing policy,” said Mudavadi.

Uneven playing field

Moreover, he added, setting a minimum price did not incentivise improvements in the tea quality as the policy was applied exclusively to small holder KTDA teas, excluding independent tea factories primarily in the West of the Rift. Mudavadi said this has created an uneven playing field.

Independent factories, he added, continue to sell at flexible prices, making their teas more attractive compared to KTDA teas at $2.4 (315.60). The accumulation of unsold tea, the government claims could have resulted in high indebtedness to KTDA in order to ensure farmers are paid for their delivered tea.

Therefore, Mudavadi has requested PS Agriculture to provide level of KTDA indebtedness to the farmers, financial institutions per factory as at June 30, 2024.

“Consequently, there is a market preference for independent factory teas over KTDA teas. This situation resulted in accumulation of unsold teas at the auction, severely impacting prices and causing a market glut,” he added. The government confirmed that approximately 20 million kilogrammes of teas produced in 2023 and earlier remain unsold and are stored in Mombasa warehouses, accruing high warehousing charges.

Additionally, approximately 95.2 million kg of fresh teas were unsold as at the end of June 30, 2024. The accumulation of unsold tea hampers producers’ ability to pay farmers income.

Mudavadi now demands that the Ministry of Agriculture and other tea value chains provide information on warehousing charges and lessors of the warehouses holding unsold tea and how the cost of warehousing will be handled.