National Treasury Cabinet Secretary John Mbadi will be summoned by Parliament to explain why his office has not acted on the illegal deductions in payslips to below the requisite one-third rule due to increased taxes.

The Employment Act, 2007, forbids employers from deducting more than two-thirds of the basic pay from an employee.

The law requires employees take home at least a third of their basic salary as net salary—what remains after all deductions, including statutory obligations—otherwise known as the one-third rule.

Employers who make deductions that reduce an employee’s salary to less than one-third are guilty of a criminal offense and are subject to penalties. The employer is also liable to refund any amount that was wrongfully withheld or deducted.

The law also includes the two-third salary rule, which states that employers cannot deduct more than two-thirds of an employee’s gross salary. This rule was created to help control how much debt workers can take on using their salary.

Emerging reality

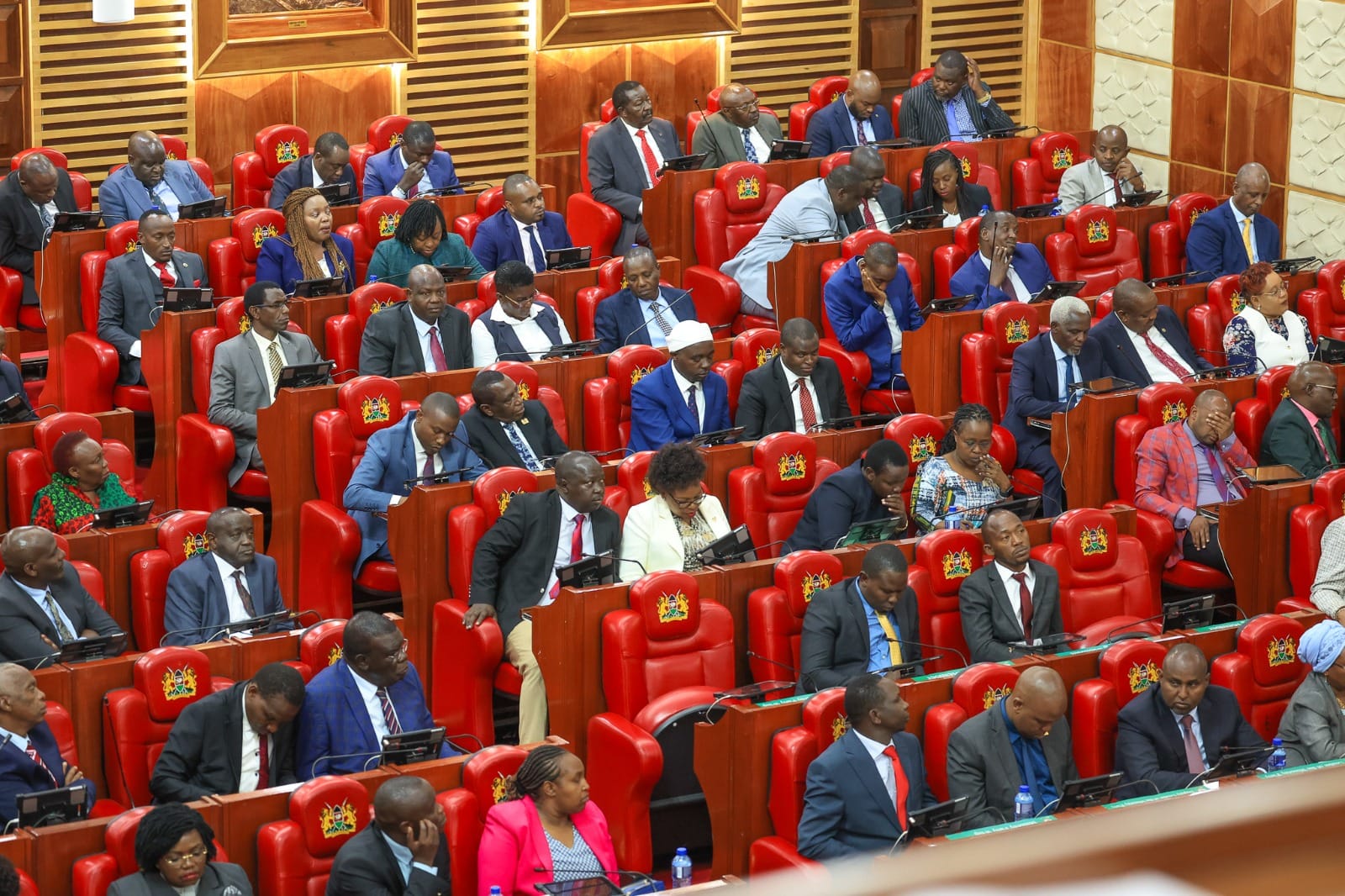

The Public Accounts Committee (PAC) of the National Assembly now wants Mbadi to shed light on plans set in place to circumnavigate the emerging reality where thousands of civil servants are earning less the one-third of their salary.

According to a report by the Public Service Commission (PSC), out of 79,453 public officers in the civil service, 17,132 representing 21.6 percent earn less than one-third of their basic salary.

The situation is the same in the counties with Kiambu leading with 2,248 taking home a salary less than a third of their basic pay.

The MPs also want the management of state departments which have breached the constitutional obligation of staff earning less than one-third of the net salary to appear to them to explain why they were acting outside the law.

Tax measures

The committee noted that the salary issue has been prompted by the new tax measures introduced by the Kenya Kwanza government in the last two years.

The committee which is chaired by Butere MP Tindi Mwale noted that in the last two years, employees have been slapped with 1.5 percent of their gross pay and a further 2.75 percent deducted to cater for the mandatory Social Health Insurance Fund (SHIF).

“The problem that the new taxes have caused is that employees end up on the one-third of basic pay threshold,” noted Mwale.

Auditor General Nancy Gathungu had in her report raised concerns over the huge number of civil servants taking home pay less than what is required by the law.

“It is time we engage with the National Treasury on why public servants are not complying with the law,” Nabii Nabwera (Lugari) said.

Rarieda MP Otiende Amolo while supporting Nabwera’s sentiments called for a review of the regulations with a view of aligning it with the new reality.

“We need to engage with the National Treasury so that we can recommend changes to the policy,” said Amolo.

The lawmakers spoke when they met Roads Principal Secretary Joseph Mbugua about queries raised by the auditor, one of which was non-compliance with the one-third of basic salary rule.

The auditor in her 2022/23 report flagged the state department for having hundreds of employees receiving net pay below a third of their basic salary.

In the 2021/22 financial year, over 10,000 public service workers earned below a third of their basic salaries.