Why Kenyans are falling behind in their savings

Only 12 per cent of Kenyans have a rooted savings culture—faithfully put aside a portion of their regular income for their future. In addition, Kenyans have the intention to want to save but continuously experience challenges in actualising the behaviour. This is according to a recent report on Savings and Investment Behaviours among Kenyans by Enwealth Financial services. Statistically, this savings rate translates to less than 15 per cent of the GDP which falls below the 30 per cent target under the Vision 2030.

Times are tough and many are struggling to financially cope with the rising cost of living. Income inadequacy is a significant hindrance to savings. Still, saving is imperative to both individual and collective financial prosperity. We often think we must be earning six-figure incomes to start saving yet all one needs is to develop the saving discipline. This means habitually setting aside a given percentage of income regardless of the amount. The art of managing money is an important life skill that everyone needs. More so, creating a balance between spending and saving is crucial to the art. Creditably, retirement is one of the top savings goals according to the report. It’s favourable to have an occupational pension scheme in organisations. Since the money is deducted before their pay, the employees save routinely.

Education is the unsurpassed way to empower people. For starters, children are not adequately acquainted with basic money concepts from a young age. Growing up, for instance, I could count the number of children who were encouraged to keep piggy banks by parents. Years later those who didn’t have such exposure have become a case of trying to teach an old dog new tricks. It is harder to learn.

But even after missing the chance, our education system does not fill the gap. Higher education institutions ought to teach mandatory financial literacy courses. Financial planning, debt management, investments, pension savings and taxes are some of the essential touch points in such courses. This is a good level to empower youth with financial knowledge so that as they transition to the workforce and start families, they can process economic information and make informed decisions on money. Furthermore, financial institutions need to increase age-based financial literacy training programmes to arm Kenyans to better manage finances at different stages of life.

As per the pension administrator’s report, black tax has also accentuated the financial strain with 84 per cent of working individuals offering monetary support to families for everyday expenses. In African culture, it is virtuous to support our kin financially. Nonetheless, an individual may get caught up in the responsibilities that they do not have much left for their own savings goals. It is important to find the right balance when apportioning.

Given the ridiculous interest rates and short repayment window, the detrimental effects of mobile loans have been stressed in the past. With digital or mobile lending apps bombarding us with ads, accessing loans is too easy. With just a few clicks, a few personal details and you have the money in a flash but you have to pay it back in a few days with exorbitant interest added failure to which heavy fines are charged. This trend has impacted the personal finances of many regardless of age. Even the older generation who are considered less digital-savvy know how to access loans through mobile apps.

To sum up, we can’t afford to live on the edge financially. We must take control of our finances regardless of economic hardships. Individuals have to find the whys and wherefores for savings shortfall and fix them.

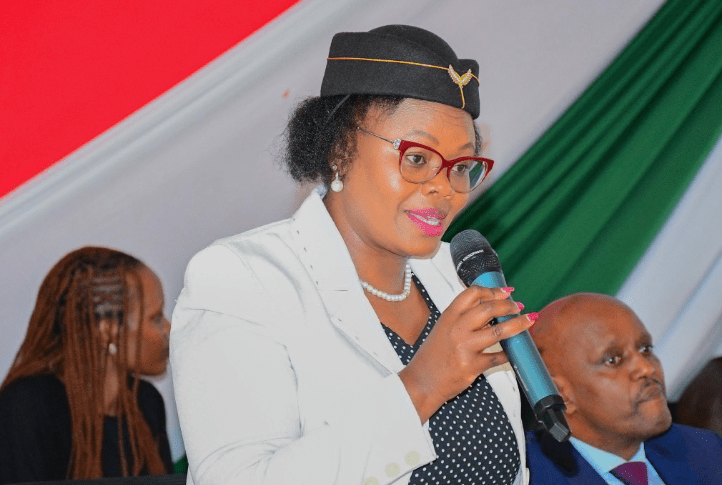

— The writer is the Head of Pension Administration and Consulting, Enwealth Financial Services