Why Kenya faces drop in global coffee market share

Kenya faces isolation in the global coffee market as local supply to the market dwindles amid standoff between the government and players on proposed reforms.

Industry stakeholders have expressed concern at the trend, warning that international buyers are increasingly turning to clean coffee beans from other sources as the local market continues to register low volumes.

They attribute this partly to the ongoing tussle between the government and private coffee companies on direction new reforms in the sub-sector should take. The government is currently implementing reforms in the sub-sector, a situation that has elicited resistance from key secondary players, mainly millers and marketers.

At the same time prices at the Nairobi Coffee Exchange (NCE) dropped by 31.13 per cent in the month of August 2023 compared to the average price during August 2022 which stood at $266.32 (Sh39,149.04) per bag.

This challenge, according to industry insiders, is over and above low prices in the international market as most coffee is not certified by international certification bodies. The auction was closed from May to August 15 when Deputy President Rigathi Gachagua presided over the ringing of the bell to reopen the facility.

Local and international buyers complain that supply of clean bags of coffee offered for sale from the start of August 2023 to date compared to July to September 2022 dropped by 36 per cent following disruption of the market over issuance of new licenses by the government.

Kenya Coffee Traders Association (KCTA), the umbrella body of traders at the exchange said the situation is getting worse as coffee roasters internationally have started scouting for coffee from other markets.

Jack Marrian, General Manager at Taylor Winch (Coffee) Ltd said currently subsidiary companies of international buyers have stopped receiving orders from the roasters owing to the declining volumes at NCE over the last one month.

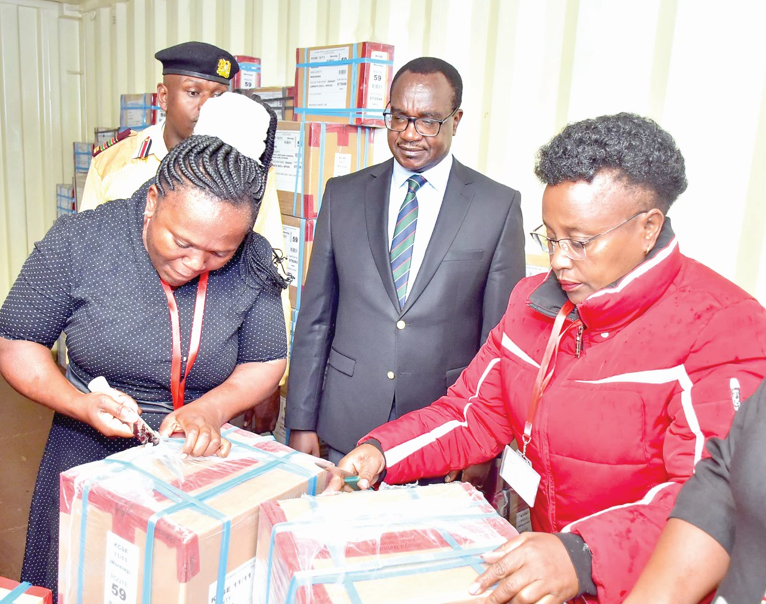

Coffee stakeholders

“Equally, the number of buyers locally has drastically declined over the period,” he disclosed. Early this week during a consultative coffee stakeholders meeting at a Nairobi hotel, Marrian warned that the standoff between the government and former marketing agents over licence issuance is hurting Kenya’s coffee internationally.

“There is high demand for Kenya coffee internationally, but of late volumes have drastically declined leading to the roasters turning to other segments of the international market,” he stated, adding that this is a big blow to the local industry requiring the government to swiftly act to end the stalemate. Marrian explained that during the July-September 2022 licensing cycle, more than 260,000 bags of clean coffee were traded out of which 25 per cent were certified coffee. In the July-September licensing cycle of 2023, only 16,000 bags of clean coffee beans have been traded and none was certified.

During the meeting characterised by exchange of words between private companies and coffee brokers’ institutions sponsored by the government, the buyers warned that if the current situation is not resolved Kenya might be isolated in the global market despite its endowed production of fine Arabica coffee.

Speaking during a media brief at the NCE offices yesterday, NCE chairman Peter Gikonyo explained that the current auction attracts an average of 25 buyers on each auction day.

This low participation by buyers, he said has affected competition in bidding of coffee at the auction as this is where 80 per cent of the Kenyan coffee is traded.

“The auction has witnessed low prices in the ending season under review. The auction volumes for August 2022 reached 4,380 tonnes compared to 192 tonnes this year, accounting for a 95.6 per cent drop of volumes,” said Gikonyo.

He explained that currently there are 121 licensed coffee buyers by Agriculture and Food Authority (AFA) for the season 2023/2024 but only 58 have registered at the NCE to buy from the auction.

“This is a major concern. As at the end of the coffee year 2021/22, we had 52 buyers participating in the auction against 122 coffee buyers licensed by AFA Coffee Directorate for the same period,” he disclosed.