Treasury gives detailed explanation of new proposed tax laws

Months after the Kenya Kwanza administration succumbed to pressure and withdrew the Finance Bill 2024, the National Treasury has unveiled proposed amendments to tax laws that are poised to impact various sectors of the economy.

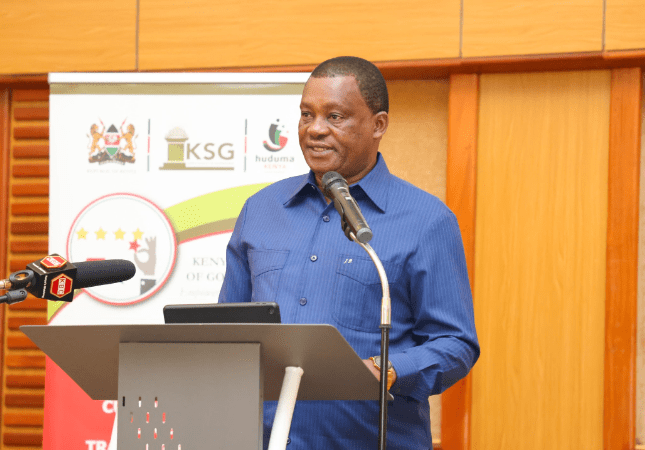

In a statement on Saturday, November 2, 2024, the National Treasury led by Cabinet Secretary John Mbadi indicated that it had proposed amendments to the Tax Laws (Amendment) Bill 2024, Tax Procedures (Amendment) Bill 2024, and the Public Finance Management (Amendment) Bill 2024.

Treasury detailed that the Business Laws Amendment Bill 2024 aims to create a more enabling and competitive environment to drive private investment.

On the other hand, the exchequer stated that the Tax Laws (Amendment) Bill, 2024, Tax Procedures (Amendment) Bill, 2024, and Public Finance (Amendment) Bills are designed to streamline tax policies and improve public finance management, ensuring fiscal responsibility and transparency.

While defending the proposals, the National Treasury indicated that the said amendments were born out of extensive consultations with various stakeholders and that they are aimed at helping grow the country’s economy.

“These proposed amendments, shaped by extensive consultations with diverse stakeholders, are intended to provide a conducive environment for sustainable growth, innovation, and long-term economic resilience,” the statement read in part.

Key proposals

In the four-page document, the National Treasury highlighted key areas that would be affected by the proposal including the digital ecosystem, pensions, affordable housing and imported goods.

Digital sector

Under the Tax Laws (Amendment) Bill 2024, the National Treasury seeks to alter section 3 of the income tax in the definition of the term digital marketplace by including ride-hailing services, food delivery services, freelance services and professional services among others.

“This proposal is to expand the tax base by bringing the income of the owners of the digital platforms that offer the above services into the tax net,” the National Treasury explained.

Railway levy

The bill also seeks to increase the Railway Development Levy from 1.5 per cent to 2.5 per cent

Rates of Excise Duty

The bill also seeks to make the following amendments; increase in the rate of excise duty for imported sugar confectionary to Ksh85.82 per Kg, restructure in the rate of excise duty for wines including fortified wine and other alcoholic beverages obtained by fermentation of fruits from Ksh243.43 per litre to Ksh22.50 per centilitre of pure alcohol.

It also proposes to impose excise on electronic transformers and parts at 25 per cent, imported ink at 15 per cent, imported ceramic sins, washbasin and other imported materials at 35 per cent.

Moreover, it seeks to revise the excise duty on excusable services such as telephone and internet data services at 20 per cent.

Betting, gaming and price competitions would also be targeted if the bill sails through.

Tax on multinationals

The proposed amendments also aim to align Kenya’s tax system with the global push for fair corporate taxation by introducing a minimum top-up tax on multinational companies.

The goal is to ensure that such entities pay a minimum effective tax rate of 15 per cent on profits generated within Kenya.

Pensions

The proposed Bill further seeks to amend the Income Tax Act to increase the amount deductible in respect of contributions to registered pension or provident funds from taxable income of an individual and also contributions by an employer from Ksh240,000 to Ksh360,000 per year and Ksh20,000 to Ksh30,000 per month.

Affordable Housing Relief

The proposed amendments seek to repeal the Affordable Housing Relief, a tax break initially intended to make home ownership more accessible for middle- and low-income Kenyans.

Scrapping this relief would raise costs for aspiring homeowners and could be seen as another blow to the middle class.

Explainer:

— The National Treasury & Economic Planning (@KeTreasury) November 2, 2024

Proposed Amendments to the Tax Laws, Tax Procedures, Public Finance, and Business Laws Bills, 2024.

In line with the Government’s commitment to strengthening Kenya's investment climate and enhancing economic governance, the Business Laws Amendment Bill 2024 aims to… pic.twitter.com/f74UBA4gcJ