Telkom in search for new investors amid resistance

Telkom Kenya has started a fresh process of soliciting new investors to resuscitate it despite facing probable full acquisition by the government that remains controversial and is currently under parliamentary scrutiny.

Investigation on one hand and a lurking acquisition is already sending a mixed signal to the market and investors, especially for a company whose ownership has severally changed hands in less than a decade.

Interested strategic investors will be forced to take over multi-billion shilling debts that Telkom accrued and inherited in the strings of changes in shareholdings that started back in 2016 after France Telecom, trading as Orange, exited after selling 70 per cent stake in Telkom Kenya.

Telkom has now disclosed that the purported full acquisition by the government remains an ill move that could entirely collapse it.

Due diligence

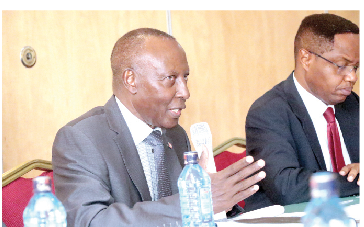

“It (acquisition) would have been an end of the company. This company cannot operate as a parastatal. We have been getting requests from people who have come over to do due diligence. We have requested to get a new investor,” Telkom board chair Edward Njoroge told the Kuria Kimani-led committee on Finance and National Planning committee.

National Treasury under the current administration is backing up the search for new investors. The board was side-lined in the alleged Sh6.14 billion buyback of Telkom by the previous government, which the committee later established was instead a loan repayment.

The current largest shareholder, Jamhuri Holding Ltd (JHL) had conspired with the national treasury under the previous regime’s last days to be repaid Sh6.14 billion loan by concealing the transaction as a full government acquisition.

A full acquisition meant that Telkom would have been expected to operate as a government parastatal as per the Public Finance Management Act. It would have also strained the National Treasury to bail it out as the company is technically insolvent.

Telkom has struggled to find a strategic investor to make a breakthrough in Kenya’s telco industry since being privatised in 2007. As it stands, JHL still has a 60 per cent stake at Telkom, with the remaining 40 per cent held by the government of Kenya.

A proposed merger between Telkom and Airtel collapsed in 2022 due to a regulatory stalemate. A successful merger would have given Telkom board a signal that JHL was preparing an exit, according to Njoroge.

Communication Authority Director General, Ezra Chiloba, who also appeared before the Finance Committee, has however poured cold water on Telkom’s plan to get new investors, arguing that it will not grant an operation licence unless the telco clears debt owed to some of its competitors.

Government entity

“It is impossible to be competitive if it operates as a government entity. You cannot manage in this sector if you depend on a bureaucratic environment. The authority can’t grant it (license) unless debt is cleared,” he told the Committee.

Telkom is still reeling under some $239 million (Sh30.8 billion) loan that JHL absorbed from Orange East Africa, an amount that the government would have inherited through the purported full acquisition. It also owes Safaricom and America Towers about Sh9.4 billion in total.