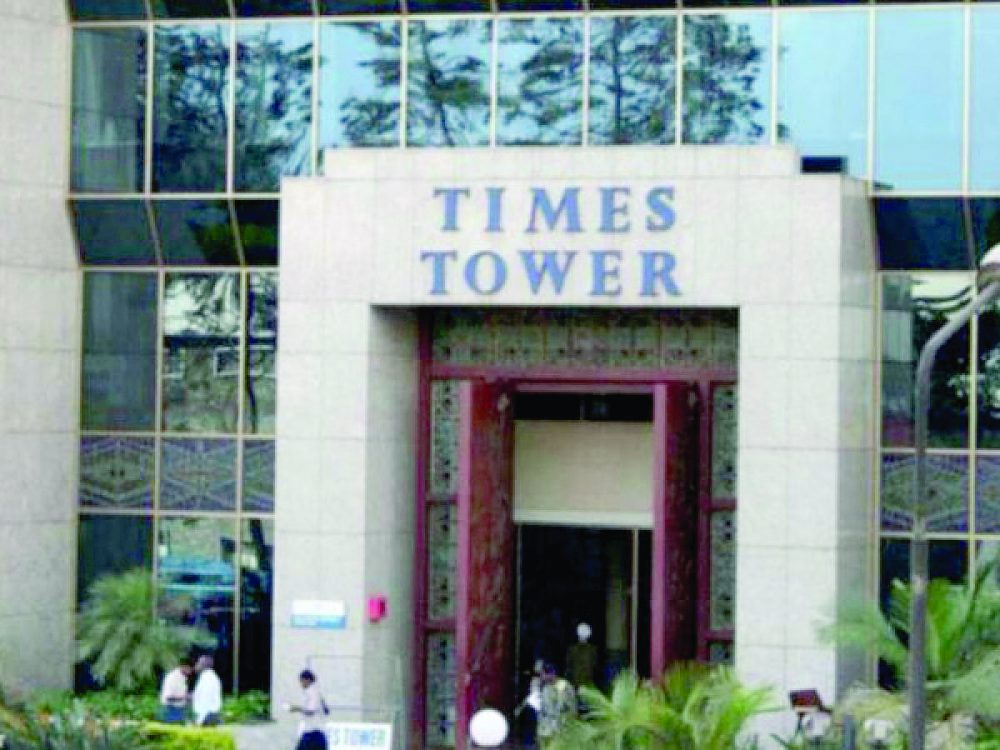

Taxman reconfigures ETR in search of extra Sh400b

Kenya Revenue Authority (KRA) is realigning electronic tax monitoring devices just three months after its rollout deadline as it rushes to transition to a new web-based solution to tap up to Sh400 billion in additional revenues.

The device, known as Electronic Tax Register (ETR) embedded with KRA’s Tax Invoice Management Systems (TIMS), was to help seal tax leaks while targeting businesses with an annual turnover of at least Sh5 million.

However, businesses still underquoted their turnover to evade being enlisted in TIMS which offers KRA real-time data access to traders’ daily sales, forcing the taxman to roll out the new improved and cheaper software solution – eTIMS.

eTIMS will now allow KRA to establish sales turnover from its own end even for businesses with little visibility, especially in the informal sector which is being targeted for tax base expansion drive to increase revenues.

New system

“This (new system) is going to help us. The invoice for sale is the same one for purchase, so if we’ve seen your votes and maybe we can tell you are a manufacturing entity then ordinarily we are able to make determination how much you are going to sell and we can easily recruit you for VAT purposes,” explains George Obel, Deputy Commissioner at KRA’s Domestic Tax department and eTIMS project lead.

eTIMS has been in the pilot stage over the past one month, with a full rollout expected to commence by next May. As of March 2, the number of businesses with successful software installation stood at 298 during the pilot period.

The authority had brought on board some 67,954 taxpayers into the old TIMS through the ETR gadgets by Monday this week, against the 113,239 active taxpayers. This means the balance of 45,285 taxpayers are targeted to onboard the new eTIMS.

Supply chain hitches, the high cost of ETR machines, and the strict deadline saw the migration to TIMS delayed, forcing KRA to extend the deadline for the second time to November 2022. KRA had authorised only 16 dealers to supply the whole country with the costly ETR gadgets priced between Sh50,000 – Sh60,000 each.

Obel says the cost of transitioning to the new software-based solution is “nearly zero” for small businesses compared to big companies. The software solution has options for both windows and android users and Virtual Sales Control Unit – an integration between the taxpayer’s billing system and KRA.

The implementation of eTIMS is expected to close the Value-Added-Tax (VAT) collection gap by bringing all VAT-registered taxpayers on board and enhance compliance.

Economic levels

VAT collection, which currently accounts 4 per cent of gross domestic product (GDP), has been improving over the years but is still estimated to be performing poorly in regard to the country’s economic levels.

“Part of what has affected VAT performance is fictitious invoices. With this system we should then be able to narrow the field significantly for this kind of players,” says Obel. VAT adjusted target 2022/23 is Sh330 billion.

Migration to the software solutions is part of a technology-based shift by the taxman to mobilise more revenues to finance the upcoming Sh3.64 trillion budget for the full 2023/23 financial year. eTIMS will be trolled to every sector, including betting and lotteries and rentals.