Taxman demands Sh61 billion from betting companies

Kenya Revenue Authority (KRA) is demanding Sh61 billion in taxes from 27 betting firms before they can be allowed to resume operations in Kenya.

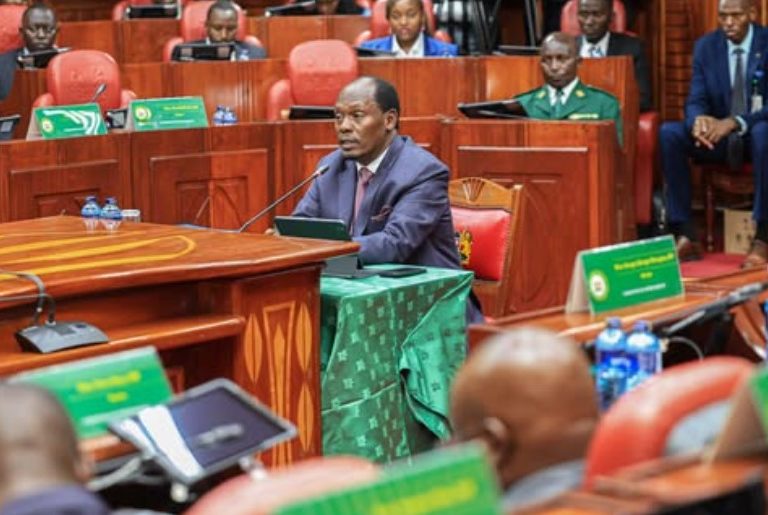

Appearing before the Senate’s Human Right Committee yesterday, commissioner Elizabeth Meyo said the firms had failed to comply with tax obligations, forcing KRA to invoke its powers.

“There has been non-compliance by the industry with the provisions of the law that requires betting companies to act as withholding agents for KRA and remit the taxes to the government,” she said.

She told the senators that out of the 72 registered betting firms, 27 had compliance issues, seven had made payment plans while the rest had complied.

Meyo, however, said KRA has been engaging industry players on a case-to-case basis with the aim of arriving at a payment plan acceptable to both parties.

The commissioner said Sh2.7 billion has so far been paid under the arrangement while total taxes paid for 13 months by betting firms stands at Sh13.2 billion.

She said the companies licences were cancelled by the Betting Control and Licensing Board (BCLB) after KRA informed it of the firms’ tax compliance status.

Enforce law

“We did not cancel their licences. We only received a request from Betting Control and Licensing Board asking us to give them the status of how the taxes have been paid. KRA does not licence firms, we only enforce the law,” she said.

Members of the committee chaired by Samson Charargei (Nandi) accused the government of using the pretext of enforcing morality to punish the betting firms.

“Is the ministry of Interior trying to legislate morality by closing down some companies and leaving others? We must separate the morality issue with the taxman issues,” said Nakuru Senator Susan Kihika.

The senators who included Leader of Minority James Orengo (Siaya), Cleophas Malala (Kakamega), Mithika Linturi (Meru) and Mutula Kilonzo Jr (Makueni) also accused the government of frustrating the companies which they said were the biggest taxpayers.

They summoned Interior Cabinet Secretary Fred Matiang’i and BLCB to appear before the committee today to answer questions on the matter.

SportsPesa Kenya CEO Ronald Karauri said that although his firm had paid taxes amounting to Sh17.6 billion since inception, KRA had slapped it with a bill of more than Sh21 billion.

Gaming industry

He said that despite the company’s compliance with the law, BLCB did not inform it about the status of their application and the need to renew its licence.

“The Ministry of Interior’s claims that the gaming industry is worth Sh200 billion is wrong information that has been used to pressure and intimidate industry players with inflated tax demands,” he said.

Betin said its directors had been barred from the country by the Department of Immigration without giving any reasons.