Senators fault digital lending law

Senators have questioned the effectiveness and enforceability of the recently enacted Digital Credit Providers Regulations 2022 that seeks to check dishonest digital money lenders.

The lawmakers lamented that despite the amendment to the CBK Act and the development of policies to regulate the sector, desperate Kenyans were still being exploited by lenders.

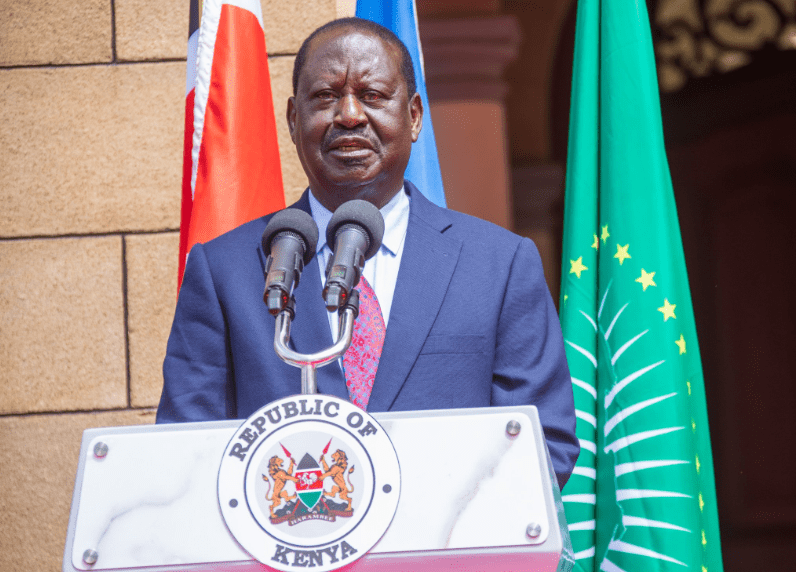

Laikipia Senator John Kinyua (pictured) petitioned the House to interrogate the operations of the money lenders.

In the petition directed at the House’s Finance and Budget Committee, Kinyua wants the panel chaired by Kirinyaga Senator Charles Kibiru to find out the number of digital credit providers operating in the country, stating the terms and conditions of the credit they offer as well as examine the effectiveness of the regulations.

“State measures, if any, to protect households and SMEs from predatory lending by digital credit providers outlining targeted interventions against fraudulent transfer of property resulting from defaulting on these loans,” he said.

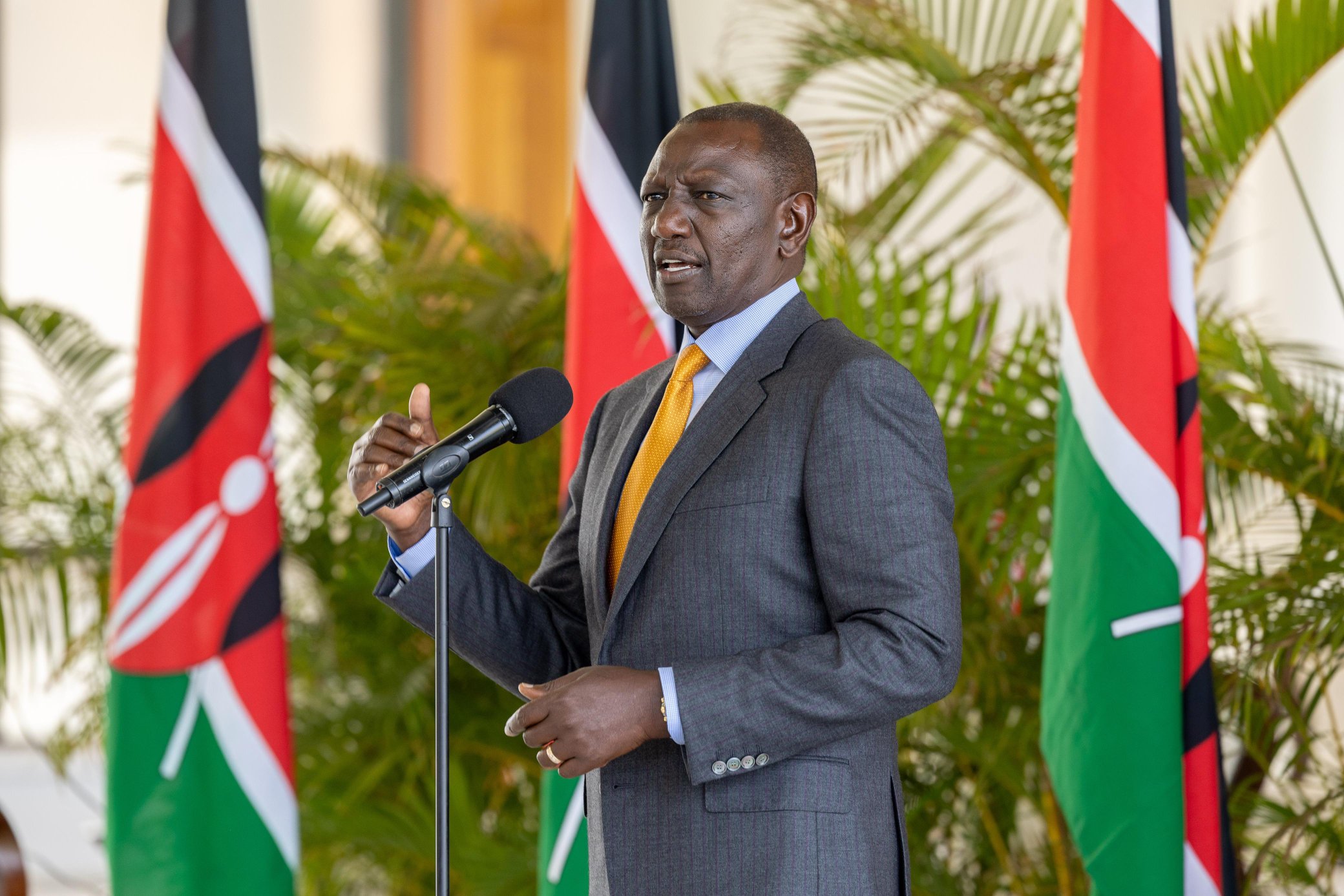

In December last year, President Uhuru Kenyatta signed to law the Central Bank of Kenya (Amendment) Bill that sought to among others, end debt shaming by the lenders.

In March, CBK gazetted Digital Credit Providers Regulations to place the digital money lending business under regulations.