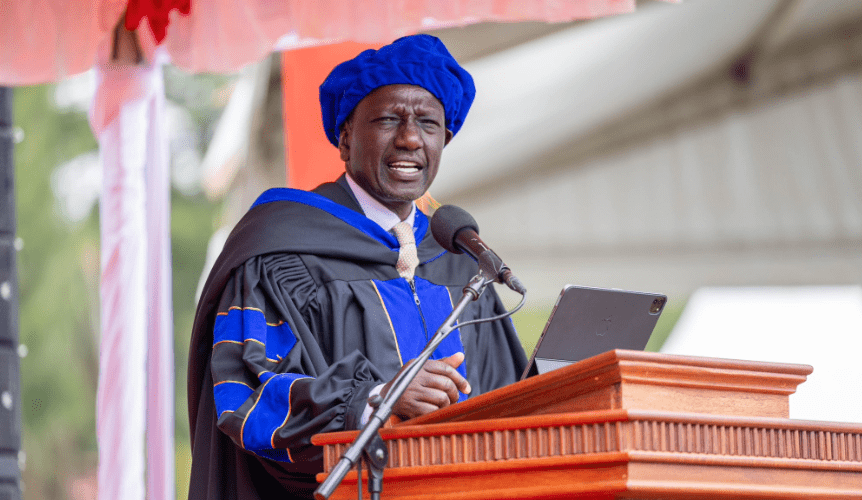

‘It was almost destroying our education’ – Ruto explains reason for scrapping old university funding model

President William Ruto has been compelled to defend the decision behind the scrapping of the old university funding model and adopting the newly launched one.

Speaking on Sunday, August 25, 2024. President Ruto stated that his administration settled on the new model, which allocates funds to students based on their financial needs, due to some challenges experienced in the old model.

According to the Head of State, the previous model (Differentiated Unit Cost) which focused on the course that a student selected, was on the verge of destroying the education system.

Was assumption-based

Ruto detailed that the old system had many hitches, including assuming that all the courses were the same and that the government had financial muscles to pay 80 per cent for all students who qualified to join universities after meeting the cut-off mark.

“The old model was almost destroying our education. Because it assumed that all the courses were the same and also assumed that the government had the money to pay 80 per cent for everybody,” Ruto emphasised.

While insisting that there is room for improvement, President Ruto told those who attended the Town Hall meeting that sticking to the old funding model could have compromised the country’s education system.

“When I came into office, 23 universities out of 40 were bankrupt. Explain to me what kind of education we are going to get from a university that is bankrupt?” he posed.

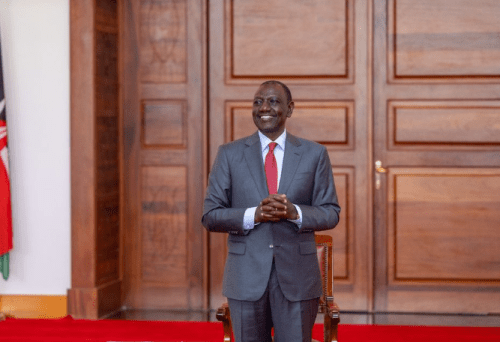

Support from VCs

Despite opposition from some stakeholders, Ruto maintained that the new model has received tremendous support from the Vice Chancellors.

In the new model, the Ministry of Education uses the Means Testing Instrument (MTI) to determine the appropriate financial assistance each learner deserves and then places them in the respective bands based on their level of need.

The Head of State reiterated that the decision was informed by proper research and analysis of what the country needs to move forward to save universities from insolvency.

Nonetheless, he told the students that his administration is open to receiving new suggestions that would help improve the quality of the country’s education system.

“Only 10 per cent of children from vulnerable families make it to university; it’s serious and is something that depresses me. As a nation, we cannot continue having an education system that shuts out millions of the children of the poor.

“We will continue to improve on the model; we are not saying the model is perfect, but I think to a great extent it is towards 95 per cent in the right direction, and we will keep improving on it,” Ruto stated.

Banding system

Band 1

Band 1 is for families whose monthly income is Ksh5,995. According to the Ministry of Education, learners placed in this band are eligible for 70 per cent of government scholarships and 25 per cent loan, making total government support 95 per cent. Parents will contribute 5 per cent while the student will receive a Ksh60,000 upkeep loan.

Band 2

In this category, the family income is Ksh23,670 per month. Scholarships will cover 60 per cent; loan 30 per cent putting total government support at 90 per cent. The family will contribute 10 per cent, while the student will receive an upkeep loan of Ksh55,000.

Band 3

Here, the family income is up to Ksh70,000. Learners in this category are expected to benefit from a 50 per cent scholarship, 30 per cent loan bringing the total support to 80 per cent. The family will contribute 20 per cent while the student receives a Ksh50,000 upkeep loan.

Band 4

Learners in this band are considered to come from families with a monthly income of up to Ksh120,000.

They are entitled to a 40 per cent scholarship and a 30 per cent loan putting the total government support at 70 per cent. The family will cater for 30 per cent cost while the student will receive Ksh45,000 upkeep loan.

Band 5

Band 5 is for families with a monthly income above Ksh120,000. For them, scholarships will cover 30 per cent, loan 30 per cent making total support 60 per cent. The family will contribute 40 per cent while the student will receive an upkeep loan of Ksh40,000.