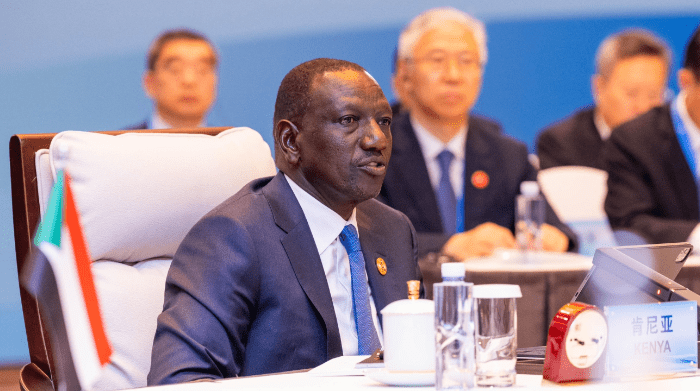

‘Govt cannot end corruption and mismanagement in SACCO’s alone’ – CS Oparanya

Cooperatives and MSMEs Development Cabinet Secretary Wycliffe Oparanya has called for a joint effort to fight mismanagement and corruption in the country’s Savings and Credit Cooperative Societies (SACCOs) sector.

The former Kakamega County governor said that his ministry is working on reviewing the legal framework but says that efforts from the SACCOs themselves are also needed if corruption is to come to an end.

“My ministry has continually reviewed the legal and regulatory framework governing leadership and management of SACCOs. But this still has not eliminated mismanagement and other corrupt practices by some cooperative leaders.

“Thus it is my submission that dealing with mismanagement cannot be the business of government alone,” Oparanya said in a statement on X on Wednesday, August 11, 2024.

Oparanya also called upon the SACCO industry to align itself to the policy vision of the government as captured in the Cooperative Bill 2024 where a federation of SACCOs is proposed.

“Like other industry associations, I will expect the federation to be the custodian of good governance as it has both the legal and moral authority given the huge public interest SACCOs as deposit-taking financial institutions carry.

“The SACCO industry, through a federation, must own, promote, and uphold good governance practices through public education and self-regulation, with the government left to intervene and enforce compliance for any transgressions,” he added.

Policy options

The former minister in the Mwai Kibaki government also said that his docket is exploring policy options to include expansion of the Coperative Tribunal.

“The ministry is exploring policy options to include expanding the jurisdiction of the Cooperative Tribunal to cover disputes between cooperatives and employers so as to expedite the resolution of these non-remittance issues, introducing stricter compliance regulations with robust enforcement, and increasing public awareness about remittance obligations,” he continued.

Meanwhile, Oparanya said that the total membership among the 357 regulated SACCOs increased by 6.57 per cent to 6.84 million in 2023 from 6.42 million reported in 2022.

“This is a commendable growth rate, but we must not forget that it represents just under 30 per cent of the total adult working population in Kenya. From the World Council of Credit Unions (WOCCU) statistics report, there are countries with over 40 per cent penetration rate. Thus, there is huge room for growth for the Kenya Sacco Industry,” the statement continued.

The Kenya SACCO industry is expected to host the SACCA congress from October 6–12 this year. This is Africa’s largest financial cooperative event, convening over 2000 SACCO professionals from 42 countries representing 5 continents.