Offices of Ruto, DP face budget cuts

By Mercy.Mwai, May 29, 2024The National Treasury has proposed reductions to three top government departments in the 2024/2025 financial year.

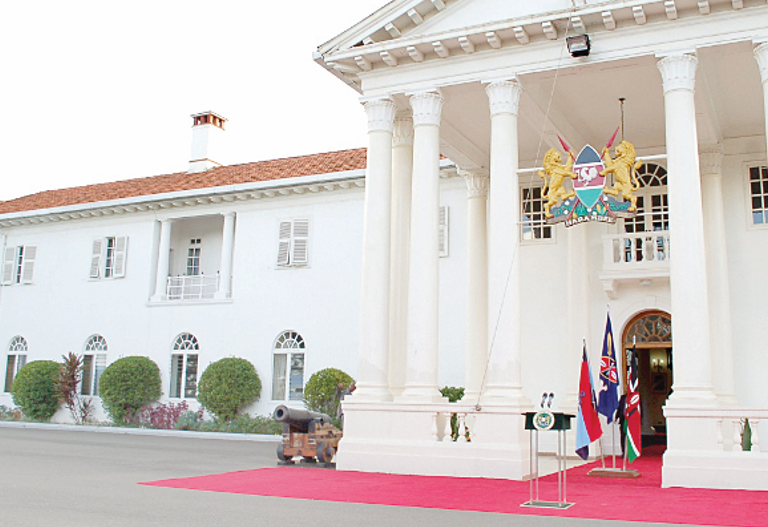

They include State House, the offices of the President and that of his deputy, as well as the office of the Prime Cabinet Secretary.

The overall budget was reduced by Sh273.3 billion, from Sh4.188 trillion to Sh 3.9 trillion, with the Treasury blaming under-collection of revenue.

Documents tabled in the National Assembly show that the Treasury had resolved to review and rationalise the budgets for the offices of President William Ruto, his deputy Rigathi Gachagua and Prime Cabinet Secretary Musalia Mudavadi in order to find money to fund other departments.

National Treasury Principal Secretary Chris Kiptoo submitted the documents to the Budget and Appropriations Committee, which is scrutinising the budgets for ministries, departments and agencies.

Public uproar

The documents show that the savings from the cuts to the three offices will be used to cover ongoing reforms in the coffee sector, fight illicit alcohol and drug abuse.

Gachagua is spearheading the coffee reforms and the fight against illicit brews and drug abuse. Last week, he disclosed that the government will amend the Alcoholic Drinks Control Act in relation to the manufacturing, distribution, sale and consumption of liquor following the proliferation of killer drinks.

The proposal to reduce the budgets of the three offices follows uproar from Kenyans that they were allocated money to fund non-essential services while critical departments suffered large cuts that could paralyse their operations.

Cash for luxuries

While State House and Gachagua’s office were allocated money for luxuries such as renovation of offices, refurbishment of State House and lodges, as well as the purchase of cars, other departments such as Basic Education and the school feeding programme, Ministry of Health, National Police Service, National Construction Authority, Arid and Semi-Arid Lands all sufferedcuts amounting to billions of shillings.

Gachagua’s office was seeking Sh 2.6 billion in the 2024/2025 financial year to refurbish Harambee House Annex office and his Karen residence, as well as to meet other essential expenses in his office.

State House, on the other hand, received the entire Sh 7.9 billion for recurrent expenditure that it says it needs in the next financial year. The money will be spent on hospitality for visiting foreign delegations.

And yesterday, in his presentation, Kiptoo also said that more money will be allocated in the budget for other departments that have shortfalls.

Those to benefit include foreign missions, education and the judiciary. Funds will also be reinstated for Semi-Autonomous Government Agencies.

The tree planting programme will also receive a boost with an additional allocation of Sh10 billion, while the Treasury proposed to transfer Sh1.1 billion that was meant for group personal insurance under its office to the Department of Public Service in line with Executive Order No. 1/2023.

Said Kiptoo: “Mr Chairman, these proposed amendments will be considered against the available resources and will be formally submitted to the National Assembly for consideration.”

Non-priority spending

In his presentation to the budget committee, Kiptoo explained that the government would continue its efforts to improve efficiency in public spending and ensure that there is value for money by eliminating non-priority expenditure to curb wastage and eliminate leakages.

But Kiptoo noted that fiscal debts, including grants, are projected at Sh514.7 billion, which will be financed by net external borrowing of Sh256.8 billion and net domestic borrowing of Sh257.9 billion.

As of April 2024, he said, total revenues collected were Sh2.179 trillion against a target of Sh 2.4 trillion, indicating a deficit of Sh222.2 billion.

He blamed the shortfall on the decline of import volumes due to the depreciation of the Kenyan shilling, difficulty raising domestic resources, and reduced economic activity.

But he said the Treasury expects to collect Sh334 billion from the Finance Bill, and more from additional non-tax revenue, including from immigration and citizen services and the Department for Lands and Physical Planning.

He said that, when enacted the Finance Bill 2024 will unlock additional revenue to close the projected gap in revenue collection.

On taxes, he said they will rationalize tax expenditures to protect the tax base through elimination of unproductive tax incentives, scaling up the use of Public Private Partnership (PPP) framework that targets to take out commercially viable projects, digitizing of asset reporting through operationalization of IFMIS asset as well as rolling out of an end to end e-Government Procurement (e-GP) System to the National and County Governments where all public procurement and assets disposal transactions are undertaken online.