New proposals for sin taxes to fund health

A health finance specialist is proposing expansion of taxation measures on health risk factors such as sweetened drinks, cigarettes and alcohol to fund strategic programmes. Interventions around HIV and AIDS, tuberclosis and malaria, have for a long time been heavily dependent on donor financing but are likely to suffer with declining donor funds.

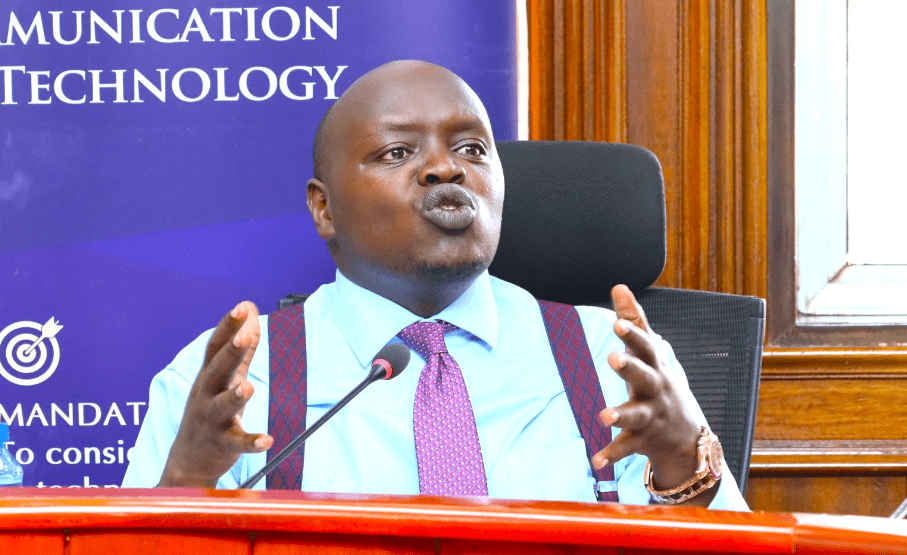

Dr Daniel Mwai, the Advisor to the Presidential Economic Transformation Team on Health believes that increasing taxation on those products that fall in the category of risk factors is going to curb consumption appetite.

“So we need to start thinking around innovative channels which we can use to fund the chronic path on the risk factors that continue putting burden on the country’s health care, and therefore a need to have new domestic financing models,” he said during a Health Sector Intergovernmental Consultative Forum at Kenya School of Government recently.

An increase in the burden of non-communicable diseases (NCDs), which include diseases such as diabetes, cancers, cardiovascular diseases and chronic respiratory infections have in recent years been associated with lifestyle behaviours, and are the cause of health loss in the country.

Besides unhealthy diet and physical inactivity, tobacco use and the harmful use of alcohol are the other factors identified to be among the most important risk factors for NCDs. The smoking prevalence in Kenya for instance, especially among men, continues to remain high, partly contributing to the rise of cardiovascular disease and other NCDs in Kenya.

Dr. Mwai pointed out that he has been closely watching the consumption patterns among Kenyans, and is seeing an increase in appetite for sweetened drinks as one of the risk factors.

“They expose these populations to chronic illnesses that need to be treated.

“Now, how do we bring on board tax measures, for instance, that reduces the consumption of these products?” he posed.

He called for the monitoring of several tax programmes in the country to redirect some of the amount of money collected under those national initiatives to cater for health interventions as the reality of donor exit continues to become clear.

The tobacco fund, he said, is one of them.