New affordable housing strategy excites players

Barely three months into his administration, President William Ruto is attempting to do what his predecessor often said he was planning to do to make the affordable housing plan a reality to Kenyans.

Details of a recent State House meetings have excited industry stakeholders who want to see the government take a more active role in reducing legal and financial restrictions on housing supply.

After ideas from the past administration were watered down and deferred, new suggestions including a special purpose vehicle akin to the Real Estate Investment Trust (REITs), from the House on the Hill, are beginning to take shape.

Its aim (a specialised financing vehicle), according to insiders, is to make that “dream” a little more affordable by encouraging investors in the pension sector to firmly participate in the programme.

Proposals contained in an economic transformation agenda draft paper for the housing and infrastructure chapter by pension funds, show that pensioners would prefer complete autonomy, if the private sector is to easily participate in the scheme’s offtake, which failed under former President Uhuru Kenyatta.

Raise money

“The reason I would not hesitate to take on another D-Reit challenge has to do with the opportunities I think exist to raise money through this method to develop counties,” says Luke Kinoti, an investment analyst.

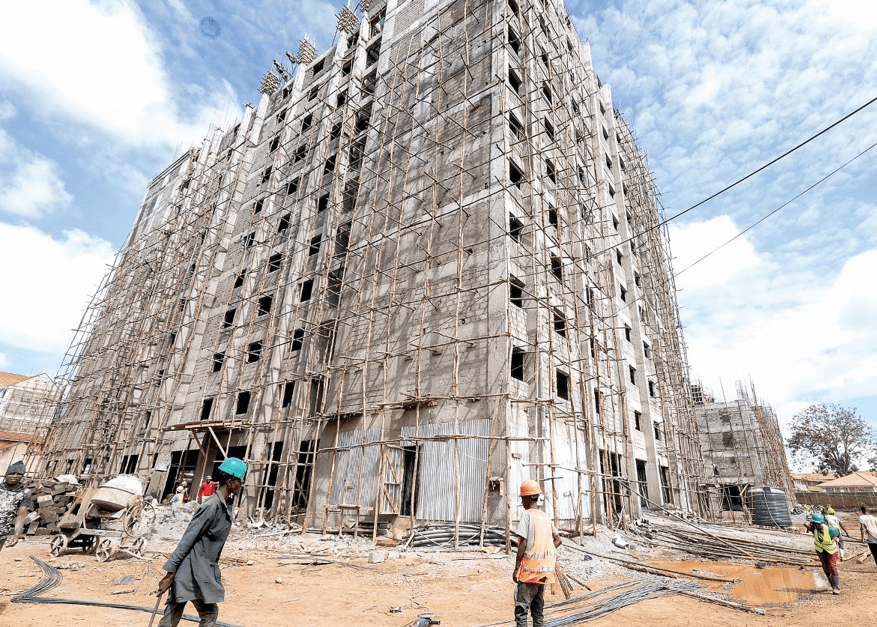

For the devolved units of government, he adds, floating D-Reits can help them attract private investors to put their money in property and infrastructure development. During his second term in office, Kenyatta intended to construct over 500,000 affordable houses by 2022 to meet the existing annual deficit of 200,000 low-income housing units, against annual production of less than 50,000 units.

That deficit, according to World Bank reports, continues to rise due to fundamental constraints on both the demand and supply side and is exacerbated by an urbanisation rate of 4.4 per cent, or 0.5 million new city dwellers every year.

Just over 1,000 such units are ready for occupation since the project’s commencement in 2017, whose implementors pinned some of the blame on zoning policies, harsh regulations and scarce infrastructure.

But the Ruto – led administration has since pledged to offer “free land” which are idle parcels owned by parastatals as well as horizontal infrastructure considerations, to lower the cost of putting up such structures through a public private partnerships (PPP) model.

Similarly, players in the pension industry want a special purpose vehicle to pool funds for investment projects, which they believe will encourage home-ownership and eliminate regulatory barriers to new housing construction. “The pension fund industry will co-invest in such a structure,” the white paper document by the pension funds to President Ruto, reads in part.

Besides expanding the mandate of Kenya Mortgage Refinance Company (KMRC) to include offering of local guarantees for rent-to-own arrangements, pension firms have also put forward a proposal to consolidate all pension assets in a structure similar to the US government sponsored enterprises that pooled funds for affordable housing.

Its outcome, they noted, would see the growth of primary and secondary housing finance systems as well as the provision of liquidity and a secondary market for pension assets.

Pension funds

In the early 90s, the US pension funds helped finance affordable housing for low-and moderate-income families, focusing on the features and common elements of affordable housing arrangements financed by such funds and the expected rates of return on such housing investments.

Kenya is seen to be looking at such options in order to meet the shortfall in its quest to provide affordable housing units to its citizens, in a model also expected to give valuable returns to pensioners on such investments.