MPs approve Act to increase ceiling of debt to Sh10 trillion

The incoming government has the liberty to borrow up to Sh10 trillion after members of the National Assembly approved new regulations by the National Treasury yesterday, raising the debt ceiling from Sh9 trillion.

The lawmakers approved the Public Finance Management (National Government) (Amendment) Regulations 2022 tabled by Leader of Majority Amos Kimunya.

Reads the amendment: “Pursuant to provisions of section 50(2) of the Public Finance Management Act 2012, this House approves the amendment of new regulations published as Legal Notice No. 89 of May 26, 2022.”

The House approved the amendment made to the Public Finance Management (National Government) Regulations 2015 (principal regulations) in regulation 26(1), by deleting paragraph (c) and substituting the following paragraph: “(c) pursuant, to provisions of section 50(2) of the Act. The public debt shall not exceed shilling 10 trillion.”

Par,iament’s move came even as MPs from both sides of the political divide differed on the need to increase the debt ceiling. A section of lawmakers allied to Deputy President William Ruto opposed the move, while those supporting President Uhuru Kenyatta and Azimio la Umoja presidential candidate Raila Odinga were in support.

MPs Kimani Ichung’wa (Kikuyu), Robert Pukose (Endebess) and John Kiarie (Dagoretti South) said the borrowing appetite by the government is strenuous to the economy and ought to be scaled down. Ichung’wah opposed the move, saying a variation of the Sh10 trillion will be a huge burden to the people, especially at this time when the cost of living has gone up.

“The issue of public debt is not something to justify to ourselves to appease ourselves. As a representative of the people, I oppose. In our Budget, there are no specific projects to be financed by public debt. We spend money in non-priority areas. If we approve this, we are killing Kenyans with a burden they cannot withstand,” he said.

Pukose echoed Ichung’wa’s sentiments, saying the Government should stop borrowing as this would subject Kenyans to more problems. Kiarie said that borrowing would have been more effective if the money raised would be put to prudent use.

“Borrowing is not a problem but the style in which the proceeds are used. Mwai Kibaki, as President, financed his Budget without necessarily borrowing too much. The money we are borrowing cannot be accounted for. Let us say ‘No’ to an increased debt ceiling. Let’s not dig a hole for the future generation,” he said.

Won’t affect country

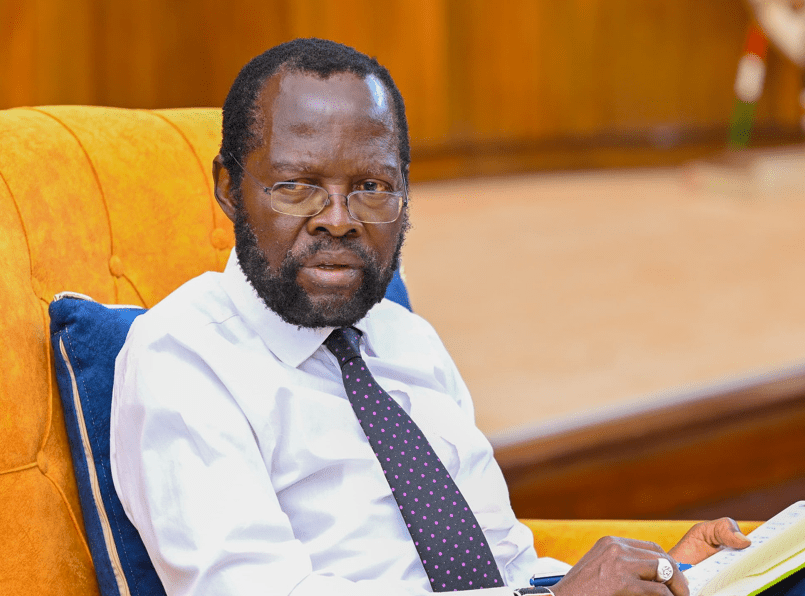

But MPs Kimunya, Kanini Kega (Kieni), William Kamket (Tiaty), and Opiyo Wandayi (Ugunja) said that having debts would not negatively affect the country as long as the money is used for the intended purpose it was borrowed for.

Kimunya, who moved the motion, defended the move, saying as long as the country’s Gross Domestic Product (GDP) was increasing, then the government should also be able to borrow more.

“People have talked about the debt as if it’s evil. Debt becomes evil if it has been used for the wrong reasons. I want to debunk the myth that borrowing is bad. As your GDP increases, so should be your capacity to borrow,” he said.

Wandayi said as a House they should be able to prepare the ground for the next government to enable it to operate without hitches.

“Debt is not a burden; the most important thing is what you use it for. We must prepare the ground for the next administration to be able to transact business. We are damned if we do; we are damned if we don’t. As a responsible House, we must allow the next administration to operate. Public debts must be utilised in a responsible manner that adds value.

Kega said Kenya will not be able to finance the next Budget without altering the debt ceiling.

The move comes after the Public Accounts Committee (PAC,) in its report for 2018/2019 released two weeks ago, said any borrowing by the national government for projects worth Sh1 billion should be approved by the House.

The committee also directed the Cabinet Secretary for the National Treasury to, within three months of tabling and adoption of the report, form a national task-force on public debt and engage an independent audit consultant. The public debt stock is projected to be Sh8.6 trillion as at June 2022, against the current debt ceiling of Sh9 trillion.