Media companies hit by State ban on gambling advertising

Media organisations have suffered another significant financial blow following the government’s decision to immediately ban gambling advertisements across all platforms.

This decision was made by the relevant government agency after a surge in gambling-related ads, especially during watershed hours (5am to 10pm), which gradually exposed vulnerable members of Kenya’s population, particularly minors, to gambling addiction.

The Betting Control and Licensing Board (BCLB) also argues that some gambling promoters increasingly mischaracterize gambling as a legitimate investment opportunity and a shortcut to wealth creation, which presents adverse socioeconomic consequences.

“The [BCLB] hereby ORDERS the immediate suspension of all gambling advertisements and testimonials across all media platforms for a period of thirty (30) days with effect from the date of this statement,” BCLB chairperson Jane Mwikali Makau said in a statement.

Gambling activities

The ban covers all gambling activities, including betting, gaming, lottery prize competitions, and related promotional undertakings.

The suspension applies to licensed gambling operators and all forms of related advertisements and promotional activities including: television and radio advertisements; social media platforms; print media (newspapers, magazines, flyers); outdoor advertising (billboards, branded transport, etc.); SMS, email campaigns, and push notifications; and celebrity endorsements and influencer marketing.

The regulator has also directed that all gambling-related ads be submitted to the Kenya Film Classification Board for review according to specific requirements.

The board also wants Parliament to expedite the enactment of the Gambling Control Bill to empower the sector regulator with enhanced enforcement and supervisory powers. Additionally, the Media Council of Kenya is being urged to finalize and implement new guidelines to replace the programming code declared unconstitutional, in full compliance with the court ruling, among other stringent measures.

Consequently, a Multi-Agency Enforcement Team has been established to formulate strategic interventions, policy recommendations, and enforcement mechanisms to advance responsible gambling practices across the country.

“BCLB hereby calls upon all stakeholders, including but not limited to betting companies, media houses, digital platforms, telecommunication service providers, and members of the public, to fully comply with this directive in the national interest.”

This comes against the backdrop of a struggling media landscape, impacted by highly volatile consumer dynamics that have shifted the focus of advertising placement by different companies to other evolving platforms.

Starving for ads

Privately owned conventional media organisations, which have been relying on such advertisements for financial stability, have been greatly affected as the government prioritises State agencies and partner groups, leaving others starving for ads.

As a result, media houses have had to lay off a significant number of staff in efforts to adjust to the prevailing harsh economic conditions, contributing to a widening unemployment gap.

“Unbalanced Advertising Expenditure: Advertisers focus their budgets on a few major broadcasters, leaving smaller stations with limited revenue. This uneven distribution makes it harder for smaller players to sustain operations,” the Communication Authority said in a report.

In line with this, government revenue generated from the industry has recorded a significant downward shift. Data from the Media Council of Kenya in its State of the Media Landscape 2023/24 report indicates that 41 percent of respondents have been adversely affected by government advertising policies.

Similarly, advertising companies have continued to report negative growth, especially during the financial year that ended December 31, 2024.

To illustrate the significance of this sector, revenue generated from the gambling industry reached Sh19.6 billion between June last year and March this year, an increase of Sh2.533 billion, representing a 15 percent growth compared with the same period last year.

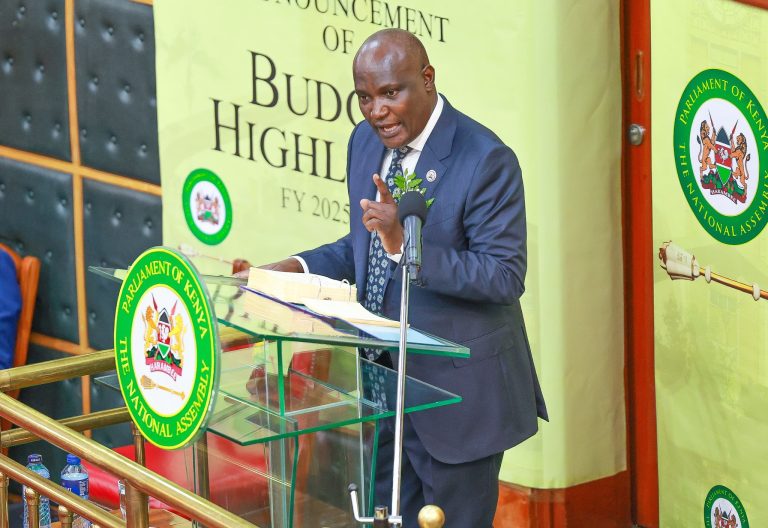

“The total revenue collection for 2024/2025 up to March 2025 has been Sh19,601 million against 2023/2024 collection of Sh17,074 million (surplus of Sh2,533 million) and a growth of 15 percent,” according to the document presented to Parliament by Joseph Otieno, KRA chief manager for betting and gaming.

Out of the Sh19.6 billion, Sh1.55 billion was collected in July last year, Sh2 billion in August, Sh2.66 billion in September, Sh2.19 billion in October, Sh1.8 billion in November, Sh2.59 billion in December, Sh2.12 billion in January, Sh2.26 billion in February, and Sh2.36 billion in March.

Regarding tax categories paid as of March, the report shows that the commission has collected Sh9.97 billion in excise duty, an increase of 24 percent from the Sh8 billion collected in the 2023/2024 financial year.

Conversely, for withholding tax on winnings, the document shows a decline of 15 percent from Sh5.65 billion collected in the 2023/2024 financial year to Sh4.81 billion.

Tax collections

On the collection of betting and gaming tax, there was a 42 per cent increase from Sh3.39 billion to Sh4.8 billion.

“The legislative framework for the betting and gaming sector requires operators to register for tax obligations which include excise duty, withholding income tax on winnings, betting and gaming tax, corporation income tax, and normal withholding tax in accordance with the statutes,” the document highlights.

Otieno also informed MPs that there are over 200 betting and gaming firms, with about 170 of them under sportsbook betting, where the Aviator game of chance falls, out of which 49 companies have both sportsbook and public casino (virtual/online casino) operations.

Furthermore, in terms of taxes paid by the Aviator game of chance, companies have paid Sh761 million in gaming-specific taxes, Sh1.68 billion in public gaming tax, and Sh2.2 billion in taxes on winnings.

Game of chance

“The Aviator game of chance is classified as a digital game of chance under the Betting Licensing and Gaming Act, and its taxation is aligned with the taxation regimes for other betting and gaming activities, which includes excise duty, withholding income tax on winnings, betting/gaming tax, and corporation income tax,” he explained.

Meanwhile, according to Reel Analytics, a research firm, advertising spending generally decreased by 19 percent in 2024 compared to the previous year.

“Overall advertising expenditure across radio, TV, print, and out-of-home (OOH) platforms decreased by 19 percent in the first half of the year compared to the second half of 2023,” the report reads.

The report further highlighted that the betting and gambling sector, traditionally a major contributor to advertising revenue, saw a 38 percent decrease in spending.