Mbadi headache to sneak back rejected Ruto taxes

Indications are that the government will need to reintroduce the Finance Bill 2024 after six months, incorporating new provisions that differ from those in the previously rejected version.

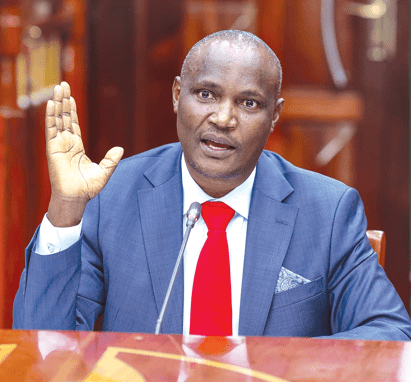

Among options available for the National Treasury and Economic Planning Cabinet Secretary (CS) John Mbadi is introducing an Omnibus Bill with amendments to the tax laws, bringing back some measures from the earlier Finance Bill.

An Omnibus Bill, which combines multiple provisions into one package, allows for the swift passage of diverse measures, though it can limit detailed debate and scrutiny. Omnibus bills are often used to pass numerous provisions quickly, but they can limit opportunities for detailed debate and scrutiny. They are commonly employed in budget and appropriations legislation to streamline the legislative process.

Reviving proposals

Mbadi last week hinted at reviving some tax proposals from the controversial Finance Bill 2024, which was withdrawn after public uproar.

The new CS said although the law does not allow him to reintroduce the bill, certain clauses, such as imposing an excise duty on imported sugar, are valuable to the country and should be reviewed and possibly amended.

“We must find a way to reintroduce certain progressive elements from the Finance Bill 2024 in a manner that promotes growth and streamlines tax administration,” Mbadi said during a recent interview.

He added “Kenyans are obsessed with this omnibus Finance Bill every year. The Finance Bill 2024 failed, and you cannot resuscitate it. It is a dead horse.”

The CS is now free to go the Omnibus route and reintroduce some of the tax measures that were in the Finance bill, 2024.

Robert Maina, Associate Director at Ernst & Young LLP notes that indeed, the Government has made it clear that it intends to introduce certain tax measures that were part of the rejected Finance Bill 2024.

“Taxpayers should therefore expect some tax changes in the coming months. However, the Government should ensure there is a fair balance of additional taxes and the favourable proposals that were in the Finance Bill 2024,” he said.

Amnesty deadline

Some of the notable changes proposed include the extension of the tax amnesty deadline to June 30, 2025, giving taxpayers more time to settle outstanding obligations without penalties.

Additionally, a new section has been introduced to allow for tax relief in cases where recovery is difficult or impractical. Changes to the computation of time for lodging tax objections and appeals have also been proposed, excluding weekends and public holidays from the calculation, potentially easing compliance for taxpayers.

A new amendments Bill, featured in the latest Kenya Gazette Supplement No. 165, is set to be introduced to the National Assembly as the Tax Procedures (Amendment) Bill, 2024. Its primary goal is to reinstate 47 clauses, including several previously suspended contentious measures. The Bill is scheduled to be reintroduced in Parliament.

The government also plans to reintroduce the contentious eco-levy tax, as part of new revenue-raising proposals aimed at generating an additional Sh150 billion. This initiative seeks to address the budget deficit caused by the withdrawal of the Finance Bill 2024.

The amendment Bill introduces Section 37F, allowing the Commissioner of Taxes to seek Cabinet Secretary approval for tax relief in cases where recovering unpaid taxes is impractical or inequitable. This aims to alleviate taxpayer burdens and enhance transparency, as approved reliefs must be gazetted and presented to Parliament.

“Clause 3 of the Bill is intended to re-enact the provision on relief because of doubt or difficulty in recovery of taxes. The provision allows the Cabinet Secretary to allow a relief as determined by the Commissioner. Further, the provision requires gazettement by the Cabinet Secretary of any approved reliefs and tabling of the same to Parliament,” reads the amendment bill in part.

The Government is seeking to extend the tax amnesty period to June 2025. This is a welcome move but it should consider extending the covered period from December 2022 to December 2023.

Robert Maina, Associate Director at Ernst & Young LLP told Business Hub that the removal of the powers of the KRA or the National Treasury to grant tax waivers was a big blow to taxpayers.