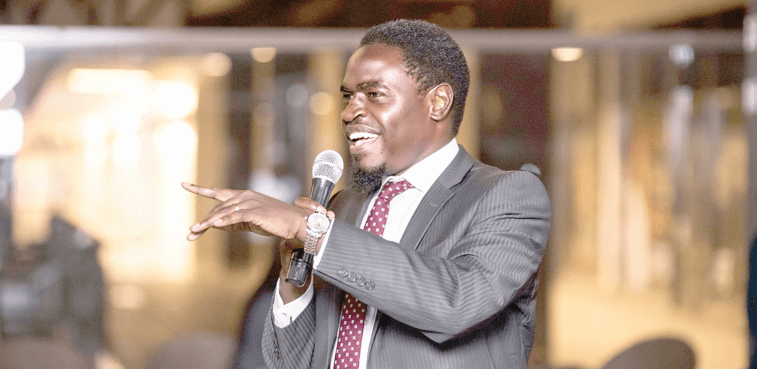

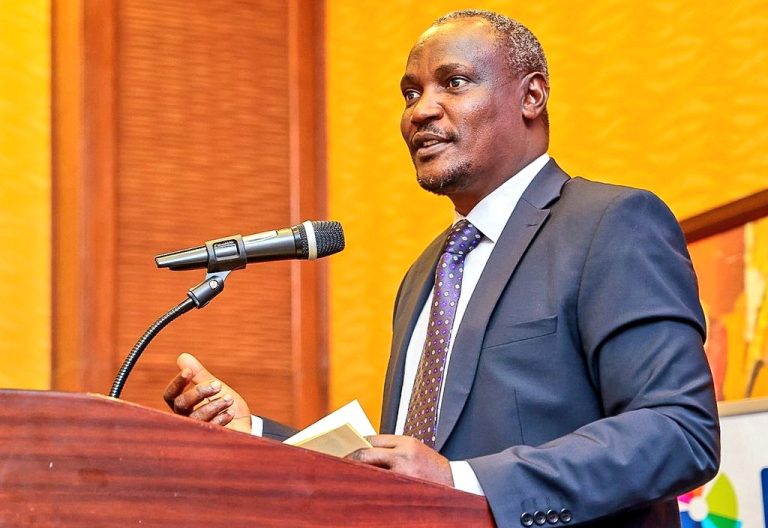

Mbadi admits Treasury struggling to balance debt, spending and tax burden

The Treasury Cabinet Secretary, John Mbadi, has acknowledged the difficult position the National Treasury finds itself in, grappling with a delicate balancing act between managing Kenya’s mounting public debt, rising expenditure, and growing demand for government services, all while avoiding overburdening taxpayers.

Speaking ahead of the Budget reading in Parliament on Thursday, June 12, 2025, Mbadi noted that the Treasury is under immense pressure to meet competing demands that the government must service existing debt obligations and fund critical public projects.

He said there is a strong public outcry against additional taxation, especially in an economy still recovering from global and domestic shocks.

He stressed the importance of prioritising sustainable economic growth as a long-term solution to the country’s fiscal challenges.

“The National Treasury faces the challenge of balancing high debt, increased expenditure, and demands for resources while meeting Kenyans’ expectations of not being overtaxed. We must spur economic growth,” the CS noted.

His remarks come after the World Bank has downgraded Kenya’s economic growth, even as it warns that growing trade tensions and policy uncertainty are expected to slow global growth this year to its slowest pace since 2008.

In its June update, the global lender forecasts Kenya’s GDP growth for 2025 to be 4.5 per cent, marking a decline from the 4.7 per cent growth recorded last year.

The projection also represents a significant cut from its earlier forecast of five per cent growth made in January 2025.

Slow economic growth?

It attributes the downward adjustment largely to persistent food inflation, which continues to exert pressure on household budgets and the broader economy.

“Droughts in Eastern Africa, especially in Kenya, Rwanda, and Uganda, have led to a sustained decline in agricultural conditions and crop yields, increasing pressure on food prices.”

Looking ahead, the lender forecasts Kenya’s economic growth to bounce back to 4.9 per cent in 2026.

However, this forecast remains 0.2 percentage points below the January projection for 2026, reflecting ongoing vulnerabilities in the economy.

Regionally, growth in Sub-Saharan Africa (SSA) is forecast to edge up from 3.5 per cent in 2024 to 3.7 per cent this year, and then average 4.2 per cent in 2026-27.

However, the forecast is generally considered weak.

According to the World Bank’s latest Global Economic Prospects report, the turmoil has cut growth forecasts in nearly 70 per cent of all economies, across all regions and income groups, including Kenya, with businesses expected to slump, job creation to slow, and the cost of living likely to shoot.

Global growth is projected to slow to 2.3 per cent in 2025, nearly half a percentage point lower than the rate that had been expected at the start of the year.

The lender of last resort has, however, ruled out a recession. Nevertheless, if forecasts for the next two years materialise, average global growth in the first seven years of the 2020s will be the slowest of any decade since the 1960s.

“It has been advertising itself for more than a decade. Growth in developing economies has ratcheted down for three decades—from six per cent annually in the 2000s to five per cent in the 2010s—to less than four per cent in the 2020s,” the report remarks.

Low-income countries are expected to grow 5.3 per cent this year—a downgrade of 0.4 percentage point from the forecast at the start of 2025.

Tariff increases and tight labour markets are also exerting upward pressure on global inflation, which, at a projected average of 2.9 per cent in 2025, remains above pre-pandemic levels.

Slowing growth will impede developing economies in their efforts to spur job creation, reduce extreme poverty, and close per capita income gaps with advanced economies.