83 per cent of Kenyans oppose giving KRA access to transactions – Infotrak

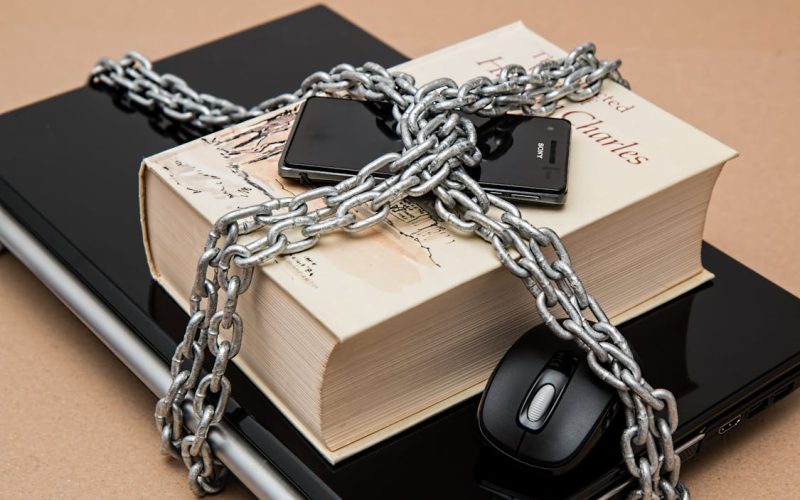

83 per cent of Kenyans have opposed granting the Kenya Revenue Authority (KRA) access to personal data and transactions through mobile phones and banks.

In a poll by Infotrak that sampled respondents from 47 counties of Kenya, only five per cent of the people agreed with the proposed finance bill section that seeks to grant KRA unrestricted access to previously protected tax-payer data.

“The processing of personal data is exempt from the provisions of this Act if disclosure is necessary for the assessment, enforcement, or collection of any tax or duty under a written tax law,” the proposed bill reads in part.

KRA limits

Currently, the law limits access to private data unless it pertains to national security or public interest, with exemptions for court-ordered disclosures.

The proposed finance bill grants KRA the authority to compel banks and mobile phone companies to disclose private transactions for audit by the tax body.

The government aims to collect Ksh350b to plug in a deficit in the Ksh3 trillion budget. The ambitious tax proposals are aimed to achieve this target where the state seeks to bring more Kenyans inside the tax bracket.

If passed, the state will have full-time access to individual payments to pay bills, cash apps and M-Pesa transactions which shall be used to calculate the amount of tax owed to the KRA.

Similarly, traders will be required to integrate the electronic tax system (e-Tims) into their daily transactions for ease of monitoring by the Kenya Revenue Authority.

The proposed finance bill also proposes a motor vehicle tax where car owners will be required to pay 2.5 per cent of the value of their cars to the state before they can be issued with vehicle insurance covers.

Additionally, the finance bill also seeks to increase excise duty on telephone and internet data services from the current 15 per cent to 20 per cent.

Further, foreign exchange transactions could be subjected to more tax leading to higher costs of importation.

Also, the banking services charges which were previously VAT-exempt could be subjected to tax and excise duties, leading to an increase in transaction fees.

For these and more credible stories, join our revamped Telegram and WhatsApp channels.

Telegram: https://t.me/peopledailydigital

WhatsApp: https://whatsapp.com/channel/0029Va698juDOQIToHyu1p2z