KCB rides on loan book to hit Sh19.2b in profit

By Zachary Ochuodho, November 14, 2019KCB Group’s profit after tax soared to Sh19.2 billion in the third quarter (Q3) of 2019 on loan book growth and non-funded income.

This growth saw the financial institution grow by six per cent compared to a similar period in 2018.

In total, net earnings increased from Sh18 billion to Sh19.2 billion as cost management initiatives started to bear fruits across all businesses.

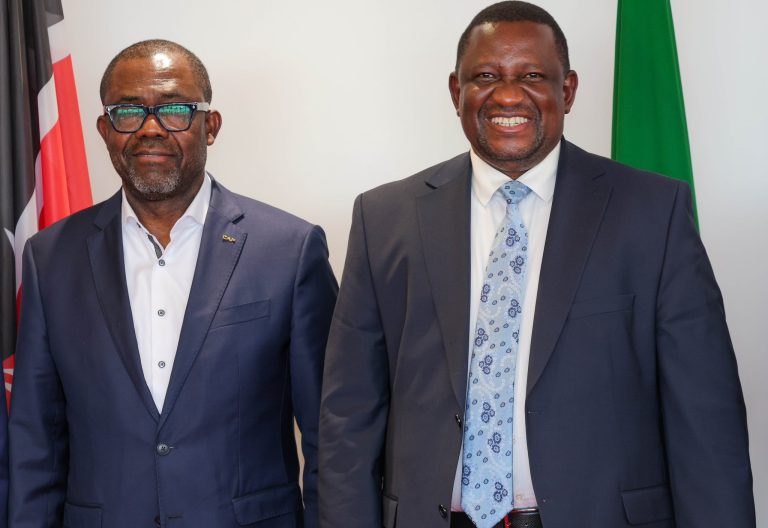

Speaking during a shareholders’ briefing, when the lender released its Q3 financial reports, KCB group chief executive and managing director Joshua Oigara said the group had a strong quarter across various segments.

“We made continued strong investments in our capabilities to serve customers better. International businesses have continued to improve while our digital offerings are witnessing increased activity, giving the business impetus to continue growing,” said Oigara.

Buying spree

The financial institution, which has been on a buying spree, saw subsidiaries post a combined increase in after-tax profit by eight per cent to Sh1.3 billion despite a tough business environment. Other than the Ugandan business, the rest of the four banking subsidiaries returned profits.

This sustained overall growth has seen the Group maintain its market leadership position.

KCB acquired the National Bank of Kenya (NBK) which is expected to further cement KCB’s position in the domestic banking sector and strengthen its ability to access more business flows.

On November 1, NBK announced profits before tax of Sh675 million for the period ended September 30, 2019, representing a 45 per cent growth from a similar period in 2018.

The Q3 financial report revealed that total income increased by 10 per cent from Sh54.2 billion to Sh59.7 billion, with non-funded income increasing by 16.9 per cent attributable to the digital proposition, largely KCB M-Pesa.

The loans disbursed under this platform improved from Sh23 billion last year to Sh98 billion.

Oigara said net interest income expanded seven per cent to Sh38.7 billion from Sh36.3 billion primarily due to a growth in the loan book and reduced cost of funds.

The lender’s book increased to Sh486.4 billion from Sh435.3 billion, an improvement of 12 per cent, reflecting the strong lending pipeline primarily driven by retail and corporate banking customers.

Income streams

Fees and commissions increased by 28 per cent to Sh14.1 billion on diversified income streams with enhanced investments in digital channels.

Year on year, total pre-provision operating expenses were down one per cent from Sh26.8 billion to Sh26.6 billion due to cost efficiency measures.

Provisions for impairment increased to Sh5.8 billion due to the increase in non-performing loans to total loan ratio which stood at 8.3 per cent; well below the industry average of 12.6 per cent.

The group’s balance sheet expanded by 12 per cent to Sh764.3 billion from Sh684.2 billion, with deposits up by 11 per cent to Sh586.7 billion supported by continued strong growth in personal and transaction accounts, underpinning the bank’s focus on providing superior customer service.

More Articles