Good news as total allocation to counties increases by Ksh37b

County governments will receive a proposed allocation of Sh370 billion as an equitable share in the Financial Year 2022/23, the same amount they were allocated last year.

Devolved units will also receive the recommended conditional allocations amounting to Sh37.1 billion, bringing the total allocation to Sh407.0 billion.

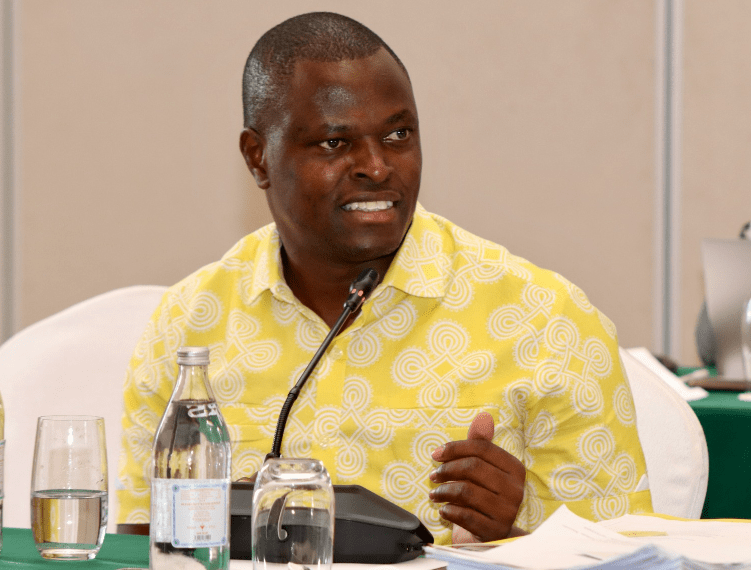

National Treasury and Planning Cabinet Secretary Ukur Yatani, said the rise represents 27.3 per cent of the most recent audited and approved revenue raised nationally.

“We have also complied with the High Court ruling on conditional grants to county governments. In this regard, conditional grants have now been excluded from the Division of Revenue Bill 2022 unlike in the case of the last Financial Year,” said Yatani.

“I note with appreciation that this House has unlocked the stalemate on the County Governments Grants Bill. This Bill will provide a legal framework for transferring conditional grants to counties,” he added.

Besides, in line with Article 204(1) of the Constitution, counties have been allocated Sh7.1 billion under the Equalisation Fund, which represents 0.55 per cent of the most recent audited accounts of revenue received.

Following the High Court ruling on petition No. 272/2016 of November 5, 2019 quashing the guidelines on administration of the Equalisation Fund, and the ensuing disbandment of the Fund’s Advisory Board, all expenditures of the fund were stopped.

To mitigate this, Treasury in collaboration with other stakeholders, developed the Public Financial Management (Equalisation Fund Administration) Regulations 2020, which was approved by Parliament in October 2021. “Following appointment of the Advisory Board, and establishment of the secretariat, it is expected that completion of projects as identified under the first policy and implementation of programmes in the second and subsequent policies will be fast-tracked,” the CS noted.

In order to ensure the process of transfer of functions between the national and county governments is clearly provided for in law, the ministry is developing legislation to operationalise Articles 187 and 189 of the Constitution on Transfer of Functions and Cooperation between the national and county governments.

Transferred functions

“The proposed legislative framework will provide transparency in the administration of intergovernmental transfers with respect to transferred functions and cooperation between Governments,” he said.

He added on: “Once completed, the legislative proposal will be submitted to this honorable House for consideration and approval.’ In order to support county governments’ efforts to enhance their Own Source Revenue (OSR), the National Treasury said it has submitted the County government (Revenue Raising Process) Bill to Parliament.

The Bill, the CS said, will regulate the manner in which counties introduce or vary fees and charges.

“Once passed, this legislation will address the problem of multiplicity of fees and charges within and across counties in line with Article 209(5) of the Constitution,” the CS explained.

The CS appealed to the National Assembly and Senate to consider and approve the Bill in a bid to create a conducive working environment for businesses so as to deal with the issue of multiplicity of fees and charges within the county governments.

To support implementation of the County Government Own Source Revenue Policy, the CS said the National Treasury in collaboration with the Ministry of Lands and Physical Planning, Council of Governors, and other stakeholders have developed the National Rating Bill 2022 to replace the outdated Valuation for Rating Act (Cap. 266) and Rating Act (Cap. 267).

“This Bill was submitted to Parliament in January and once enacted will guide the valuation for rating and imposition of rates on the rateable property,” he held.

On Sharing of Mineral Royalty Revenues, the CS submitted that Kenya has a wealth of mineral deposits.

For instance, he said, between the financial year 2016/17 and 2019/20, the Government collected a total of Sh5.5 billion in royalties from extractive activities.