Failure by counties to pay contractors hurts families

Patrick Imbandu, a contractor in Vihiga county, has spent the last six years chasing the county government for payments running into millions of shillings, to no avail.

During this time, he and fellow contractors lose their property to auctioneers hired by banks for defaulted loans. Others have died from depression, Imbandu laments.

“We worked in 2014, but haven’t been paid. Some contractors have died and others have had their property auctioned,” he charged during a demonstration called by local contractors in February this year.

“Some contractors used their own money while others took loans from financial institutions to undertake county projects that they haven’t been paid to date,” he said.

Not alone

Imbandu is not alone. Joseph Mbogo, a contractor in Kiambu county, has seen many businesses go under the auctioneer’s hammer as a result of unpaid monies for work done.

“We have gone through untold suffering and hardships after getting contracts to construct or grade county roads and I know some of my colleagues whose houses and vehicles were sold to recover bank loans,” said Mbogo who operates in Kiambu and Nairobi.

He recalls a case in which contractors in Kiambu lost huge sums of money in 2016 when the county government decided to reassess work done on murram roads after two years.

It turned out that the roads had already been degraded due to heavy rains and the county government refused to pay them.

“To add insult to injury, those of us who were paid got only 60 per cent of the work done,” the contractor said.

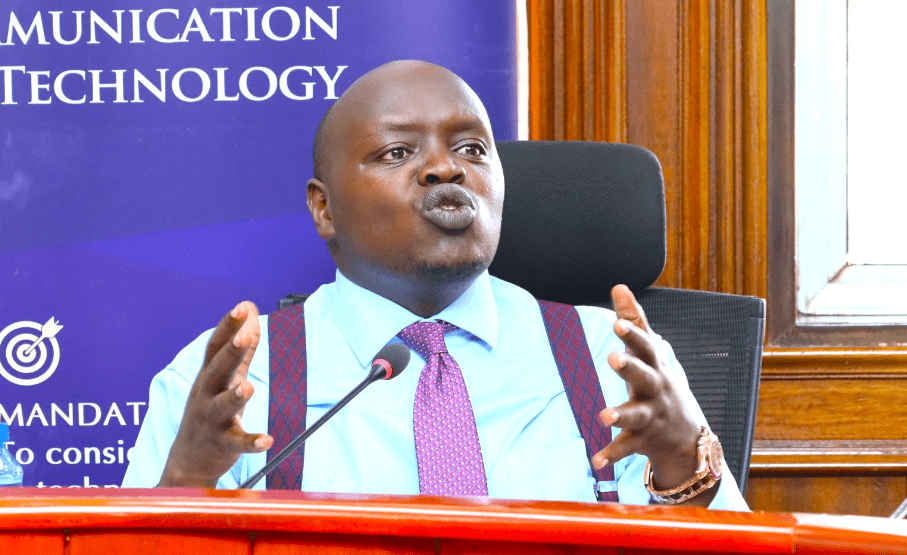

For the likes of Imbandu and Mbogo, there is some light at the end of the tunnel if a Bill sponsored by Thika Town MP Patrick Wainaina becomes law.

The bill, which has already gone through the first reading seeks to cushion contractors and suppliers from delayed payments for government tenders by ensuring that they are paid within the first two months of finishing the work.

The Public Procurement and Assets Disposal (Amendment)Bill, 2020 requires all national and county government tenders to be accompanied by bank guarantees so that if the government fails to settle payments within 60 days, a contractor or supplier shall get paid by the bank, leaving the government to settle the financier.

It also proposes that the prices for contracts should be within 15 per cent range of the engineer’s estimate to prevent cases of over-quoting or under-quoting.

It sets out to streamline a “performance bond” charged by the government at the rate of 15 per cent of the cost of the project as a penalty if the contractor fails to deliver as per the agreement.

Wainaina notes that the bill, if enacted into law, will also deter contractors or companies from quoting an unreasonably high figure for a contract whose cost is low, or those that quote low amounts just to win a tender.

Bank loans

According to the Kenya National Chamber of Commerce and Industry President Richard Ngatia, county governments owe contractors in excess of Sh100 billion in pending bills.

As a result, contractors cannot clear outstanding bank loans they obtained due to non-payment of their money by counties after completing works, says Ngatia.

He noted that delays in paying contractors and suppliers for works done or goods supplied was not only affecting their operations, but also denying them opportunities to do further business with the government or other organizations.

Wainaina says his bill is informed by the plight of contractors and suppliers, many of whom have lost their lifetime investments or saw their property auctioned by financial institutions.

“I am appealing to members of the public to give their input because once it goes through the second reading, there will be no room to do it,” Wainaina said.