Eyes on MPs as Finance Bill in Third Reading

All eyes will be on Members of Parliament (MPs) this afternoon as they conclude on the controversial Finance Bill, which enters its Third Reading.

Reports say over 50 MPs have prepared amendments to various clauses, which will be debated for and voted.

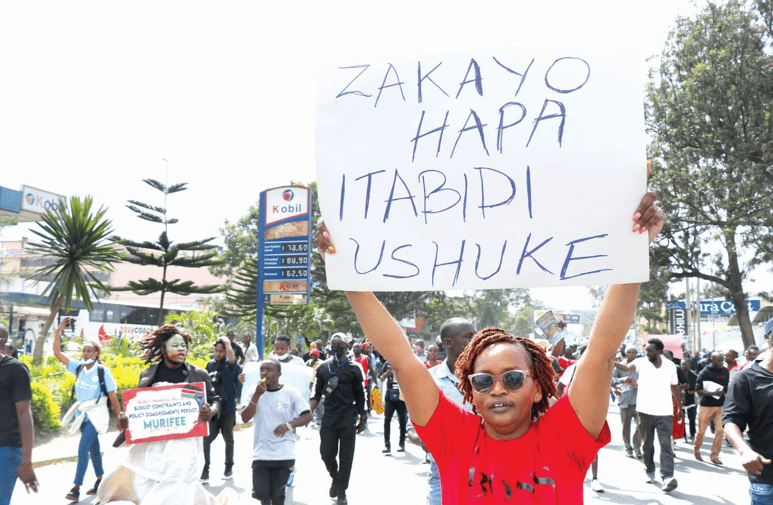

But as the lawmakers will be debating on the contentious bill, youths who have faulted the bill will be staging protests in the streets of all major towns, a repeat of last Thursday’s show which sadly left fatalities and scores injured.

Last Thursday, pro government MPs voted overwhelmingly for the bill to proceed to the final stage, setting venue for flurry amendments from both sides. In the vote, 204 MPs voted for with 115 against.

National Assembly Majority Leader Kimani Ichung’wah has since defended the decision of the members who voted ‘Yes’ for the bill.

Ichung’wah said the Bill is for the good of the country and it will help create jobs for the youth.

Encourage manufacturing

The Kikuyu MP insisted that all the decisions made by the government were deliberate and will encourage local manufacturing and employment creation for the youth.

“I want to say to our children in the Z generation, whatever decisions we make we will make responsible decisions as leaders. Leaders in the past in our country have been afraid of making the right decisions and always made popular decisions for political expediency. We want to secure your future by making the right decisions.

“When we say we will not tax locally manufactured and locally assembled products it’s deliberate. We want to levy taxes, import duty, excise duty on fully finished goods being imported from other countries so that we can secure your future,” said the Kikuyu MP.

The most contentious proposal is the increase of the Road Maintenance Levy which is charged for all petroleum fuels imported at the rate Sh18 per litre of all petroleum fuels, with an anti-adulteration levy of the same amount charged on Kerosene.

The levy is used for the annual repair and maintenance of roads under the administration by the Kenya Roads Board (KRB).

To help raise sufficient funds to maintain and repair roads across the country the committee recommends an increase of the Levy pursuant to Section 3 of the Road Maintenance Levy Fund Act.

MPs from both sides have vowed to have the move halted as it will end up increasing the price of all the petroleum products.

According to the Kuria Kimani led Finance and Planning Committee, KRA collected Sh84 billion in 2022/23, but the performance of the levy in 2023/24 has been negatively affected by the demand effects of the high fuel prices and the exchange rate depreciation. The fall in the collections under the road maintenance levy has continued to influence the repair and maintenance of highways, urban and rural roads.

El nino rains

The committee observed that the recent el nino linked heavy rains and flooding has further worsened the extent of road destruction in the country.

Finance and Planning Committee chairman Kuria Kimani will move the amendments of his team which include those dropped after the public hearings.

Among the tax proposals dropped by the committee is the motor vehicle tax. It was the view of the committee that the proposed Motor Vehicle Tax is levied on an asset, not income within the definition.

“The proposal to Cap the levy at one hundred thousand shillings makes the tax discriminatory and non-progressive. In addition, commercial vehicles are currently subject to advance tax; therefore, imposing this tax will amount to double taxation,” states the committee.

The committee proposes to reverse the decision to exempt ordinary bread from VAT and retain it at zero rate among other items, namely unleavened bread, gluten bread, inputs and raw materials supplied to manufacturers of agricultural and pest control products, agricultural pest control products, transportation of sugarcane from farms to milling factories, supply of locally assembled and manufacture of mobile phones among others.

The Committee notes that registered trust schemes serve the same purpose as pension schemes and should not be discriminated against. Trust is pivotal in providing stability and security to vulnerable beneficiaries across generations.

“In this regard, the committee resolved to retain trusts as exempt and, therefore, recommended deletion of the proposal,” the committee concluded.

In relation to the contentious Eco Levy, the committee noted that the purpose of the levy is to help redress environmental damage and pollution caused by the import of certain finished products into Kenya.

However the committee differed noting that the levy should only be applied to imported finished products to protect local manufacturers who are currently subjected to the extended producer responsibility.

But to address the concerns of a significant majority of stakeholders and to contain the prices of certain critical goods, the committee proposes to remove the imposition of the levy on diapers, tyres of motorcycles, bicycles, wheelchairs, three-wheeled motorized vehicles (tuk tuks) and reduce the rate of eco levy for certain finished goods.

With respect to the Export Investment Promotion Levy, the committee okayed it observing that the objective of the Levy is to protect the local manufacturing sector from unfair trade practices, increase the competitiveness of Kenya’s Manufacturing sector and foster a sustainable and inclusive export sector, support local manufacturing which will lead to an increase in the contribution of manufacturing to GDP from 7% to 20% by 2027 and enhance the playing field for local manufacturers.

MPs have however opposed the proposal arguing that it will end up increasing prices of key commodities and want it dropped.

The committee proposes to have the Export and investment Promotion Levy imposed on articles of leather, imported footwear, denatured ethyl alcohol, ceramic sinks, and wash basins, amongst other products.

Manyatta MP Gitonga Mukunji has proposed an amendment to this proposal saying it affects Kenyan manufacturers.