KNCCI cautions of job losses, businesses shutdown over Ksh2M eTIMS penalty

The Kenya National Chamber of Commerce and Industry (KNCCI) has opposed the proposed imposition of a Ksh2 million penalty for failing to comply with the Electronic Tax Invoice Management System (eTIMS).

In a statement on Monday, May 20, 2024, the independent body described the proposal as a punitive measure which will lead to severe repercussions for the country’s economy.

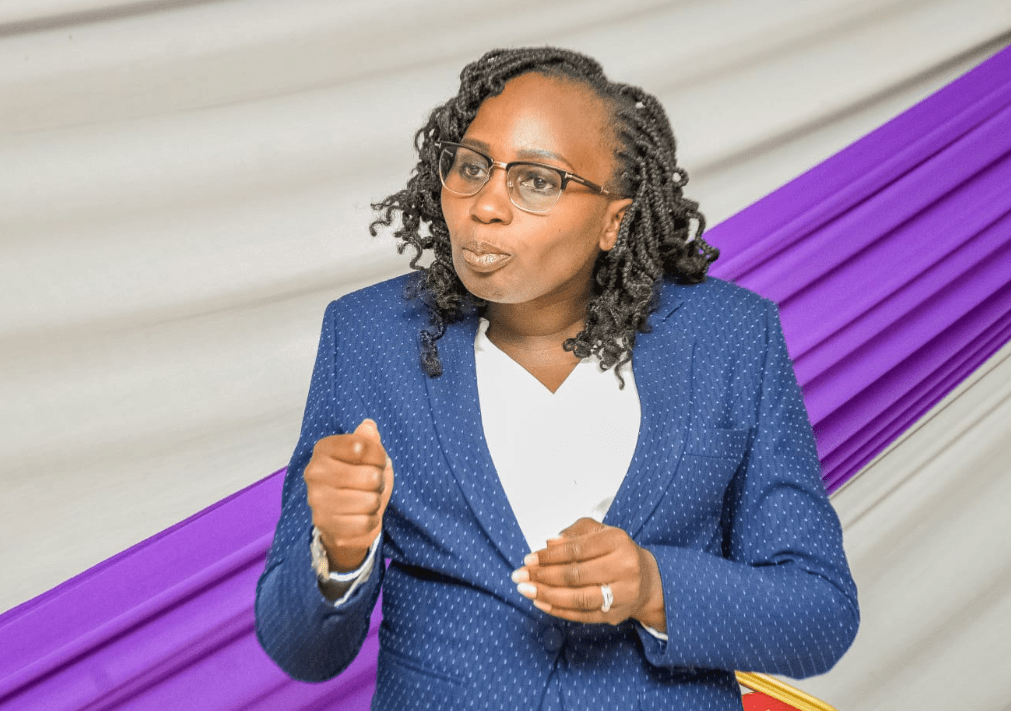

According to Erick Rutto, Kenya National Chamber of Commerce and Industry President, the new policy contained in the Finance Bill 2024 will water down the progress made to empower Micro, Small, and Medium Enterprises (MSMEs).

According to Rutto, MSMEs are the backbone of the Kenyan economy contributing nearly 40 per cent of the Gross Domestic Product (GDP). The Kenya National Chamber of Commerce President also pointed out that the sector accounts for more than 80 per cent of the country’s employment rate.

In the statement, Rutto defended the eTims’ non-compliance maintaining that most traders are not well acquainted with the system which has led to low registration.

“While we recognize the government’s efforts to streamline tax collection and enhance compliance through the adoption of eTIMS, we believe that the proposed penalty is punitive and will have severe repercussions on Micro, Small, and Medium Enterprises (MSMEs).

“MSMEs are the backbone of our economy, contributing about 40 per cent of GDP and employing more than 80 per cent of Kenyans. The majority of them operate in the informal economy and have neither clearly understood nor adopted eTIMS. This is evidenced by the low performance of the March 31, 2024. deadline that saw only 20 per cent of the targeted businesses registered on eTIMS,” the statement read in part.

While quoting the KNCCI 2024 second quarter Barometer Survey, Rutto indicated more than half of the business owners make less than Ksh1 million in annual revenue. He thus warned of massive job losses and closure of businesses.

“In the KNCCI Quarterly Business Barometer Survey for Q2/2024, more than half of the respondents. were businesses that have less than Ksh1 million in annual revenue, reflecting Kenya’s economy. Placing a penalty of Ksh2 million a month on businesses that make less than half of that in a year will lead to closures and job losses,” he insisted.

KNCCI appeal to government

Before implementing the measure where all business owners are required to generate the eTIMs receipt for every transaction, KNCCI implored the government to equip traders with fast-hand knowledge of how the system works.

We advise that before implementing such stringent penalties, it is crucial to ensure that MSMEs fully understand the requirements and processes involved in adopting eTIMS. Many small business owners may not have the technical knowledge or resources to implement these systems effectively. The government should invest in comprehensive capacity-building programs and provide clear, accessible information and training to ensure that MSMEs are well-equipped to comply with eTIMS,” Kenya Chambers stated.

Rutto further advocated for a phased approach in the implementation of the eTIMS directive which he argued would give traders enough time to familiarise themselves with the process involved.

“Additionally, a phased approach to the implementation of eTIMS would allow businesses time to adapt and ensure compliance without the immediate threat of severe penalties. A grace period or a tiered penalty system could be considered, where initial non-compliance results in warnings or smaller fines, escalating only if non-compliance persists.

KNCCI is committed to working collaboratively with the government to find solutions that enhance tax compliance while also supporting the growth and sustainability of our vital MSME sector. We believe that through constructive dialogue and targeted support measures, we can achieve a tax system that is fair, efficient, and conducive to economic growth,” Rutto concluded.

The proposal came after the Kenya Revenue Authority raised concerns over eTIMs non-compliance. According to a recent report by the taxman, half of the businesses in the country have snubbed eTIMs.

For these and more credible stories, join our revamped Telegram and WhatsApp channels.

Telegram: https://t.me/peopledailydigital

WhatsApp: https://whatsapp.com/channel/0029Va698juDOQIToHyu1p2z