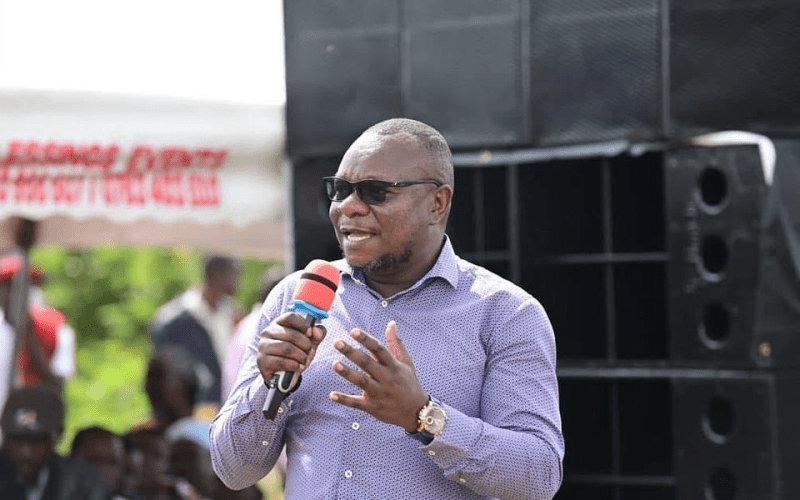

‘Azimio legislators will stand with Kenyans on the Finance Bill 2024’ – ODM’s Philip Etale

Orange Democratic Party (ODM)’s director of communication Philip Etale on Thursday, June 13, 2024, aired his view on the proposed Finance Bill 2024.

Through his official social media account, Etale disclosed that Members of Parliament in the Azimio la Umoja one Kenya coalition party will stand with Kenyans on the proposed Finance Bill 2024.

“The one thing I know, Azimio legislators will stand with Kenyans on the Finance Bill 2024 when the time comes,” he said.

The one thing I know, Azimio legislators will stand with Kenyans on the Finance Bill 2024 when the time comes.— Philip Etale (@EtalePhilip) June 13, 2024

Finance Bill 2024

His sentiments come as a section of leaders call for the review of the Finance Bill 2024 terming it oppressive while Kenyans urge Members of Parliament to reject the proposed bill ahead of the budget reading.

The proposed Bill which many have expressed dissatisfaction outlines how revenues will be collected and additional tax on the basic commodities come in the next financial year 2024/2025.

The Finance Bill 2024 was published on May 9, 2024, and tabled before the National Assembly on May 13, 2024, proposes to introduce changes to the withholding tax regime for payments made to digital content creators that were first introduced through the Finance Act 2023.

According to the published Finance Bill, withholding tax on payments made in respect of digital content monetization to non-residents will operate as a final tax and no further tax liability shall accrue on income received through such payments with effect from July 1, 2024.

It also proposes various amendments to the Tax Appeals Tribunal Act 2013, the Income Tax Act, the Value Added Tax Act 2013, the Tax Procedures Act 2015, and the Miscellaneous Fees, Levies Act 2016, and, the Excise Duty Act 2015 among others.

The bill also proposes the supply of ordinary bread to VAT at the standard rate currently, the supply of ordinary bread is zero-rated for VAT effective July 1, 2024.

A move that has faced rejections from many Kenyans since the impact of standard rating the supply of ordinary bread will be to increase the retail price of such a basic commodity, negatively affecting food security in the country.

Apart from bread, the proposed Finance Bill has imposed an excise duty of 27 per cent on edible oil.

For these and more credible stories, join our revamped Telegram and WhatsApp channels.

Telegram: https://t.me/peopledailydigital

WhatsApp: https://whatsapp.com/channel/0029Va698juDOQIToHyu1p2z