County cash crunch to persist as State navigates legal mines

The cash crunch in the devolved units is set to continue as the national government burns midnight oil to unlock the impasse that has legally tied its hands from disbursing the long overdue cash to the already broke counties.

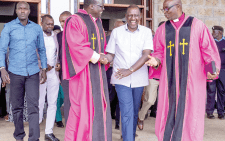

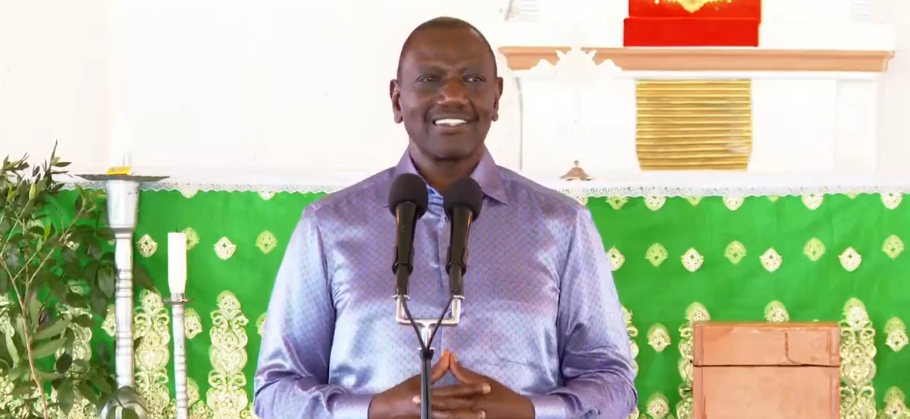

The problem compounding the National Treasury in disbursing the cash is the failure of President William Ruto in assenting to the County Allocation Revenue Bill 2024 following the withdrawal of the Finance Bill 2024 which had sought to raise more than Sh316 billion in revenue for the 2024-25 financial year.

County Allocation Revenue if passed, gives the National Treasury the mandate to disburse funds to the 47 devolved units given that it shows the schedules of what each County is supposed to get each month.

President Ruto declined to assent to the proposed law after withdrawing the Finance Bill 2024 that had hoped to raise an additional Sh316 billion.

But now the Division of Revenue (Amendment) Bill, 2024 (National Assembly Bills No. 38 of 2024) proposes to allocate County governments equitable share of Sh 380 billion from the shareable revenue raised nationally, reflecting a reduction of Sh 20 billion from an allocation of Sh 400 billion initially allocated in the Division of Revenue Act (DORA), 2024.

Sought legal opinion

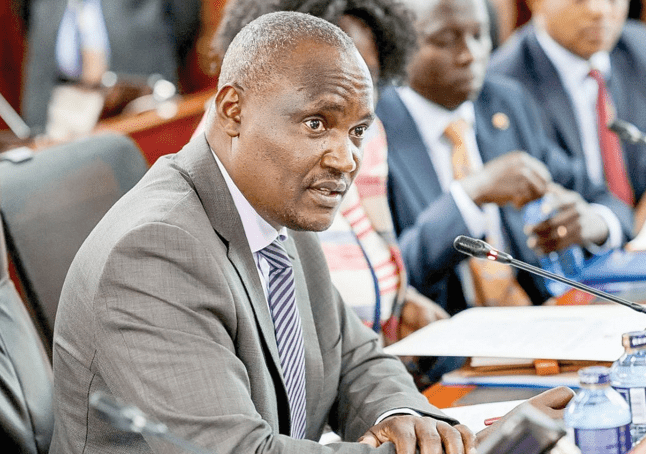

Caught between a rock and a hard place, National Treasury Cabinet Secretary John Mbadi has now written to Attorney General Dorcas Oduor seeking her legal opinion on the disbursement of County equitable share to the County governments in the absence of the County Allocation of Revenue Act, 2024.

Already, counties are facing huge financial crisis, with a number having been unable to pay salaries for the last three months. Employees of several counties have downed tools demanding for payment of their salaries.

In a letter dated September 9, Mbadi wants the State Law Office to give an advisory opinion on how he can navigate the already delicate situation which is almost plunging the counties in total operation breakdown.

Facilitate disbursement

“In the absence of the County Allocation of Revenue Act, 2024, the National Treasury seeks your legal opinion on the applicable remedy in law to facilitate disbursement of the equitable share to County Government in the Financial Year 2024/25,” reads part of Mbadi’s letter to the AG.

Regulation 134 (1) of the Public Finance Management (National Government Regulations, 2015 provides that, “if the County Allocation of Revenue Bill submitted to Parliament for a financial year has not been approved by parliament or is not likely to be approved by parliament by the beginning of the financial year, the Controller of Budget may authorize withdrawals of upto 50 per cent from the consolidated fund.

This, however, should be based on the last County Allocation of Revenue Act approved by parliament to meet the expenditure of the county governments for the financial year.

In accordance with the regulation, the Controller of Budget may authorize withdrawals of up to 50 per cent from the Consolidated Fund based on the County Allocation of Revenue Act, 2023.

However, Mbadi contends that the regulation is not anchored in the parent law- the County Allocation of Revenue Act.

In its advisory opinion number 3 of 2019, the Supreme Court averred that the percentage of the money to be withdrawn be based on the equitable allocation to Counties in the Division of Revenue Act of the proceeding financial year.

Article 222 (2) (b) of the Constitution states that the money to be withdrawn shall be 50 per cent of the total equitable share allocated to the Counties in the Division of Revenue Act.

“It is therefore not certain as to whether the same advisor would be applicable in the present circumstances whereby there is a Division of Revenue Act, 2024, but the County Allocation Revenue Bill 2024 has not been approved,” read part of Mbadi’s letter to Ms Oduor.

Mbadi in his letter also contends that the Public Management Act 2012 has not provided for an alternative legal mechanism for disbursement of County Government Equitable share, in the event there is a delay in enactment of the Annual County Allocation of Revenue Bill. Already the National Treasury has submitted a proposal to amend the Division of Revenue Act suggesting a reduction of the equitable share to County Governments from Sh400.1 billion to Sh380.0 billion.

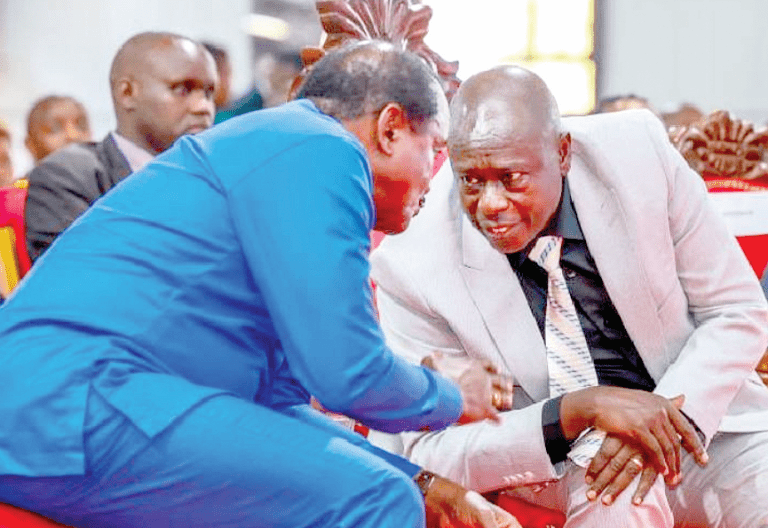

The County Allocation Revenue Act, being the legal instrument for transferring funds allocated to County Governments and having not been enacted, the National Treasury submitted a proposal to amend the CARB, 2024. On Monday, Mbadi had a hectic time as he tried to explain to Senators why the government has decided to reduce the sharable revenue to the devolved units from Sh400 billion to Sh 380 billion

Mbadi had a difficult time explaining to the Senate Finance and Budget Committee why the government would give counties Sh20 billion less than the figure arrived at after a mediation process between members of the Senate and National Assembly.

Senate Majority Whip Boni Khalwale said the government should cut the huge expenditure allocated to unconstitutional offices such as the office of the First Lady, Spouse of the Deputy President and Prime Cabinet Secretary.