List of tax proposals that have been scrapped from Finance Bill 2024

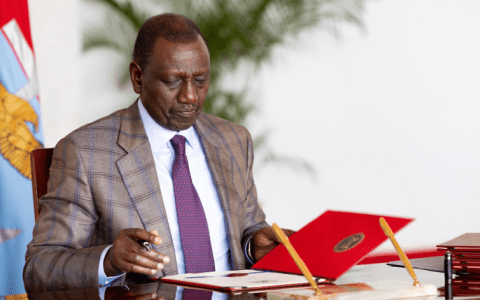

The National Assembly’s Finance and Planning Committee Chairperson Kimani Kuria has announced changes to the Finance Bill 2024.

The changes, announced hours before the Bill is tabled in Parliament, will see a number of tax proposals scrapped after pressure from members of the public and lobby groups.

Among the levies scrapped from the Bill include the 16 per cent VAT on bread, the Eco Levy on some items and the hike of taxes on mobile money transfers.

"The proposed 16 per cent VAT on bread has been removed. VAT on the transportation of sugar has also been removed. VAT on financial services and foreign exchange transactions has also been removed," Kuria said.

Kuria also announced that the proposed Motor Vehicle Tax has also been removed.

Kuria Kimani further stated that to support the reduction of the cost of living Kenya Kwanza parliamentary group have come up with a way of making edible oil less expensive.

"Excise duty on vegetable oil removed," he disclosed.

Levies on housing funds and Social Health Insurance (SHI) will be voluntary.

"Levies on the Housing Fund and Social Health Insurance will become income tax deductible. This means the levies will not attract income tax, putting much more money in the pockets of employees," he disclosed.

In a new directive, Eco Levy will be levied on imported finished products. Locally manufactured products will, therefore, not attract the Eco Levy.

On the other hand, the threshold for VAT registration has been increased from KSh5 million to KSh8 million.

Kuria also stated that small-scale farmers and mama mbogas will be exempted from electronic invoicing that was introduced by the Kenya Revenue Authority (KRA).

Excise duty will be imposed only on imported eggs, a move aimed at protecting local farmers.

"Responsibility for electronic invoicing ETIMS, recently introduced by KRA, has been receded from farmers and small businesses with a turnover of below Ksh1 million," he said.

Excise duty on alcoholic beverages will now be taxed on the basis of alcohol content and not volume. The higher the alcohol content the more excise duty it will attract.

Pension contributions exemption will increase from Ksh20,000 per month to Ksh30,000.

Before you go…how about joining our vibrant Telegram and WhatsApp channels for hotter stories?

Telegram:https://t.me/k24tvdigital

WhatsApp: https://whatsapp.com/channel/0029VaKQnFUIXnljs50pC32O