Auditor queries Wambora aides’ Sh110m irregular loan advances

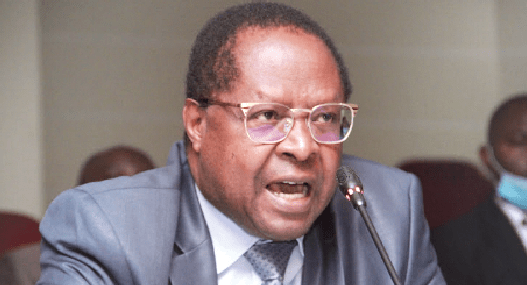

By Rawlings, June 24, 2024Officials in former Embu county governor Martin Wambora’s administration benefited from irregular loan facilities worth Sh110.8 million with repayment periods of up to 15 years, an audit report has revealed.

The auditor general’s report on Embu’s Car Loan and Mortgage Fund for the financial years between 2019 and 2022 reveals that there was an “unholy alliance” between Development Bank of Kenya and the county government.

Members of a Senate committee expressed their surprise that the loans were advanced without security, including logbooks and title deeds.

In her report, Auditor-General Nancy Gathungu added that the county government could not provide documents to confirm whether the loans were charged to the beneficiaries’ logbooks or titles.

Limits exceeded

Current Governor Cecily Mbarire told the County Public Investment and Special Funds Committee, chaired by Godfrey Osotsi (Vihiga), how the former County Executive Committee members received the car loans and mortgages irregularly.

Top officers were accorded loan repayment terms exceeding the required 48 months, with some terms going from 2019 to 2034, Mbarire said.

In a sign of impunity in the use of public funds, eight officers were given loans three months before their contracts with the county government expired. The deal with the bank also saw the lender take three percent interest charged on the loans, ostensibly as administrative expenses.

Some ministers, Mbarire said, held accounts with the bank and were accorded preferential treatment, including being given loans above the limit set by the county’s regulations and the Salaries and Remuneration Commission, which set the car loan ceiling at Sh4 million and Sh20 million for a mortgage.

The bank owned up to failing to pursue repayments and had agreed to convert the loans into commercial loans, she said.

“We are in the dark [about] at what point the beneficiaries got to the point of being given loans above the set limits,” she said.

She went on: “We have told the bank to make sure we get back our money. The headache is now with the bank and not the county government. We will ensure Embu does not lose money because of the irregularities. The bank has agreed to give us the money by the end of this month.”

Political tool

Ms Gathungu also flagged the Embu County Youth Trust Fund – which disbursed more than Sh48 million between 2014 and 2021 – describing it as a “political tool” and saying the money was loaned without collateral, with the devolved region now unable to recover the money.

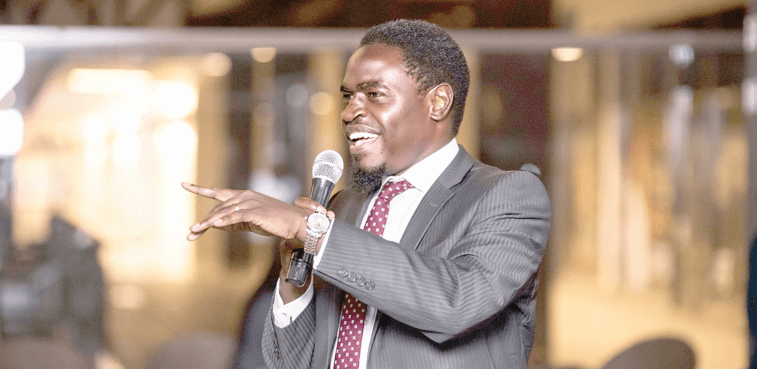

In his ruling, Osotsi directed the county government to engage the bank further to ensure logbooks, title deeds and a copy of the agreement between the lender and the county government were provided to the auditor for verification.

“All the queries have to do with the bank, as it looks like they were not following the law. We need feedback on your engagement with the bank before we make a ruling on the matter,” Osotsi said.

The committee is consider summoning Wambora and the officers who received the loans so as to shed light on the running of the two funds. Lawmakers may also hand over the auditor’s reports to the anti-graft to investigate the matter.

Tabitha Mutinda (nominated) described the officers’ actions as an abuse of power, saying advancing loans with repayment periods of up to 2034 was unheard of.

“They even received their gratuity but are not servicing their loans and it is curious that no check-off system was put on their salaries as a way of repaying the loans. These were not small people to get such favours,” Mutinda said.

More Articles