Economic strain is significantly impacting mobile money transactions in Kenya, dropping to Sh711.7 billion in April 2024 from Sh747.7 billion in March, a 4.81 per cent dip.

The May 2024 Kenya National Bureau of Statistics (KNBS) leading economic indicators show that the number of mobile money agents increased from 320,300 in March 2024 to 331, 600 in April 2024, even as the number of mobile money subscriptions dropped from 77.7 million to 77.4 million.

Number of transactions

“In addition, the total number of transactions dropped from 207.8 million to 203.6 million, during the same period. The total value of transactions decreased from Sh747.7 billion in March 2024 to Sh711.7 billion in April 2024” KNBS notes.

This decrease occurred despite inflation easing to 5 per cent in April from 5.7 per cent in March, which typically would enhance consumer purchasing power.

However, the lingering effects of higher inflation earlier in the year likely influenced consumer behaviour, and may have led to reduced transaction volumes.

In January and February 2024, Kenya’s inflation was reported at 6.6 per cent and 6.8 per cent respectively, marking a decline from a peak inflation rate of 9 per cent experienced in 2023.

Despite the recent drop in inflation, rising costs have eroded consumer purchasing power, leading to decreased discretionary spending, often facilitated through mobile money platforms.

The overall trend, however indicates a robust mobile money ecosystem, with significant transaction volumes and values throughout the period. The peak occurred in December 2023, with 213.31 million transactions valued at Sh788.35 billion, while the lowest point was in January 2023, with 198.31 million transactions valued at Sh589.30 billion.

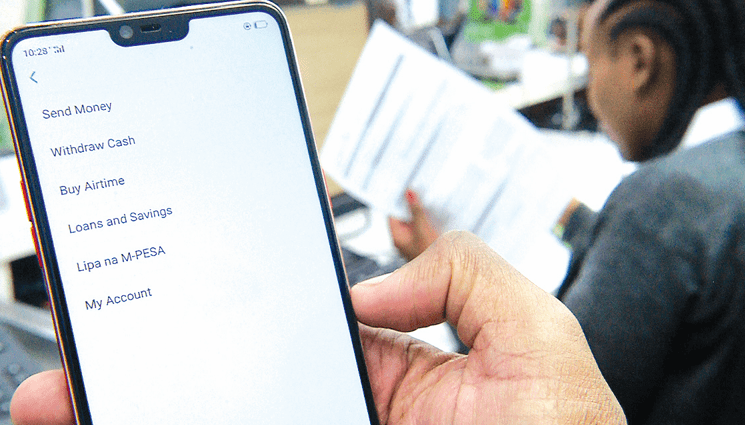

Mobile money transactions are crucial to Kenya’s economy, accounting for about 70 per cent of its gross domestic product (GDP). In 2022, the total value of mobile money transactions reached Sh7.91 trillion, a 15 per cent increase from the previous year. This growth has transformed financial access, particularly for the unbanked, enabling seamless transactions and reducing reliance on cash.

The competitive landscape between mobile operators like Safaricom’s M-Pesa and banks has intensified, driving innovation and expanding the digital payments ecosystem. Mobile money is also linked to poverty reduction, providing essential financial services to millions.

Safaricom increased its mobile transaction fees for M-Pesa on July 29, 2023, following the enactment of the Finance Act 2023. This adjustment reflected an increase in excise duty on mobile money transfer services from 12 per cent to 15 per cent affecting various transaction types, including sending money and withdrawals.

Mobile money ecosystem

The new charges were part of broader changes in the mobile money ecosystem, aimed at balancing operational costs with service accessibility.

While the withdrawn Finance Bill 2024 initially proposed raising the excise duty on mobile money transfer fees from 15 per cent to 20 per cent, the government suspended this increase following public backlash regarding its potential impact on financial inclusion.