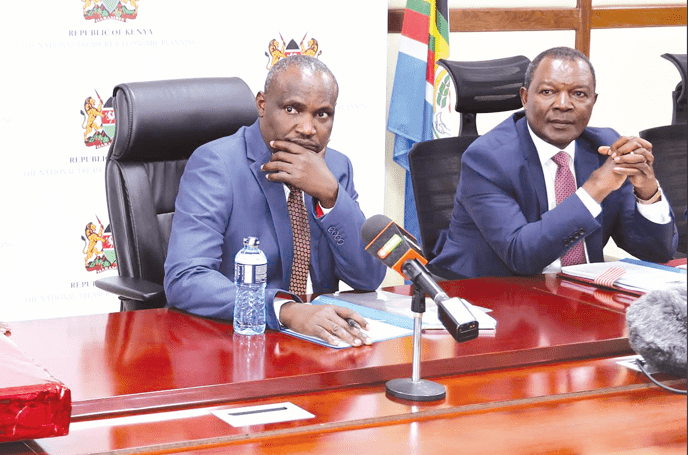

National Treasury Cabinet Secretary John Mbadi has announced plans to bring back the Eco Levy with amendments.

Speaking to a local TV station on Sunday, August 18, 2024, Mbadi noted that the Eco levy, which was part of the controversial Finance Bill 2024, had some meaning and ought to be revived through proper amendments.

However, Mbadi told the local TV station that contentious products like sanitary pads will be left out of the new proposal. Moreover, he clarified that its introduction will not affect normal citizens.

“Eco Levy has some meanings; we will just make sure that they are levied on those items that pollute the environment,” Mbadi stated.

“Issues that are contentious, like sanitary pads, those we will leave out,” he added.

The Eco Levy was among the contentious tax-raising proposals that were contained in the dropped Finance Bill 2024. It was set to affect various products, including plastic packaging, car batteries, diapers, sanitary towels, and rubber tyres.

Through the Eco levy, the government sought to remove the provision of excise duty under the Excise Duty Act, allowing manufacturers to offset the costs of their raw materials subject to excise.

However, Mbadi insisted that in the new plan, the Eco levy will be introduced with proper amendments.

More amendments

At the same time, Mbadi revealed plans to introduce 49 amendments. The Treasury CS indicated that there were plans to introduce 53 amendments before they were reduced.

“They brought about 53 suggested amendments. These 53 have now been reduced to about 49,” Mbadi explained.

He emphasised that the amendments will help the government raise an additional Ksh150 billion in revenue in the 2024/25 financial year.

Overhaul KRA

Besides introducing amendments aimed at raising more revenue, CS Mbadi disclosed that the National Treasury will overhaul the Kenya Revenue Authority (KRA).

According to Mbadi, revamping KRA, including introducing automation, will help raise close to Ksh400 billion.

“If we reform KRA the way we want, we can get not less than Ksh400 billion more. In fact, some people even project Ksh600 billion,” Mbadi stated.