Unmasking financial abuse among couples

When Eva Mungai met her husband eight years ago, it seemed like she had finally kissed the last frog.

At that time, John Mungai, her prince charming, was a full time businessman, visionary, charismatic, charming and intelligent, things that attracted the independent, full-of-life Eva.

Even though Mungai’s business was not going on well, Eva was not worried as she had a financially stable job and was always supportive of her future husband’s ambitions.

Six months later, John proposed; they wedded soon after, but things changed three months later.

“He began belittling my salary because he felt his business contributed more to the family.

Funny thing is he would wait until I am paid to withdraw all funds from our joint account without my consent.

When I asked him about it, he would abuse and threaten to leave me because he felt I was interrogating him,” she says.

Matters worsened, when they began falling back on paying rent, electricity and water. Food lacked in the house, and John began spending less time at home every time Eva confronted him about his actions.

While it’s common for couples to argue over money and bills, it is worrying when a spouse controls your spending or income, which might be a sign of financial abuse.

We are more conversant with verbal or physical, abuse, but not so much on financial abuse.

Research by Harris Interactive, a German based firm, found out that one partner in every 10 couples is a financially bully. This percentage tends to be higher amongst couples aged 22-34 years.

Perpetrator’s mercy

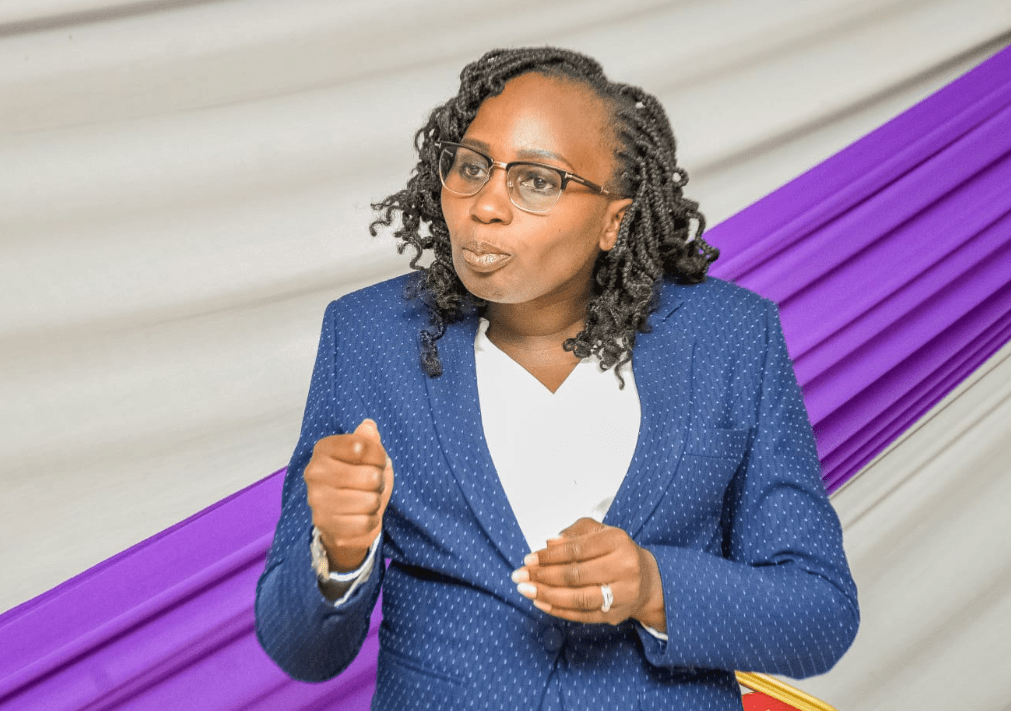

Financial expert, Catherine Mbugua says this form of abuse occurs when an individual uses, or misuses money or financial resources belonging to another person without their consent.

The bully does this with the aim of restricting or controlling their partner’s finances.

It comprises putting contractual obligations in their partner’s name, using credit cards or withdrawing cash without consent or gambling assets belonging to the family without permission.

Then there is economic abuse, where one party controls the other’s present or future access to economic resources or empowerment such as education.

This may result in curtailing the victim’s ability to be financially independent and keeping them forever at the perpetrator’s mercy.

In the dark

“The spouse belittles your salary and goes to the extent of demanding you turn over your full paycheck and passwords of accounts and spend cash behind your back.

They keep you in the dark about financial matters and when you question them, they become confrontational.

In extreme cases of economic abuse, the victim is on a strict allowance where the perpetrator withholds cash as a form of control, forcing the victim to beg for it. They are given less cash and the abuse continues,” she notes.

Notably, failure of an abuser to provide child support can be regarded as financial bullying.

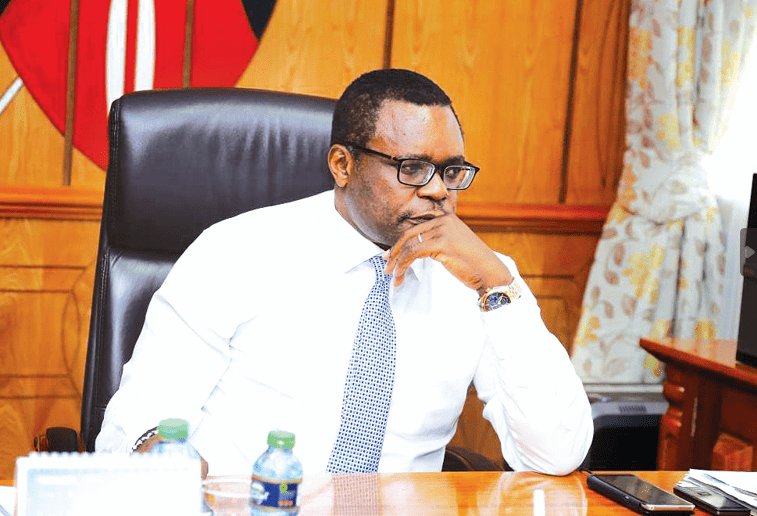

Psychologist Ruth Mwaura argues that the intent of the abuser is what distinguishes it.

Whether consciously or subconsciously, the perpetrator’s intent is to have the upper hand in the relationship as they are insecure from within and they feel undermined whenever they are not in control.

“In any relationship, money means power to access what one desires, to influence the other person or power over the other individual.

The one earning less might find themselves at the mercy of the one earning more. While some become victims, others develop manipulative tendencies to remain dominant,” says Ruth.

It is okay to have disagreements and be able to work them out as fast as possible in the relationship.

However, Ruth warns that spouses should watch out for financial abuse, as it is a symptom of other forms of abuse to come.

“Abuse is wrong and gives one partner the power over the other, which eventually will result in loss of emotional intimacy, authenticity and trust in the union,” she adds.

According to Catherine, there are various ways in which a partner can protect himself or herself from financial abuse in a relationship.

She advises couples to openly discuss finances from the beginning and not just assume things will be fine simply because someone is good.

“Seek financial advice together, start making financial decisions together and build an emergency or saving fund together.

But if none of this works and the other partner is not willing to talk about the issues, it might be best to talk to a third party like a close friend, family member, or counsellor to assist,” she says.

It is also good for both parties to be financially independent and have a say in the financial affairs of their families.

A person in a relationship should be able to monitor unusual activities in the bank, which they haven’t discussed with the other partner.