Despite the increasing appetite for spending, the National Treasury has reduced Kenya’s fiscal deficit to Sh862.5 billion from over Sh930 billion in the last financial year, hinting at attempts to cut back Kenya’s escalating debt levels.

However, this still means the government is spending beyond its means, since a fiscal deficit is a shortfall in a government’s income compared with spending, or simply put, money spent more than income.

This practice has seen Kenya’s gross public debt surge, and by the end of last year, it had hit Sh8.2 trillion, from Sh7.2 trillion by the end of 2020, which is more than two-thirds of the annual gross domestic product (GDP).

Looking at the Sh3.3 trillion Budget for FY2022/23 therefore, after having added another Sh300 billion to the FY 2021/22 budget, Treasury has no option but to increase tax collection and debt in a bid to service the financial estimates.

According to the Treasury, the thinking was informed by predictions that the economy will grow at 6 per cent. However, with the pandemic, ongoing Ukraine-Russian war, and an upcoming election this could come a cropper.

It would be safe to say that with the expected uncertainty from global geopolitics and an electioneering period, Treasury’s ambitions were off the mark. The situation is exacerbated by the fact that amid slow job creation in most sectors, very little foreign direct investment is expected as investors monitor the political environment.

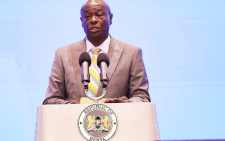

Be that as it may, National Treasury Cabinet Secretary Ukur Yatani has gone ahead to suggest a debt ceiling at 55 per cent of debt to GDP in present value terms. According to CS Yatani, the current ceiling set at Sh9 trillion is inhibitive to service provision and the effects of external shocks.

Unfortunately, with the government always hell-bent on using supplementary budgets to raise money beyond the budget, Kenya has a long way to go in terms of living within its means.

For starters, most of the money set aside for development projects never delivers the real worth of projects. The more than Sh9 trillion worth of projects currently stalled speaks volumes.

Indeed, these could be the main reasons denying the country the benefits envisioned by these projects. There is, therefore, a need to cut recurrent spending further and ensure that new projects do not hold the economy hostage while old ones are still in ICU.